Cigna 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

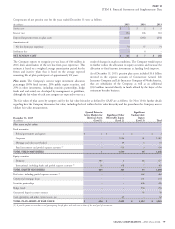

The deferred income tax provision generally represents the net change See Note 19 for additional information.

in deferred income tax assets and liabilities during the year, exclusive

of amounts reported as adjustments to accumulated other

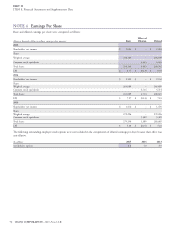

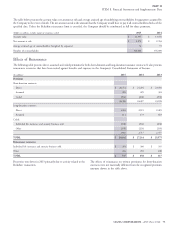

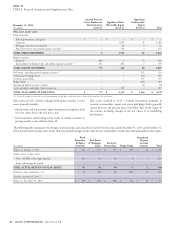

W. Earnings Per Share

comprehensive income or amounts initially recorded due to business

combinations. The current income tax provision generally represents The Company computes basic earnings per share using the weighted-

the estimated amounts due on the various income tax returns for the average number of unrestricted common and deferred shares

year reported plus the effect of any uncertain tax positions. Uncertain outstanding. Diluted earnings per share also includes the dilutive

tax positions are evaluated in accordance with GAAP. effect of outstanding employee stock options and unvested restricted

stock granted after 2009 using the treasury stock method and the

Income tax provisions related to the Company’s foreign operations are effect of strategic performance shares. See Note 4 for additional

generally determined based upon the local country income tax rate. information.

Acquisitions and Dispositions

decision is final and non-appealable; or (2) the merger has not closed

Proposed Merger

by January 31, 2017 (subject to extension to April 30, 2017 under

On July 23, 2015, the Company entered into a merger agreement certain circumstances) only because all necessary regulatory approvals

with Anthem, Inc. (‘‘Anthem’’) and Anthem Merger Sub Corp. have not been received.

(‘‘Merger Sub’’), a direct wholly owned subsidiary of Anthem. The

The merger agreement contains customary covenants, including

merger agreement provides (a) for the merger of the Company and

covenants that Cigna conduct its business in the ordinary course

Merger Sub, with the Company continuing as the surviving

during the period between entering into the merger agreement and

corporation and (b) if certain tax opinions are delivered, immediately

closing. In addition, Cigna’s ability to take certain actions prior to

following the completion of the initial merger, for the surviving

closing without Anthem’s consent is subject to certain limitations.

corporation to be merged with and into Anthem, with Anthem

These limitations relate to, among other matters, the payment of

continuing as the surviving corporation (collectively, the ‘‘merger’’).

dividends, capital expenditures, the payment or retirement of

Subject to certain terms, conditions, and customary operating

indebtedness or the incurrence of new indebtedness, settlement of

covenants, each share of Cigna common stock issued and outstanding

material claims or proceedings, mergers or acquisitions, and certain

immediately prior to the effective time of the merger will be converted

employment-related matters.

into the right to receive (a) $103.40 in cash, without interest, and

(b) 0.5152 of a share of Anthem common stock. The closing price of The transaction is expected to close in the second half of 2016.

Anthem common stock on February 24, 2016 was $130.75.

For the year ended December 31, 2015, the Company incurred

At special shareholders’ meetings held in December 2015, Cigna pre-tax costs of $66 million ($57 million after-tax) directly related to

shareholders approved the merger and Anthem shareholders approved the proposed merger. These costs consisted primarily of fees for

the issuance of shares of Anthem common stock in connection with financial advisory, legal and other professional services.

the merger. Completing the merger remains subject to certain

customary conditions, including the receipt of certain necessary

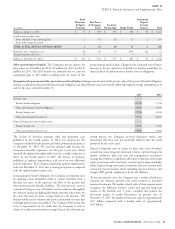

Acquisitions

governmental and regulatory approvals and the absence of a legal

restraint prohibiting the merger. Completing the merger is not subject The Company completed certain acquisitions during the three years

to a financing condition. ended December 31, 2015. In accordance with GAAP, the purchase

price for each acquisition was allocated to the tangible and intangible

If the merger agreement is terminated under certain circumstances, net assets acquired based on management’s preliminary estimates of

Anthem will be required to pay Cigna a termination fee of their fair values. The results of acquisition activities for these years

$1.85 billion. Anthem’s obligation to pay the termination fee arises if were not material to the Company’s results of operations, liquidity or

the merger agreement is terminated because: (1) a governmental financial condition.

entity, such as the Department of Justice or a state Department of

Insurance, has prevented the merger for regulatory reasons and that

CIGNA CORPORATION - 2015 Form 10-K 71

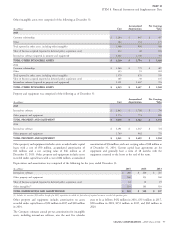

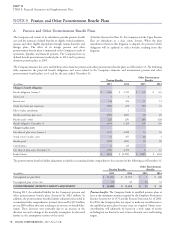

NOTE 3