Cigna 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

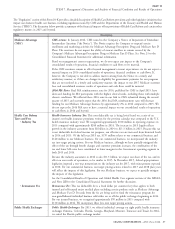

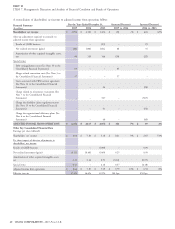

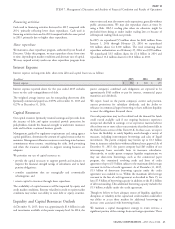

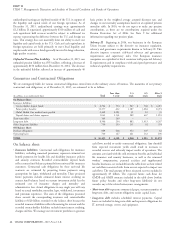

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Operating revenues increased in both 2015 and 2014 in each of our operating covenants, with Anthem continuing as the surviving

ongoing reporting segments (Global Health Care, Global company. Upon closing, our shareholders will receive $103.40 in cash

Supplemental Benefits, and Group Disability and Life). These and 0.5152 of a share of Anthem common stock for each common

increases are primarily attributable to customer growth in our targeted share of the Company. The closing price of Anthem common stock

market segments, rate actions in our commercial health care on February 24, 2016 was $130.75. At special shareholders’ meetings

businesses to recover medical cost trend as well as amounts assessed held in December 2015, Cigna shareholders approved the merger

under Health Care Reform (as defined on page 2 in this Form 10-K), with Anthem and Anthem shareholders voted to approve the issuance

and growth in our specialty businesses within our Global Health Care of shares of Anthem common stock according to the merger

segment. agreement. Consummation of the merger remains subject to certain

customary conditions, including the receipt of certain necessary

Total revenues. The increases in operating revenues in both 2015 and governmental and regulatory approvals and the absence of a legal

2014 were partially offset by decreases in realized investment results. restraint prohibiting the consummation of the merger. See Note 3 to

See additional discussion in our Consolidated financial results the Consolidated Financial Statements for additional details. In

beginning on page 39 of this MD&A. addition, see Item 1A. – Risk Factors in this Form 10-K for risks to

our business due to the proposed merger.

Shareholders’ net income was flat in 2015 compared with 2014

primarily due to higher adjusted income from operations as discussed Management expects this transaction to close in the second half of

below offset by lower realized investment gains and the impact of the 2016

2015 special item charges described in our Consolidated financial

results on page 40 of this MD&A. Shareholders’ net income per share

Other Significant Items Reported in Prior Years:

in 2015 and 2014 benefited from the favorable effect of share

•Run-off reinsurance transaction: See Note 7 to the Consolidated

repurchase.

Financial Statements for further information.

For 2014, the significant increase in shareholders’ net income

•Disability claims regulatory matter: See Note 23 to the

compared with 2013 is largely due to the absence of the $507 million

Consolidated Financial Statements for further information.

after-tax charge associated with the reinsurance agreement with

Berkshire recorded in 2013. See Note 7 to the Consolidated Financial •Organizational efficiency plan: See Note 6 to the Consolidated

Statements for further information. Financial Statements for further information.

Adjusted income from operations increased in both 2015 and 2014

reflecting higher earnings in each of our ongoing reporting segments.

Health Care Industry Developments

These favorable effects were driven by continued customer growth in The Patient Protection and Affordable Care Act and the Health Care

our targeted market segments and improved contributions from our and Education Reconciliation Act (‘‘Health Care Reform’’) and the

specialty health care businesses. Adjusted income from operations per implementing regulations have resulted in broad changes that are

share in 2015 and 2014 benefited from share repurchase. meaningfully impacting the industry, including relationships with

Global medical customers. Our medical customer base increased in customers and health care providers, the design of products and

2015, primarily driven by growth in our targeted market segments services, and pricing and delivery systems. In 2014, there were changes

and the acquisition of QualCare Alliance Networks, Inc. Excluding resulting from the implementation of Health Care Reform regulations

customers from our limited benefits business that we were required to including public exchanges, a non-deductible industry tax in addition

exit in 2014, our medical customer base increased in 2014 compared to fees and assessments, and minimum medical loss ratio requirements

with 2013, primarily due to growth in our targeted market segments. for Medicare Advantage and Medicare Part D plans. In both 2014 and

2015, there were ongoing payment reductions for Medicare

Further discussion of detailed components of revenues and expenses Advantage plans by the Centers for Medicare & Medicaid Services

can be found in the ‘‘Consolidated Results of Operations’’ section of (‘‘CMS’’). Collectively, these changes have had a significant impact on

this MD&A beginning on page 39. For further analysis and our business and customers, requiring adjustments to our business

explanation of individual segment results, see the ‘‘Segment model to mitigate their effects on our results of operations and cash

Reporting’’ section of this MD&A beginning on page 48. flows.

Key Transactions and Other Significant Items

Proposed Merger with Anthem, Inc. (‘‘Anthem’’)

On July 23, 2015, we entered into a definitive agreement to merge

with Anthem, subject to certain terms, conditions and customary

36 CIGNA CORPORATION - 2015 Form 10-K