Cigna 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

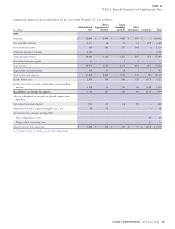

PART II

ITEM 8. Financial Statements and Supplementary Data

Contingencies and Other Matters

The Company, through its subsidiaries, is contingently liable for calculated exposure, without considering any reinsurance coverage,

various guarantees provided in the ordinary course of business. using the following hypothetical assumptions:

no annuitants surrendered their accounts;

A. Financial Guarantees: Retiree and Life

all annuitants lived to elect their benefit;

Insurance Benefits

all annuitants elected to receive their benefit on the next available

date (2016 through 2021); and

Separate account assets are contractholder funds maintained in

accounts with specific investment objectives. The Company records all underlying mutual fund investment values remained at the

separate account liabilities equal to separate account assets. In certain December 31, 2015 value of $944 million with no future returns.

cases, the Company guarantees a minimum level of benefits for The Company has reinsurance coverage in place that covers the

retirement and insurance contracts written in separate accounts. The exposures on these contracts. Using these hypothetical assumptions,

Company establishes an additional liability if management believes GMIB exposure is $776 million, which is lower than the recorded

that the Company will be required to make a payment under these liability for GMIB calculated using fair value assumptions. See

guarantees. Notes 7, 10 and 12 for further information on GMIB contracts.

The Company guarantees that separate account assets will be

sufficient to pay certain life insurance or retiree benefits. The

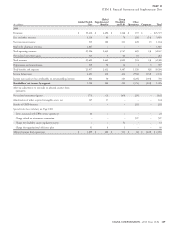

C. Certain Other Guarantees

sponsoring employers are primarily responsible for ensuring that assets

are sufficient to pay these benefits and are required to maintain assets The Company had indemnification obligations to lenders of up to

that exceed a certain percentage of benefit obligations. This $173 million as of December 31, 2015, related to borrowings by

percentage varies depending on the asset class within a sponsoring certain real estate joint ventures that the Company either records as an

employer’s portfolio (for example, a bond fund would require a lower investment or consolidates. These borrowings, that are nonrecourse to

percentage than a riskier equity fund) and thus will vary as the the Company, are secured by the joint ventures’ real estate properties

composition of the portfolio changes. If employers do not maintain with fair values in excess of the loan amounts and mature at various

the required levels of separate account assets, the Company or an dates beginning in 2016 through 2021. The Company’s

affiliate of the buyer of the retirement benefits business (Prudential indemnification obligations would require payment to lenders for any

Retirement Insurance and Annuity Company) has the right to redirect actual damages resulting from certain acts such as unauthorized

the management of the related assets to provide for benefit payments. ownership transfers, misappropriation of rental payments by others or

As of December 31, 2015, employers maintained assets that exceeded environmental damages. Based on initial and ongoing reviews of

the benefit obligations. Benefit obligations under these arrangements property management and operations, the Company does not expect

were $495 million as of December 31, 2015 and approximately 13% that payments will be required under these indemnification

of these are reinsured by an affiliate of the buyer of the retirement obligations. Any payments that might be required could be recovered

benefits business. The remaining guarantees are provided by the through a refinancing or sale of the assets. In some cases, the

Company with minimal reinsurance from third parties. There were no Company also has recourse to partners for their proportionate share of

additional liabilities required for these guarantees as of December 31, amounts paid. There were no liabilities required for these

2015. Separate account assets supporting these guarantees are indemnification obligations as of December 31, 2015.

classified in Levels 1 and 2 of the GAAP fair value hierarchy. See As of December 31, 2015, the Company guaranteed that it would

Note 10 for further information on the fair value hierarchy. compensate the lessors for a shortfall of up to $41 million in the

The Company does not expect that these financial guarantees will market value of certain leased equipment at the end of the lease.

have a material effect on the Company’s consolidated results of Guarantees of $16 million expire in 2016 and $25 million expire in

operations, liquidity or financial condition. 2022. The Company had liabilities for these guarantees of

$14 million as of December 31, 2015.

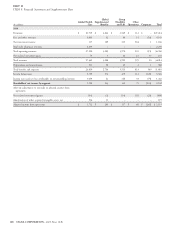

B. Guaranteed Minimum Income Benefit

The Company does not expect that these guarantees will have a

material adverse effect on the Company’s consolidated results of

Contracts

operations, financial condition or liquidity.

Under these guarantees, future payment amounts are dependent on

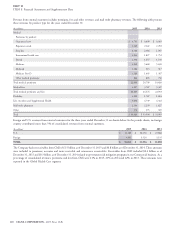

The Company had indemnification obligations as of December 31,

underlying mutual fund investment values and interest rate levels

2015 in connection with acquisition, disposition and reinsurance

prior to and at the date of annuitization election that must occur

transactions. These indemnification obligations are triggered by the

within 30 days of a policy anniversary after the appropriate waiting

breach of representations or covenants provided by the Company,

period. Therefore, the future payments are not fixed and determinable

such as representations for the presentation of financial statements,

under the terms of these contracts. Accordingly, the Company

actuarial models, the filing of tax returns, compliance with law or the

identification of outstanding litigation. These obligations are typically

subject to various time limitations, defined by the contract or by

CIGNA CORPORATION - 2015 Form 10-K 111

NOTE 23

•

•

•

•