Cigna 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

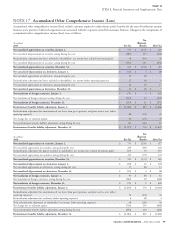

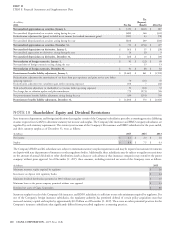

PART II

ITEM 8. Financial Statements and Supplementary Data

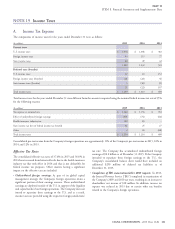

Income Taxes

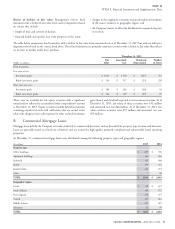

A. Income Tax Expense

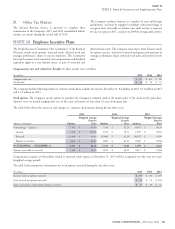

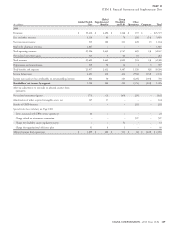

The components of income taxes for the years ended December 31 were as follows:

(In millions)

2015 2014 2013

Current taxes

U.S. income taxes $ 1,076 $ 1,068 $ 382

Foreign income taxes 93 115 77

State income taxes 60 49 42

1,229 1,232 501

Deferred taxes (benefits)

U.S. income taxes 22 10 152

Foreign income taxes (benefits) (6) (22) 46

State income taxes (benefits) 5 (10) (1)

21 (22) 197

Total income taxes $ 1,250 $ 1,210 $ 698

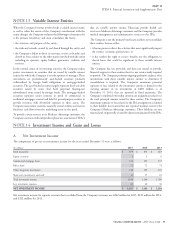

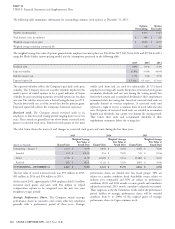

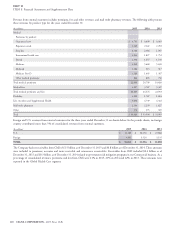

Total income taxes for the years ended December 31 were different from the amount computed using the nominal federal income tax rate of 35%

for the following reasons:

(In millions)

2015 2014 2013

Tax expense at nominal rate $ 1,164 $ 1,156 $ 761

Effect of undistributed foreign earnings (67) (74) (42)

Health insurance industry tax 109 83 –

State income tax (net of federal income tax benefit) 42 25 27

Other 2 20 (48)

Total income taxes $ 1,250 $ 1,210 $ 698

Consolidated pre-tax income from the Company’s foreign operations was approximately 11% of the Company’s pre-tax income in 2015, 10% in

2014 and 12% in 2013.

tax rate. The Company has accumulated undistributed foreign

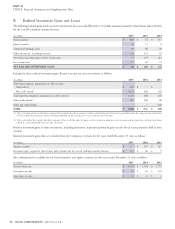

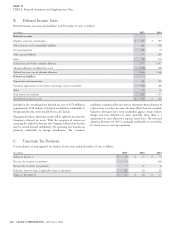

Effective Tax Rates

earnings of $2.2 billion as of December 31, 2015. If the Company

The consolidated effective tax rates of 37.6% in 2015 and 36.6% in intended to repatriate these foreign earnings to the U.S., the

2014 have increased from historical levels due to the health insurance Company’s consolidated balance sheet would have included an

industry tax that took effect in 2014 and that is not deductible for additional $290 million of deferred tax liabilities as of

federal income tax purposes. Other matters having a significant December 31, 2015.

impact on the effective tax rate included: •Completion of IRS examinations/other 2013 impacts. In 2013,

•Undistributed foreign earnings. As part of its global capital the Internal Revenue Service (‘‘IRS’’) completed its examination of

management strategy, the Company’s foreign operations retain a the Company’s 2009 and 2010 tax years, resulting in an increase to

significant portion of their earnings overseas. These undistributed shareholders’ net income of $18 million. In addition, income tax

earnings are deployed outside of the U.S. in support of the liquidity expense was reduced in 2013 due to certain other tax benefits

and capital needs of our foreign operations. The Company does not related to the Company’s foreign operations.

intend to repatriate these earnings to the U.S. and as a result,

income taxes are provided using the respective foreign jurisdictions’

CIGNA CORPORATION - 2015 Form 10-K 101

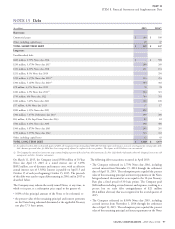

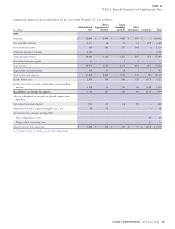

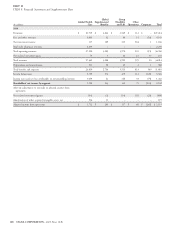

NOTE 19