Cigna 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8. Financial Statements and Supplementary Data

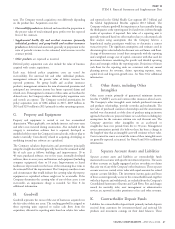

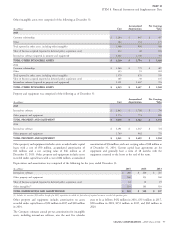

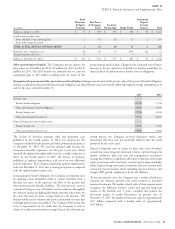

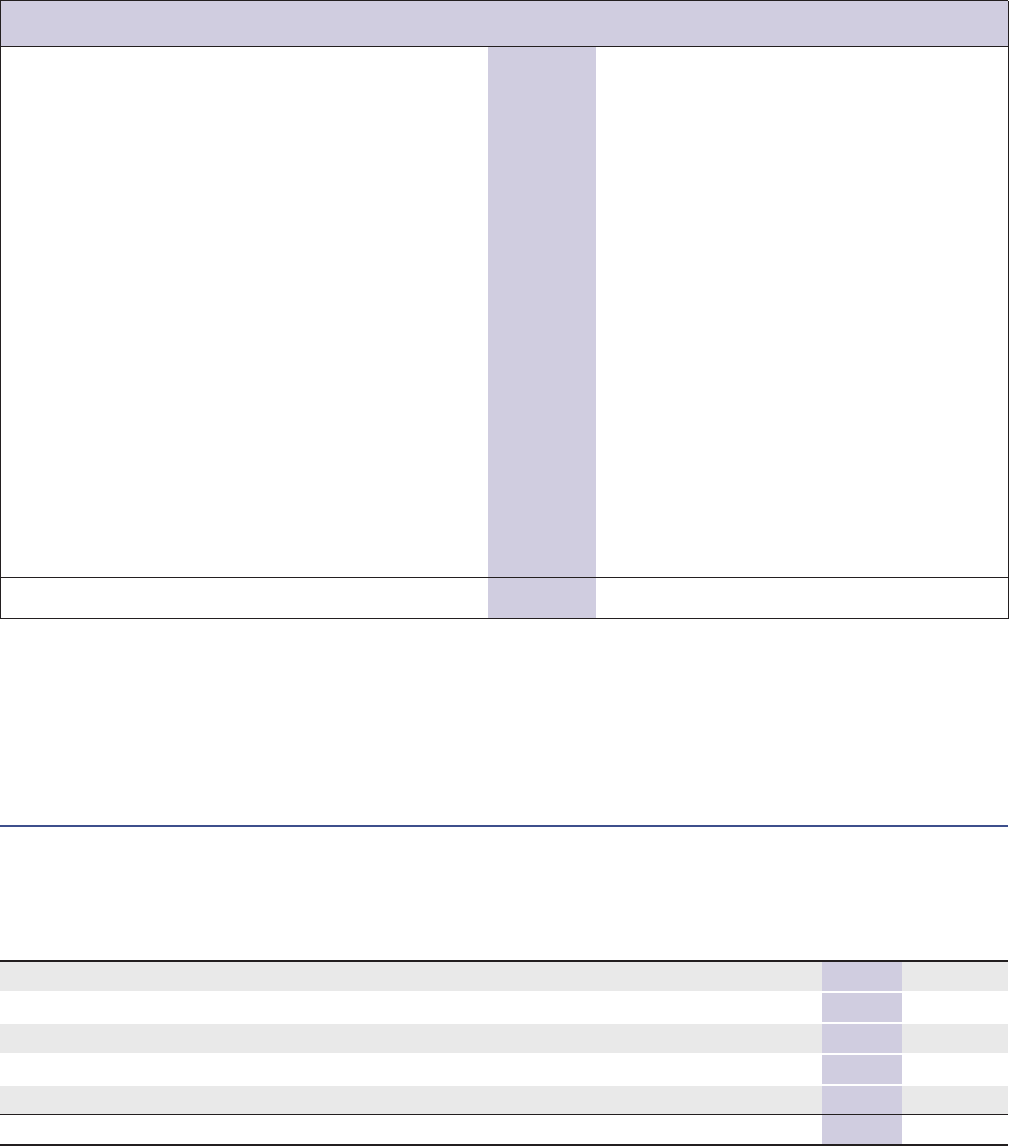

Reinsurance Recoverables

The majority of the Company’s reinsurance recoverables balance resulted from acquisition and disposition transactions in which the underwriting

company was not acquired. Components of the Company’s reinsurance recoverables are presented below:

(In millions)

December 31, December 31, Collateral and Other Terms

Line of Business Reinsurer(s) 2015 2014 at December 31, 2015

GMDB Berkshire $ 1,123 $ 1,147 100% were secured by assets in a trust.

Other 41 39 100% were secured by assets in a letter of

credit or a trust.

Individual Life and Annuity (sold in Lincoln National Life and 3,705 3,817 Both companies’ ratings were sufficient to

1998) Lincoln Life & Annuity avoid triggering a contractual obligation to

of New York fully secure the outstanding balance.

Retirement Benefits Business (sold in Prudential Retirement 995 1,092 100% were secured by assets in a trust.

2004) Insurance and Annuity

Supplemental Benefits Business (2012 Great American Life 315 336 99% were secured by assets in a trust.

acquisition)

Global Health Care, Global Supplemental Various 553 561 Recoverables from approximately 75

Benefits, Group Disability and Life reinsurers, including the U.S. Government,

used in the ordinary course of business.

Excluding the recoverable from the U.S.

Government of approximately $160 million,

