CVS 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

CVS Caremark

10-year agreement with Cardinal Health to form the

largest generic-sourcing entity in the United States. We

will collaborate with generic manufacturers to develop

innovative purchasing methodologies, improve supply

chain efficiencies, and use our compelling scale to

create attractive offerings for these suppliers.

The power of our integrated model has created a sus-

tainable competitive advantage for us. This is highlighted

by the growth of CVS/pharmacy’s share of our own

PBM’s retail network claims. That figure has jumped from

19 percent in 2008 – just following our merger – to

30 percent in 2013. This is a clear indicator that our

channel-agnostic approach is better positioned to cap-

ture share over the long-term, regardless of changes in

payor mix, plan design strategies, or patient preferences.

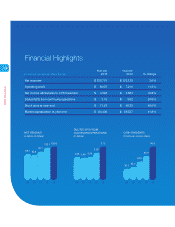

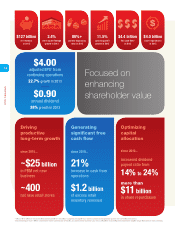

We generated $4.4 billion in free cash flow in 2013, and

we returned more than $5 billion to shareholders through

dividends and share repurchases. We increased our

quarterly dividend by 38 percent in 2013 and recently

announced another 22 percent increase for 2014,

which marks our 11th consecutive year of increases.

This recent dividend increase should allow us to achieve

a 25 percent payout ratio sometime this year, up from

14 percent in 2010. Looking forward, we recently set

a target payout ratio of 35 percent by 2018 as we

continue to focus on returning value to our shareholders.

Furthermore, after spending approximately $11 billion

on share repurchases from 2011 through 2013, our

board of directors recently authorized a new $6 billion

share repurchase program. Our current plans call for the

repurchase of approximately $4 billion of our shares in

2014, consistent with last year.

Our 2013 acquisitions of Drogaria Onofre and NovoLogix,

and of Coram, which closed in January 2014, offer good

examples of how we apply disciplined capital allocation

practices to supplement existing assets and bolster our

offerings. Drogaria Onofre, a 46-store retail drugstore

chain in Brazil, represents our first retail foray into the

international markets, while NovoLogix and Coram have

broadened our already compelling specialty solutions.

Our focus on enhancing shareholder value paid off

handsomely in 2013, with our shares producing a total

return to shareholders of 50.4 percent for the year. That

far surpassed the total returns of both the S&P 500

Index and Dow Jones Industrial Average over the same

period. We have outperformed these broader indices on

a three-, five-, and 10-year basis as well.

Our differentiated PBM offerings continue to

gain momentum

Our PBM business posted another strong year in

2013 with nice momentum heading into 2014. For the

2014 selling season, gross new business wins totaled

$5.3 billion. Factoring in a 96 percent retention rate,

we gained approximately $2.4 billion in client net new

business for 2014. Not reflected in that number is

$1.3 billion in lost revenue in 2014 resulting from last

year’s Medicare Part D sanction. I’m pleased to report

that the sanction was lifted on January 1, 2014, and

that we have once again started enrolling new members

into our SilverScript prescription drug plans (PDPs) as

they age into the Medicare program.

Although price is still a very important part of their

decision process, clients are telling us that we’re also

being selected because of the unique capabilities we

deliver. Among them, our Pharmacy Advisor® program

helps participating plan members with certain chronic

diseases, such as diabetes and cardiovascular condi-

tions, to identify gaps in care, adhere to their prescribed

medications, and better manage their health conditions.

We have also expanded this program to Medicare

beneficiaries, which is helping health plan clients achieve

better clinical star ratings.

Maintenance Choice® remains a unique offering in the

market that no competitor has been able to replicate.

It allows plan members to receive their 90-day mainte-

nance prescriptions by mail or at one of our convenient

retail stores for the same price. Client adoption has

risen significantly over the past two years, with 17 million

members currently enrolled, up 55 percent in that time

frame. Moreover, significant opportunity for growth

remains, with potential adoption among current clients

representing up to a total of 34 million members.

Regarding our long-term partnership with Aetna, we

have successfully completed the migration of Aetna’s

commercial membership to our destination platform.

Aetna’s Medicare Part D business will transition in