CVS 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

CVS Caremark

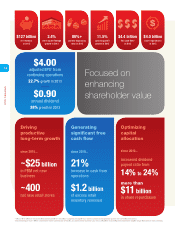

Focused on

enhancing

shareholder value

$127 billion

net revenues

in 2013

$4.00

adjusted EPS

†

from

continuing operations

22.7%

growth in 2013

–

$0.90

annual dividend

38%

growth in 2013

$4.0 billion

share repurchases

in 2013

11.5%

operating profit

growth in 2013

$4.4 billion

free cash flow*

in 2013

80%+

generic dispensing

rates in 2013

2.4%

store square footage

growth in 2013

$

Driving

productive

long-term growth

since 2010...

~$25 billion

in PBM net new

business

~400

net new retail stores

Generating

significant free

cash flow

since 2010...

21%

increase in cash from

operations

$1.2 billion

of excess retail

inventory removed

Optimizing

capital

allocation

since 2010...

increased dividend

payout ratio from

14% to 24%

more than

$11 billion

in share repurchases

* Free cash flow is defined as net cash provided by operating activities less net additions to properties and equipment (i.e., additions to property and equipment plus proceeds from sale-leaseback transactions).

† Adjusted earnings per share is defined as income before income tax provision plus amortization, less adjusted income tax provision, plus net loss attributable to noncontrolling interest divided by the weighted average diluted common shares outstanding.