Cigna 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

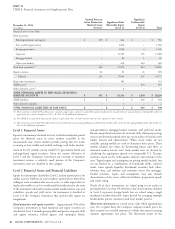

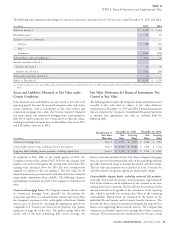

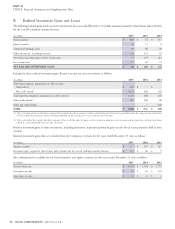

inputs are unobservable (supported by little or no market activity) and and remaining maturities. These measurements were classified in

significant to their resulting fair value measurement. Level 2 because the fair values are based on quoted market prices or

other inputs that are market observable or can be corroborated by

Long-term debt, including current maturities, excluding capital market data.

leases. The fair value of long-term debt is based on quoted market

prices for recent trades. When quoted market prices are not available, Fair values of off-balance-sheet financial instruments were not

fair value is estimated using a discounted cash flow analysis and the material as of December 31, 2015 and 2014.

Company’s estimated current borrowing rate for debt of similar terms

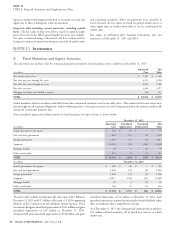

Investments

A. Fixed Maturities and Equity Securities

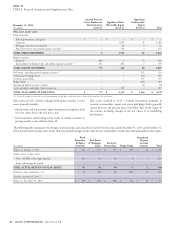

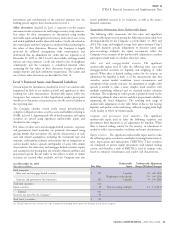

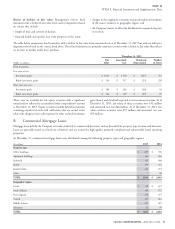

The amortized cost and fair value by contractual maturity periods for fixed maturities were as follows at December 31, 2015:

Amortized Fair

(In millions)

Cost Value

Due in one year or less $ 1,397 $ 1,403

Due after one year through five years 6,251 6,504

Due after five years through ten years 6,905 7,058

Due after ten years 3,363 3,917

Mortgage and other asset-backed securities 540 573

TOTAL $ 18,456 $ 19,455

Actual maturities of these securities could differ from their contractual maturities used in the table above. This could occur because issuers may

have the right to call or prepay obligations, with or without penalties, or because in certain cases the Company may have the option to unilaterally

extend the contractual maturity date.

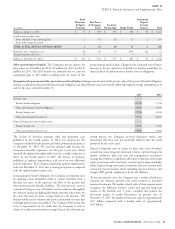

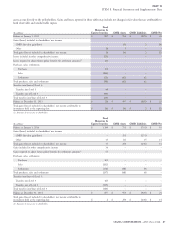

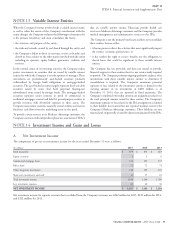

Gross unrealized appreciation (depreciation) on fixed maturities by type of issuer is shown below.

December 31, 2015

Amortized Unrealized Unrealized Fair

(In millions)

Cost Appreciation Depreciation Value

Federal government and agency $ 528 $ 251 $ – $ 779

State and local government 1,496 147 (2) 1,641

Foreign government 1,870 147 (3) 2,014

Corporate 14,022 632 (206) 14,448

Mortgage-backed 48 2 (1) 49

Other asset-backed 492 39 (7) 524

TOTAL $ 18,456 $ 1,218 $ (219) $ 19,455

(In millions)

December 31, 2014

Federal government and agency $ 608 $ 346 $ – $ 954

State and local government 1,682 176 (2) 1,856

Foreign government 1,824 121 (5) 1,940

Corporate 12,517 1,014 (33) 13,498

Mortgage-backed 83 3 (1) 85

Other asset-backed 564 87 (1) 650

TOTAL $ 17,278 $ 1,747 $ (42) $ 18,983

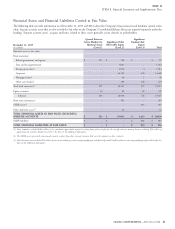

The above table includes investments with a fair value of $2.7 billion at unrealized depreciation of $2 million at December 31, 2014. Such

unrealized amounts are reported in future policy benefit liabilities rather

December 31, 2015 and $3.1 billion at December 31, 2014 supporting

than accumulated other comprehensive income.

liabilities of the Company’s run-off settlement annuity business. These

investments had gross unrealized appreciation of $521 million and gross As of December 31, 2015, the Company had commitments to purchase

unrealized depreciation of $38 million at December 31, 2015, $15 million of fixed maturities, all of which bear interest at a fixed

compared with gross unrealized appreciation of $758 million and gross market rate.

90 CIGNA CORPORATION - 2015 Form 10-K

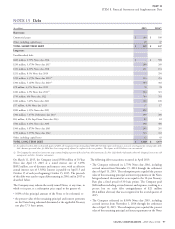

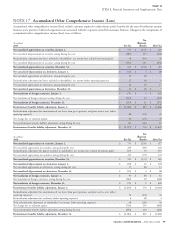

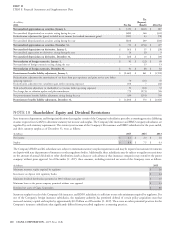

NOTE 11