Cigna 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

Variable Interest Entities

When the Company becomes involved with a variable interest entity, that are variable interest entities. Physicians provide health care

as well as when the nature of the Company’s involvement with the services to Medicare Advantage customers and the Company provides

entity changes, the Company evaluates the following to determine if it medical management and administrative services to the IPAs.

is the primary beneficiary and must consolidate the entity: The Company is not the primary beneficiary and does not consolidate

the structure and purpose of the entity; these entities because either:

the risks and rewards created by and shared through the entity; and it has no power to direct the activities that most significantly impact

the entities’ economic performance; or

the Company’s ability to direct its activities, receive its benefits and

absorb its losses relative to the other parties involved with the entity it has neither the right to receive benefits nor the obligation to

including its sponsors, equity holders, guarantors, creditors and absorb losses that could be significant to these variable interest

servicers. entities.

In the normal course of its investing activities, the Company makes The Company has not provided, and does not intend to provide,

passive investments in securities that are issued by variable interest financial support to these entities that it is not contractually required

entities for which the Company is not the sponsor or manager. These to provide. The Company performs ongoing qualitative analyses of its

investments are predominantly asset-backed securities primarily involvement with these variable interest entities to determine if

collateralized by foreign bank obligations or mortgage-backed consolidation is required. The Company’s maximum potential

securities. The asset-backed securities largely represent fixed-rate debt exposure to loss related to the investment entities is limited to the

securities issued by trusts that hold perpetual floating-rate carrying amount of its investments of $600 million as of

subordinated notes issued by foreign banks. The mortgage-backed December 31, 2015, that are reported in fixed maturities. The

securities represent senior interests in pools of commercial or Company’s combined ownership interests are insignificant relative to

residential mortgages created and held by special-purpose entities to the total principal amount issued by these entities. The Company’s

provide investors with diversified exposure to these assets. The maximum exposure to loss related to the IPA arrangements is limited

Company owns senior securities issued by several entities and receives to their liability for incurred but not reported medical costs for the

fixed-rate cash flows from the underlying assets in the pools. Company’s Medicare Advantage customers. These liabilities are not

material and are generally secured by deposits maintained by the IPAs.

To provide certain services to its Medicare Advantage customers, the

Company contracts with independent physician associations (‘‘IPAs’’)

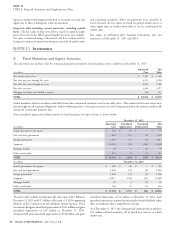

Investment Income and Gains and Losses

A. Net Investment Income

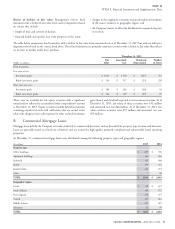

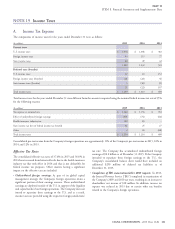

The components of pre-tax net investment income for the years ended December 31 were as follows:

(In millions)

2015 2014 2013

Fixed maturities $ 879 $ 876 $ 823

Equity securities 336

Commercial mortgage loans 112 133 174

Policy loans 72 72 74

Other long-term investments 116 105 101

Short-term investments and cash 14 17 22

Total investment income 1,196 1,206 1,200

Less investment expenses 43 40 36

NET INVESTMENT INCOME $ 1,153 $ 1,166 $ 1,164

Net investment income for separate accounts that is excluded from the Company’s revenues was $262 million for 2015, $225 million for 2014,

and $232 million for 2013.

CIGNA CORPORATION - 2015 Form 10-K 95

NOTE 13

•

••

•

•

NOTE 14