CVS 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

CVS Caremark

Notes to Consolidated Financial Statements

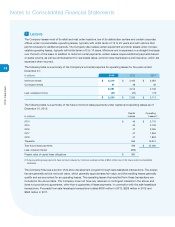

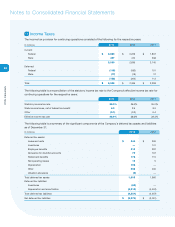

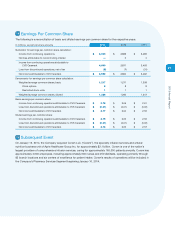

11 Income Taxes

The income tax provision for continuing operations consisted of the following for the respective years:

In millions

2013 2012 2011

Current:

Federal

$ 2,623

$ 2,226 $ 1,807

State

437

410 338

3,060

2,636 2,145

Deferred:

Federal

(115)

(182) 101

State

(17)

(18) 12

(132)

(200) 113

Total

$ 2,928

$ 2,436 $ 2,258

The following table is a reconciliation of the statutory income tax rate to the Company’s effective income tax rate for

continuing operations for the respective years:

2013 2012 2011

Statutory income tax rate

35.0 %

35.0 % 35.0 %

State income taxes, net of federal tax benefit

4.0

3.9 3.9

Other

(0.1)

(0.3) 0.4

Effective income tax rate

38.9 %

38.6 % 39.3 %

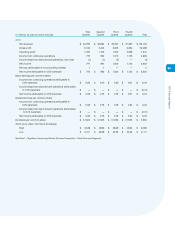

The following table is a summary of the significant components of the Company’s deferred tax assets and liabilities

as of December 31:

In millions

2013 2012

Deferred tax assets:

Lease and rents

$ 344

$ 336

Inventories

—

141

Employee benefits

213

202

Allowance for doubtful accounts

79

137

Retirement benefits

172

115

Net operating losses

10

5

Depreciation

192

—

Other

598

430

Valuation allowance

(3)

—

Total deferred tax assets

1,605

1,366

Deferred tax liabilities:

Inventories

(69)

—

Depreciation and amortization

(4,512)

(4,457)

Total deferred tax liabilities

(4,581)

(4,457)

Net deferred tax liabilities

$ (2,976)

$ (3,091)