Cigna 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

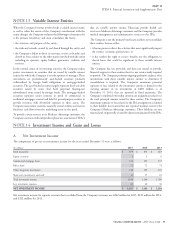

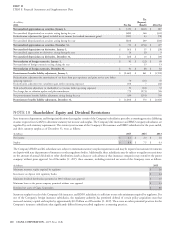

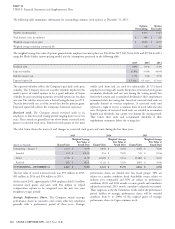

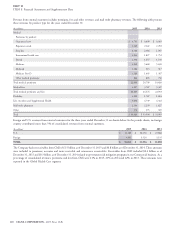

The following table summarizes information for outstanding common stock options at December 31, 2015:

Options Options

Outstanding Exercisable

Number (in thousands) 6,433 3,414

Total intrinsic value (in millions) $ 498 $ 341

Weighted average exercise price $ 68.86 $ 46.55

Weighted average remaining contractual life 6.8 5.4

The weighted average fair value of options granted under employee incentive plans was $36.40 for 2015, $23.56 for 2014 and $19.84 for 2013

using the Black-Scholes option-pricing model and the assumptions presented in the following table.

2015 2014 2013

Dividend yield 0.0% 0.1% 0.1%

Expected volatility 35.0% 35.0% 40.0%

Risk-free interest rate 1.3% 1.3% 0.7%

Expected option life 4.3 years 4.3 years 4.5 years

The expected volatility reflects the Company’s past daily stock price widely used form and are used for substantially all U.S.-based

volatility. The Company does not consider volatility implied in the employees receiving such awards. Recipients of restricted stock grants

market prices of traded options to be a good indicator of future accumulate dividends and can vote during the vesting period, but

volatility because remaining maturities of traded options are less than forfeit their awards and accumulated dividends if their employment

one year. The risk-free interest rate is derived using the four-year U.S. terminates before the vesting date. Awards of restricted stock units are

Treasury bond yield rate as of the award date for the primary grant. generally limited to overseas employees. A restricted stock unit

Expected option life reflects the Company’s historical experience. represents a right to receive a common share of stock when the unit

vests. Recipients of restricted stock units are entitled to accumulate

Restricted stock. The Company awards restricted stock to its hypothetical dividends, but cannot vote during the vesting period.

employees or directors with vesting periods ranging from two to five They forfeit their units and accumulated dividends if their

years. These awards are generally in one of two forms: restricted stock employment terminates before the vesting date.

grants or restricted stock units. Restricted stock grants are the most

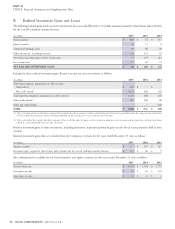

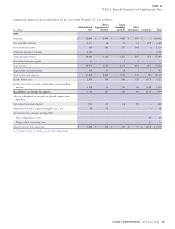

The table below shows the status of, and changes in, restricted stock grants and units during the last three years:

2015 2014 2013

Weighted Average Weighted Average Weighted Average

Fair Value at Fair Value at Fair Value at

(Awards in thousands)

Grants/Units Award Date Grants/Units Award Date Grants/Units Award Date

Outstanding – January 1 2,121 $ 53.59 2,844 $ 41.56 4,064 $ 35.00

Awarded 352 $ 121.93 454 $ 78.99 525 $ 59.36

Vested (736) $ 41.99 (1,065) $ 32.34 (1,480) $ 30.24

Forfeited (95) $ 68.31 (112) $ 52.95 (265) $ 39.46

OUTSTANDING – DECEMBER 31 1,642 $ 72.58 2,121 $ 53.59 2,844 $ 41.56

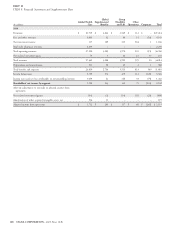

The fair value of vested restricted stock was: $92 million in 2015, performance shares are divided into two broad groups: 50% are

$85 million in 2014 and $94 million in 2013. subject to a market condition (total shareholder return relative to

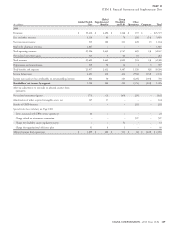

industry peer companies) and 50% are subject to performance

At the end of 2015, approximately 3,900 employees held 1.6 million conditions (2013 and 2014 awards: revenue growth and cumulative

restricted stock grants and units with $56 million of related adjusted net income; 2015 awards, cumulative adjusted net income).

compensation expense to be recognized over the next two years These targets are set by the Committee. At the end of the performance

(weighted average period). period, holders of strategic performance shares will be awarded

anywhere from 0 to 200% of the original grant of strategic

Strategic Performance Shares. The Company awards strategic performance shares in Cigna common stock.

performance shares to executives and certain other key employees

generally with a performance period of three years. Strategic

104 CIGNA CORPORATION - 2015 Form 10-K