Cigna 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

Pension and Other Postretirement Benefit Plans

A. Pension and Other Postretirement Benefit Plans

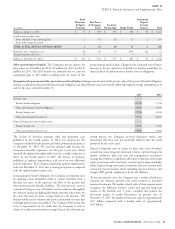

The Company and certain of its subsidiaries provide pension, health As further discussed in Note 23, the Company and the Cigna Pension

care and life insurance defined benefits to eligible retired employees, Plan are defendants in a class action lawsuit. When the plan

spouses and other eligible dependents through various domestic and amendment related to this litigation is adopted, the pension benefit

foreign plans. The effect of its foreign pension and other obligation will be updated to reflect benefits resulting from this

postretirement benefit plans is immaterial to the Company’s results of litigation.

operations, liquidity and financial position. The Company froze its

defined benefit postretirement medical plan in 2013 and its primary

domestic pension plans in 2009.

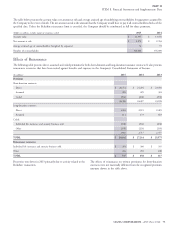

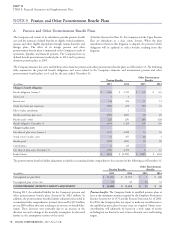

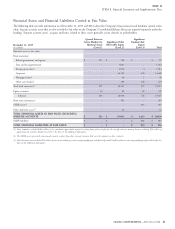

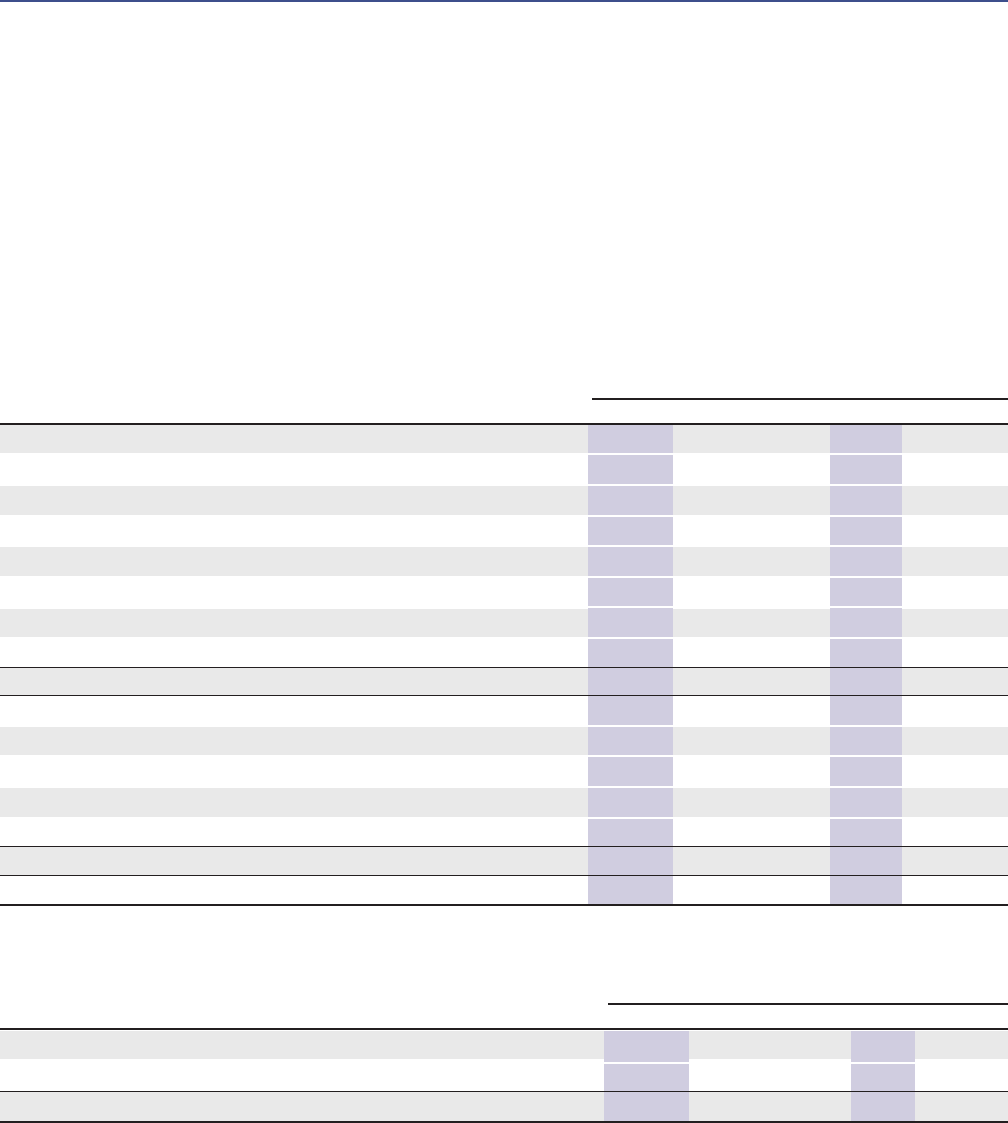

The Company measures the assets and liabilities of its domestic pension and other postretirement benefit plans as of December 31. The following

table summarizes the projected benefit obligations and assets related to the Company’s domestic and international pension and other

postretirement benefit plans as of, and for the year ended, December 31:

Other Postretirement

Pension Benefits Benefits

(In millions)

2015 2014 2015 2014

Change in benefit obligation

Benefit obligation, January 1 $ 5,269 $ 4,700 $ 335 $ 323

Service cost 22––

Interest cost 194 206 11 12

(Gain) loss from past experience (239) 679 (19) 31

Effect of plan amendment – 2 – –

Benefits paid from plan assets (270) (291) (3) (5)

Benefits paid – other (22) (29) (29) (26)

Benefit obligation, December 31 4,934 5,269 295 335

