Cigna 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

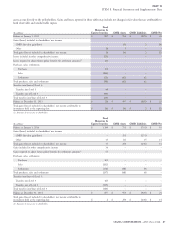

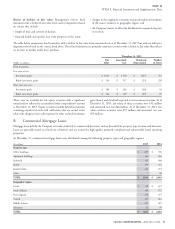

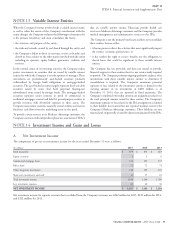

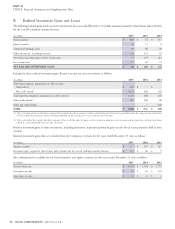

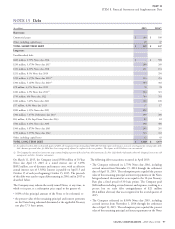

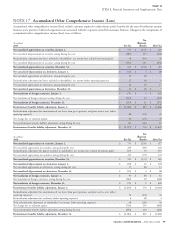

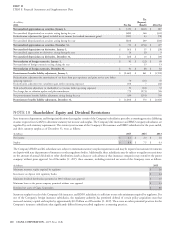

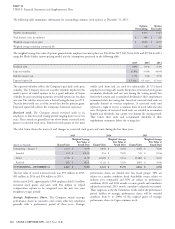

Debt

(In millions)

2015 2014

(1)

Short-term:

Commercial paper $ 100 $ 100

Other, including capital leases 49 47

TOTAL SHORT-TERM DEBT $ 149 $ 147

Long-term:

Uncollateralized debt:

$600 million, 2.75% Notes due 2016 $ – $ 598

$250 million, 5.375% Notes due 2017 249 249

$131 million, 6.35% Notes due 2018 131 131

$251 million, 8.5% Notes due 2019 – 250

$250 million, 4.375% Notes due 2020

(2)

254 253

$300 million, 5.125% Notes due 2020

(2)

303 302

$78 million, 6.37% Notes due 2021 78 78

$300 million, 4.5% Notes due 2021

(2)

304 301

$750 million, 4% Notes due 2022 743 741

$100 million, 7.65% Notes due 2023 100 100

$17 million, 8.3% Notes due 2023 17 17

$900 million, 3.25% Notes due 2025 892 –

$300 million, 7.875% Debentures due 2027 299 298

$83 million, 8.3% Step Down Notes due 2033 82 82

$500 million, 6.15% Notes due 2036 498 498

$300 million, 5.875% Notes due 2041 295 295

$750 million, 5.375% Notes due 2042 743 743

Other, including capital leases 32 43

TOTAL LONG-TERM DEBT $ 5,020 $ 4,979

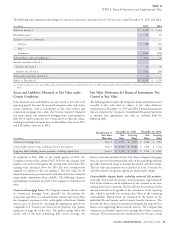

(1) As explained in Note 2(B), in the fourth quarter of 2015, the Company retrospectively adopted ASU 2015-03 that requires debt issuance costs to be netted against the carrying value of the

debt. Amounts presented above for 2014 have been retrospectively adjusted to conform to the new guidance. The impact on 2014 balances was not material.

(2) The Company has entered into interest rate swap contracts hedging a portion of these fixed-rate debt instruments. See Note 12 for further information about the Company’s interest rate risk

management and these derivative instruments.

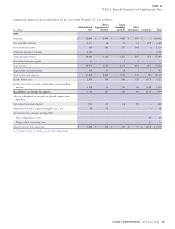

On March 11, 2015, the Company issued $900 million of 10-Year The following debt transactions occurred in April 2015:

Notes due April 15, 2025 at a stated interest rate of 3.25% The Company redeemed its 2.75% Notes due 2016, including

($892 million, net of discount and issuance costs, with an effective accrued interest from November 15, 2014 through the settlement

annual interest rate of 3.36%). Interest is payable on April 15 and date of April 13, 2015. The redemption price equaled the present

October 15 of each year beginning October 15, 2015. The proceeds value of the remaining principal and interest payments on the Notes

of this debt were used to repay debt maturing in 2016 and in 2019 as being redeemed, discounted at a rate equal to the 10-year Treasury

described below. Rate plus a fixed spread of 30 basis points. The Company paid

The Company may redeem the newly issued Notes, at any time, in $626 million including accrued interest and expenses, resulting in a

whole or in part, at a redemption price equal to the greater of: pre-tax loss on early debt extinguishment of $21 million

($14 million after-tax) that was recognized in the second quarter of

100% of the principal amount of the Notes to be redeemed; or 2015.

the present value of the remaining principal and interest payments The Company redeemed its 8.50% Notes due 2019, including

on the Notes being redeemed discounted at the applicable Treasury accrued interest from November 1, 2014 through the settlement

rate plus 17.5 basis points. date of April 13, 2015. The redemption price equaled the present

value of the remaining principal and interest payments on the Notes

CIGNA CORPORATION - 2015 Form 10-K 97

NOTE 15

•

•

••