Cigna 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

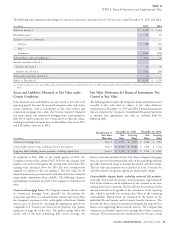

PART II

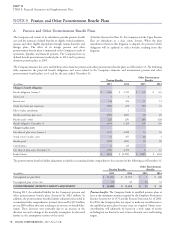

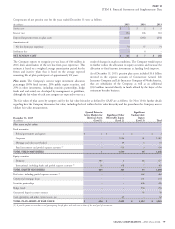

ITEM 8. Financial Statements and Supplementary Data

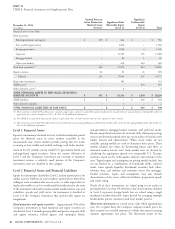

investments and corroboration of the reported amounts over the review published research in its evaluation, as well as the issuer’s

holding period support their classification in Level 2. financial statements.

Other derivatives classified in Level 2 represent over-the-counter Quantitative Information about Unobservable Inputs

instruments such as interest rate and foreign currency swap contracts.

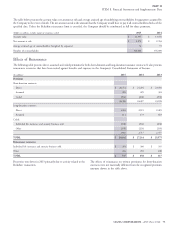

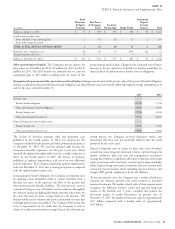

The following tables summarize the fair value and significant

Fair values for these instruments are determined using market

unobservable inputs used in pricing the following securities that were

observable inputs including forward currency and interest rate curves

developed directly by the Company as of December 31, 2015 and

and widely published market observable indices. Credit risk related to

2014. The range and weighted average basis point amounts (‘‘bps’’)

the counterparty and the Company is considered when estimating the

for fixed maturity spreads (adjustment to discount rates) and

fair values of these derivatives. However, the Company is largely

price-to-earnings multiples for equity investments reflect the

protected by collateral arrangements with counterparties and

Company’s best estimates of the unobservable adjustments a market

determined that no adjustment for credit risk was required as of

participant would make to calculate these fair values.

December 31, 2015 or 2014. Level 2 also includes exchange-traded

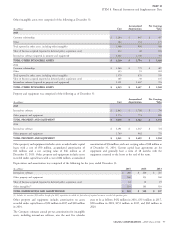

interest rate swap contracts. Credit risk related to the clearinghouse Other asset and mortgage-backed securities. The significant

counterparty and the Company is considered minimal when unobservable inputs used to value the following other asset and

estimating the fair values of these derivatives because of upfront mortgage-backed securities are liquidity and weighting of credit

margin deposits and daily settlement requirements. The nature and spreads. When there is limited trading activity for the security, an

use of these other derivatives are described in Note 12. adjustment for liquidity is made as of the measurement date that

considers current market conditions, issuer circumstances and

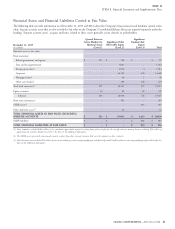

Level 3 Financial Assets and Financial Liabilities

complexity of the security structure. An adjustment to weight credit

Certain inputs for instruments classified in Level 3 are unobservable spreads is needed to value a more complex bond structure with

(supported by little or no market activity) and significant to their multiple underlying collateral and no standard market valuation

resulting fair value measurement. Unobservable inputs reflect the technique. The weighting of credit spreads is primarily based on the

Company’s best estimate of what hypothetical market participants underlying collateral’s characteristics and their proportional cash flows

would use to determine a transaction price for the asset or liability at supporting the bond obligations. The resulting wide range of

the reporting date. unobservable adjustments in the table below is due to the varying

liquidity and quality of the underlying collateral, ranging from high

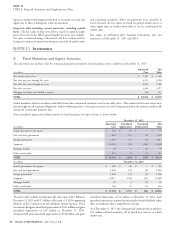

The Company classifies certain newly issued, privately-placed, credit quality to below investment grade.

complex or illiquid securities, as well as assets and liabilities relating to

GMIB, in Level 3. Approximately 4% of fixed maturities and equity Corporate and government fixed maturities. The significant

securities are priced using significant unobservable inputs and unobservable input used to value the following corporate and

classified in this category. government fixed maturities is an adjustment for liquidity. When

there is limited trading activity for the security, an adjustment is

Fair values of other asset and mortgage-backed securities, corporate needed to reflect current market conditions and issuer circumstances.

and government fixed maturities are primarily determined using

pricing models that incorporate the specific characteristics of each Equity securities. The significant unobservable input used to value

asset and related assumptions including the investment type and the following equity securities is a multiple of earnings before interest,

structure, credit quality, industry and maturity date in comparison to taxes, depreciation and amortization (‘‘EBITDA’’). These securities

current market indices, spreads and liquidity of assets with similar are comprised of private equity investments with limited trading

characteristics. For other asset and mortgage-backed securities, inputs activity and therefore a ratio of EBITDA is used to estimate value

and assumptions for pricing may also include collateral attributes and based on company circumstances and relative risk characteristics.

prepayment speeds. Recent trades in the subject security or similar

securities are assessed when available, and the Company may also

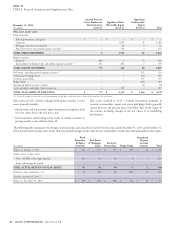

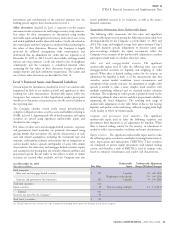

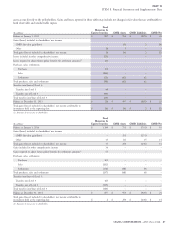

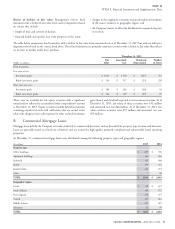

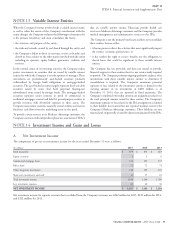

Unobservable Unobservable Adjustment

As of December 31, 2015

(Fair value in millions)

Fair Value Input Range (Weighted Average)

Fixed maturities:

Other asset and mortgage-backed securities $ 327 Liquidity 60 - 440 (200)

Weighting of credit spreads 170 - 630 (220)

Corporate and government fixed maturities 285 Liquidity 70 - 930 (280)

Total fixed maturities 612

Equity securities 69 Price-to-earnings multiples 4.2 - 11.6 (8.3)

Subtotal 681

Securities not priced by the Company

(1)

45

Total Level 3 securities $ 726

(1) The fair values for these securities use single, unadjusted non-binding broker quotes not developed directly by the Company.

CIGNA CORPORATION - 2015 Form 10-K 85