Cigna 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

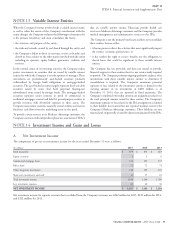

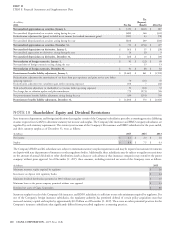

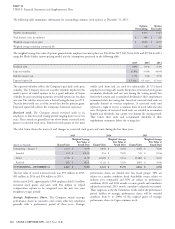

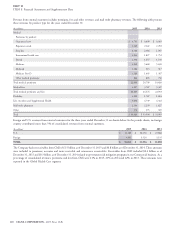

B. Deferred Income Taxes

Deferred income tax assets and liabilities as of December 31 were as follows:

(In millions)

2015 2014

Deferred tax assets

Employee and retiree benefit plans $ 535 $ 597

Other insurance and contractholder liabilities 465 440

Net operating losses 101 72

Other accrued liabilities 177 203

Other 99 105

Deferred tax assets before valuation allowance 1,377 1,417

Valuation allowance for deferred tax assets (71) (49)

Deferred tax assets, net of valuation allowance 1,306 1,368

Deferred tax liabilities

Depreciation and amortization 765 755

Unrealized appreciation on investments and foreign currency translation 152 298

Other 10 22

Total deferred tax liabilities 927 1,075

Net deferred income tax assets $ 379 $ 293

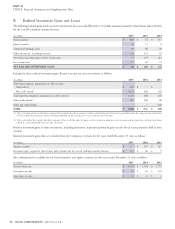

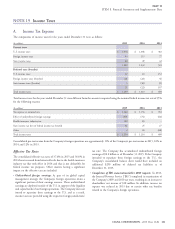

Included in the consolidated net deferred tax asset of $379 million is establishes a valuation allowance when it determines that realization of

approximately $150 million of deferred tax liabilities attributable to a deferred tax asset does not meet the more likely than not standard.

foreign jurisdictions, most notably Korea and Taiwan. Valuation allowances have been established against certain federal,

foreign and state deferred tax assets, generally when there is a

Management believes that future results will be sufficient to realize the requirement to assess them on a separate entity basis. The increased

Company’s deferred tax assets. With the exception of certain net valuation allowance for 2015 is primarily attributable to tax benefits

operating loss related tax benefits, the Company’s deferred tax benefits of certain overseas start-up operations.

may be carried forward indefinitely. Net operating loss benefits are

primarily attributable to foreign jurisdictions. The Company

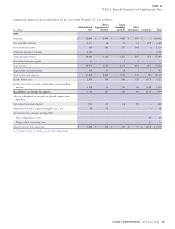

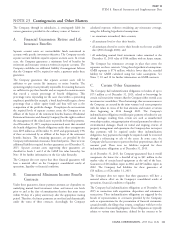

C. Uncertain Tax Positions

A reconciliation of unrecognized tax benefits for the years ended December 31 was as follows:

(In millions)

2015 2014 2013

Balance at January 1, $26 $17 $51

Decrease due to prior year positions – – (35)

Increase due to current year positions 712 6

Reduction related to lapse of applicable statute of limitations (2) (3) (5)

Balance at December 31, $31 $26 $17

102 CIGNA CORPORATION - 2015 Form 10-K