Cigna 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

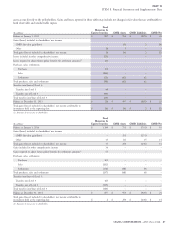

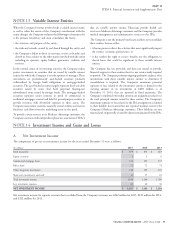

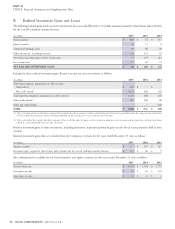

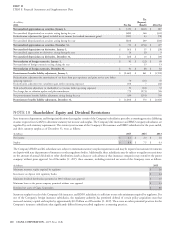

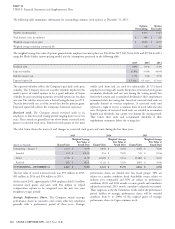

B. Realized Investment Gains and Losses

The following realized gains and losses on investments for the years ended December 31 exclude amounts required to adjust future policy benefits

for the run-off settlement annuity business.

(In millions)

2015 2014 2013

Fixed maturities $ (82) $ 14 $ 113

Equity securities 36 13 8

Commercial mortgage loans (2) (6) (3)

Other investments, including derivatives 105 133 95

Net realized investment gains, before income taxes 57 154 213

Less income taxes 17 48 72

NET REALIZED INVESTMENT GAINS $ 40 $ 106 $ 141

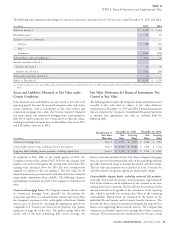

Included in these realized investment gains (losses) were pre-tax asset write-downs as follows:

(In millions)

2015 2014 2013

Other-than-temporary impairments on debt securities:

Credit-related $ (11) $ – $ –

Non credit-related

(1)

(101) (36) (11)

Total other-than-temporary impairments on debt securities (112) (36) (11)

Other credit-related

(2)

(28) (16) (8)

Other non credit-related – – (10)

TOTAL $ (140) $ (52) $ (29)

(1) These write-downs pertain to other-than-temporary declines in fair values due to increases in market yields (widening of credit spreads), particularly within the energy sector, for certain below

investment grade fixed maturities with an increased probability of sales activity prior to recovery of amortized cost basis.

(2) Other credit-related losses include other-than-temporary declines in the fair values of equity securities, increases in valuation reserves on commercial mortgage loans, and asset write-downs

related to security partnerships and real estate investments.

Realized investment gains in other investments, including derivatives, represented primarily gains on sale of real estate properties held in joint

ventures.

Realized investment gains that are excluded from the Company’s revenues for the years ended December 31 were as follows:

(In millions)

2015 2014 2013

Separate accounts $ 117 $ 376 $ 417

Investment gains required to adjust future policy benefits for the run-off settlement annuity business $ 114 $ 86 $ 9

Sales information for available-for-sale fixed maturities and equity securities for the years ended December 31 were as follows:

(In millions)

2015 2014 2013

Proceeds from sales $ 1,555 $ 1,769 $ 1,775

Gross gains on sales $ 85 $ 62 $ 102

Gross losses on sales $13$ 6$ 4

96 CIGNA CORPORATION - 2015 Form 10-K