Change in plan assets

Fair value of plan assets, January 1 4,170 4,089 12 16

Actual return on plan assets 75 257 (1) 1

Benefits paid (270) (291) (3) (5)

Contributions 6 115 – –

Fair value of plan assets, December 31 3,981 4,170 8 12

Funded Status $ (953) $ (1,099) $ (287) $ (323)

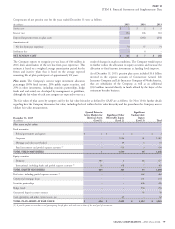

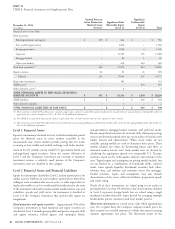

The postretirement benefits liability adjustment included in accumulated other comprehensive loss consisted of the following as of December 31:

Other Postretirement

Pension Benefits Benefits

(In millions)

2015 2014 2015 2014

Unrecognized net gain (loss) $ (2,201) $ (2,317) $ 1 $ (16)

Unrecognized prior service cost (7) (7) 52 54

POSTRETIREMENT BENEFITS LIABILITY ADJUSTMENT $ (2,208) $ (2,324) $ 53 $ 38

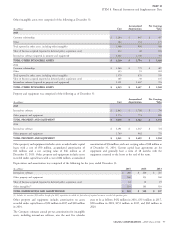

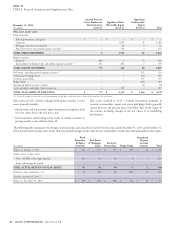

During 2015, the unfunded liability for the Company’s pension and Pension benefits. The Company funds its qualified pension plans at

other postretirement benefit plans decreased by $182 million. In least at the minimum amount required by the Employee Retirement

addition, the postretirement benefits liability adjustment (recorded in Income Security Act of 1974 and the Pension Protection Act of 2006.

accumulated other comprehensive income) decreased by $131 million For 2016, the Company does not expect to make any contributions to

pre-tax ($85 million after-tax) resulting in an increase to shareholders’ the qualified pension plans because none are required. Future years’

equity. These decreases were primarily due to an increase in the contributions will ultimately be based on a wide range of factors

discount rate and a change in the mortality assumption (as discussed including but not limited to asset returns, discount rates, and funding

further in the assumptions section of this note). targets.

78 CIGNA CORPORATION - 2015 Form 10-K

NOTE 9