Cigna 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

ITEM 8. Financial Statements and Supplementary Data

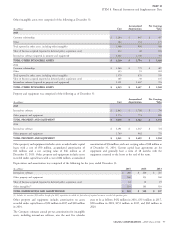

taxes. The Company records acquisition costs differently depending and reported in the Global Health Care segment ($5.7 billion) and

on the product line. Acquisition costs for: the Global Supplemental Benefits segment ($0.3 billion). The

Company evaluates goodwill for impairment at least annually during

Universal life products are deferred and amortized in proportion to the third quarter at the reporting unit level and writes it down through

the present value of total estimated gross profits over the expected results of operations if impaired. Fair value of a reporting unit is

lives of the contracts. generally estimated based on either market data or a discounted cash

flow analysis using assumptions that the Company believes a

Supplemental health, life and accident insurance (primarily

hypothetical market participant would use to determine a current

individual products) and group health and accident insurance

transaction price. The significant assumptions and estimates used in

products are deferred and amortized, generally in proportion to the

determining fair value include the discount rate and future cash flows.

ratio of periodic revenue to the estimated total revenues over the

A range of discount rates is used that corresponds with the reporting

contract periods.

unit’s weighted average cost of capital, consistent with that used for

Other products are expensed as incurred. investment decisions considering the specific and detailed operating

plans and strategies within the reporting units. Projections of future

Deferred policy acquisition costs also include the value of business

cash flows for the reporting units are consistent with our annual

acquired with certain acquisitions.

planning process for revenues, claims, operating expenses, taxes,

Each year, deferred policy acquisition costs are tested for capital levels and long-term growth rates. See Note 8 for additional

recoverability. For universal life and other individual products, information.

management estimates the present value of future revenues less

expected payments. For group health and accident insurance

I. Other Assets, including Other

products, management estimates the sum of unearned premiums and

anticipated net investment income less future expected claims and

Intangibles

related costs. If management’s estimates of these sums are less than the Other assets consist primarily of guaranteed minimum income

deferred costs, the Company reduces deferred policy acquisition costs benefits (‘‘GMIB’’) assets and various other insurance-related assets.

and records an expense. The Company recorded amortization for The Company’s other intangible assets include purchased customer

policy acquisition costs of $286 million in 2015, $289 million in and producer relationships, provider networks and trademarks. The

2014 and $255 million in 2013 primarily in other operating expenses. fair value of purchased customer relationships and the amortization

method were determined as of the dates of purchase using an income

G. Property and Equipment

approach that relies on projected future net cash flows including key

assumptions for the customer attrition rate and discount rate. The

Property and equipment is carried at cost less accumulated Company amortizes other intangibles on an accelerated or

depreciation. When applicable, cost includes interest, real estate taxes straight-line basis over periods from five to 30 years. Management

and other costs incurred during construction. Also included in this revises amortization periods if it believes there has been a change in

category is internal-use software that is acquired, developed or the length of time that an intangible asset will continue to have value.

modified solely to meet the Company’s internal needs, with no plan to Costs incurred to renew or extend the terms of these intangible assets

market externally. Costs directly related to acquiring, developing or are generally expensed as incurred. See Notes 8 and 10 for additional

modifying internal-use software are capitalized. information.

The Company calculates depreciation and amortization principally

using the straight-line method generally based on the estimated useful

J. Separate Account Assets and Liabilities

life of each asset as follows: buildings and improvements, 10 to

40 years; purchased software, one to five years; internally developed Separate account assets and liabilities are contractholder funds

software, three to seven years; and furniture and equipment (including maintained in accounts with specific investment objectives. The assets

computer equipment), three to 10 years. Improvements to leased of these accounts are legally segregated and are not subject to claims

facilities are depreciated over the lesser of the remaining lease term or that arise out of any of the Company’s other businesses. These separate

the estimated life of the improvement. The Company considers events account assets are carried at fair value with equal amounts for related

and circumstances that would indicate the carrying value of property, separate account liabilities. The investment income, gains and losses

equipment or capitalized software might not be recoverable. If the of these accounts generally accrue to the contractholders and, together

Company determines the carrying value of any of these assets is not with their deposits and withdrawals, are excluded from the Company’s

recoverable, an impairment charge is recorded. See Note 8 for Consolidated Statements of Income and Cash Flows. Fees and charges

additional information. earned for mortality risks, asset management or administrative

services are reported in either premiums or fees and other revenues.

H. Goodwill

K. Contractholder Deposit Funds

Goodwill represents the excess of the cost of businesses acquired over

the fair value of their net assets. The resulting goodwill is assigned to Liabilities for contractholder deposit funds primarily include deposits

those reporting units expected to realize cash flows from the received from customers for investment-related and universal life

acquisition, allocated to reporting units based on relative fair values products and investment earnings on their fund balances. These

CIGNA CORPORATION - 2015 Form 10-K 67

•

•

•