Cigna 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

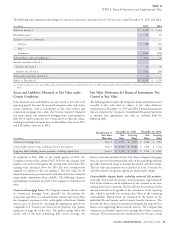

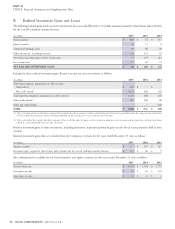

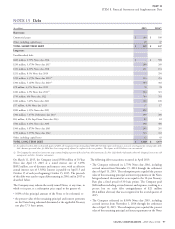

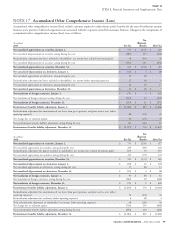

PART II

ITEM 8. Financial Statements and Supplementary Data

being redeemed, discounted at a rate equal to the 10-year Treasury adjustment attributable to pension that is included in accumulated

Rate plus a fixed spread of 50 basis points. The Company paid other comprehensive loss on the Company’s consolidated balance

$329 million including accrued interest and expenses, resulting in a sheet.

pre-tax loss on early debt extinguishment of $79 million The Company had $7.9 billion of borrowing capacity within the

($51 million after-tax) that was recognized in the second quarter of maximum debt coverage covenant in the letter of credit agreement, in

2015. addition to the $5.2 billion of debt outstanding as of December 31,

The Company has a five-year revolving credit and letter of credit 2015. This additional borrowing capacity includes the $1.5 billion

agreement for $1.5 billion that permits up to $500 million to be used available under the credit agreement. Letters of credit outstanding as

for letters of credit. This agreement extends through December 2019 of December 31, 2015 totaled $19 million.

and is diversified among 16 banks with three banks each having 12% The Company was in compliance with its debt covenants as of

of the commitment and the remainder spread among 13 banks. The December 31, 2015.

credit agreement includes options to increase the commitment

amount to $2 billion and to extend the term past December 2019, Maturities of long-term debt, excluding capital leases, are as follows

subject to consent by the administrative agent and the committing (in millions): none in 2016, $250 in 2017, $131 in 2018, none in

banks. The credit agreement is available for general corporate 2019, $550 in 2020 and the remainder in years after 2020. Maturities

purposes including for the issuance of letters of credit. The credit of debt under capital lease arrangements are as follows (in millions):

agreement contains customary covenants and restrictions, including a $23 in 2016, $12 in 2017, $7 in 2018, $6 in 2019, none in 2020 and

financial covenant that the Company may not permit its leverage ratio the remainder in years after 2020. Interest expense on long-term and

to be greater than 0.50. The leverage ratio is total consolidated debt to short-term debt was $252 million in 2015, $265 million in 2014, and

total consolidated capitalization (each as defined in the credit $270 million in 2013. The 2015 expense excludes losses on the early

agreement) and excludes net unrealized appreciation in fixed extinguishment of debt.

maturities and the portion of the post-retirement benefits liability

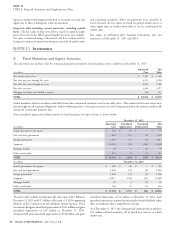

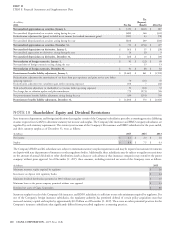

Common and Preferred Stock

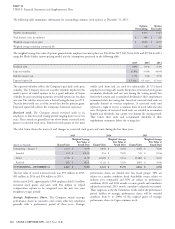

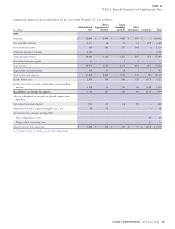

As of December 31, the Company had issued the following shares:

(Shares in thousands)

2015 2014 2013

Common: Par value $0.25; 600,000 shares authorized

Outstanding – January 1, 259,276 275,526 285,829

Issued for stock option and other benefit plans 2,751 2,284 3,319

Repurchased common stock (5,483) (18,534) (13,622)

Outstanding – December 31, 256,544 259,276 275,526

Treasury stock 39,601 36,869 90,619

ISSUED – DECEMBER 31, 296,145 296,145 366,145

The Company maintains a share repurchase program authorized by its In 2014, the Company retired 70 million shares of treasury stock.

Board of Directors. Under this program, we may repurchase shares This transaction had no effect on total shareholders’ equity.

from time to time, depending on market conditions and alternate uses The Company has authorized a total of 25 million shares of $1 par

of capital. We may suspend activity under our share repurchase value preferred stock. No shares of preferred stock were outstanding at

program from time to time and may also remove such suspensions December 31, 2015, 2014 or 2013.

without public announcement. We may also repurchase shares at

times when we otherwise might be precluded from doing so under

insider trading laws or because of self-imposed trading black-out

periods by using a Rule 10b5-1 trading plan.

98 CIGNA CORPORATION - 2015 Form 10-K

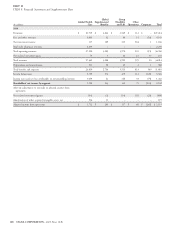

NOTE 16