CVS 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

2013 Annual Report

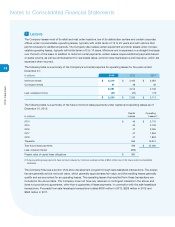

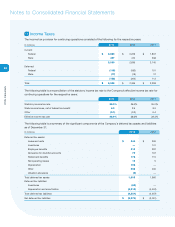

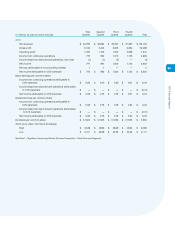

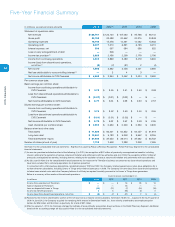

Net deferred tax assets (liabilities) are presented on the consolidated balance sheets as follows as of December 31:

In millions

2013 2012

Deferred tax assets – current

$ 902

$ 693

Deferred tax assets – noncurrent (included in other assets)

23

—

Deferred tax liabilities – noncurrent

(3,901)

(3,784)

Net deferred tax liabilities

$ (2,976)

$ (3,091)

The Company believes it is more likely than not the deferred tax assets will be realized during future periods.

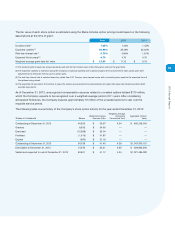

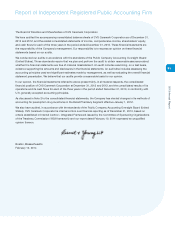

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

In millions

2013 2012 2011

Beginning balance

$ 80

$ 38 $ 35

Additions based on tax positions related to the current year

19

15 3

Additions based on tax positions related to prior years

37

42 13

Reductions for tax positions of prior years

(1)

(2) —

Expiration of statutes of limitation

(17)

(12) (7)

Settlements

(1)

(1) (6)

Ending balance

$ 117

$ 80 $ 38

The Company and most of its subsidiaries are subject to U.S. federal income tax as well as income tax of numerous

state and local jurisdictions. The Internal Revenue Service (“IRS”) is currently examining the Company’s 2012 and

2013 consolidated U.S. federal income tax returns under its Compliance Assurance Process (“CAP”) program. The

CAP program is a voluntary program under which participating taxpayers work collaboratively with the IRS to identify

and resolve potential tax issues through open, cooperative and transparent interaction prior to the filing of their

federal income tax return.

The Company and its subsidiaries are also currently under income tax examinations by a number of state and local

tax authorities. As of December 31, 2013, no examination has resulted in any proposed adjustments that would result

in a material change to the Company’s results of operations, financial condition or liquidity.

Substantially all material state and local income tax matters have been concluded for fiscal years through 2008. The

Company and its subsidiaries anticipate that a number of state and local income tax examinations will be concluded

and statutes of limitation for open years will expire over the next twelve months, which may result in the utilization or

reduction of the Company’s reserve for uncertain tax positions of up to approximately $13 million.

The Company recognizes interest accrued related to unrecognized tax benefits and penalties in income tax expense.

During the years ended December 31, 2013, 2012 and 2011, the Company recognized interest of approximately

$4 million, $4 million and $2 million, respectively. The Company had approximately $10 million accrued for interest

and penalties as of December 31, 2013 and 2012.

There are no material uncertain tax positions as of December 31, 2013 the ultimate deductibility of which is highly

certain but for which there is uncertainty about the timing of such deductibility. If present, such items would impact

deferred tax accounting, not the annual effective income tax rate, and would accelerate the payment of cash to the

taxing authority to a period earlier than expected.

The total amount of unrecognized tax benefits that, if recognized, would affect the effective income tax rate is

approximately $95 million, after considering the federal benefit of state income taxes.