current balances range from less than

$1 million up to $88 million, with 18%

secured by assets in trusts or letters of

credit.

Other run-off reinsurance Various 81 88 100% of this balance was secured by assets

in a trust and other deposits.

Total reinsurance recoverables $ 6,813 $ 7,080

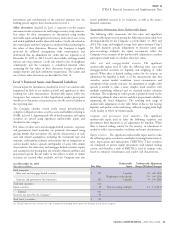

Over 90% of the Company’s reinsurance recoverables were from The Company bears the risk of loss if its reinsurers and

companies that are rated A or higher by Standard & Poors at retrocessionaires do not meet or are unable to meet their reinsurance

December 31, 2015. The Company reviews its reinsurance obligations to the Company.

arrangements and establishes reserves against the recoverables in the

event that recovery is not considered probable. As of December 31,

2015, the Company’s recoverables were net of a reserve of $3 million.

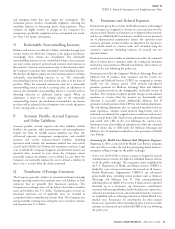

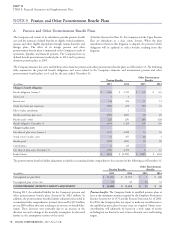

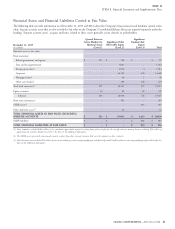

Goodwill, Other Intangibles, and Property and Equipment

Goodwill is primarily reported in the Global Health Care segment ($5.7 billion) and, to a lesser extent, the Global Supplemental Benefits segment

($0.3 billion).

Goodwill activity during 2015 and 2014 was as follows:

(In millions)

2015 2014

Balance at January 1, $ 5,989 $ 6,029

Goodwill acquired:

QualCare Alliance Networks, Inc. 74 –

Other –3

Impact of foreign currency translation (44) (43)

Balance at December 31, $ 6,019 $ 5,989

76 CIGNA CORPORATION - 2015 Form 10-K

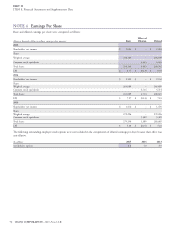

NOTE 8