CVS 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

2013 Annual Report

January 2015. With the Aetna commercial business

now on our platform, Aetna has the ability to market

CVS Caremark’s integrated offerings as well.

Back in 2010, we undertook an extensive PBM stream-

lining initiative that included consolidating our facilities,

redesigning our pharmacy front-end processes, open-

ing two new automated mail order pharmacies, and

consolidating our claims adjudication systems. These

programs are on track to deliver cumulative savings of

more than $1 billion by the end of 2015.

Our comprehensive specialty offering helps improve

outcomes and lower costs

Specialty pharmacy continues to grow at a much faster

rate than the pharmacy industry overall, with industry

projections for this market to grow from $92 billion in

2012 to $235 billion by 2018. By that time, specialty

pharmaceuticals are expected to account for 50 percent

of the total spent on drugs in the United States. CVS

Caremark’s specialty business is growing faster than

the overall market, with specialty revenues expected to

reach $26 billion in 2014.

Many believe that specialty medications represent the

pinnacle of achievement in biologic science and have

revolutionized the treatment of a host of debilitating and

life-threatening illnesses. At the same time, managing

these expensive agents and the specialty patient popula-

tion brings its own share of complexities, and our clients

are clamoring for help in controlling the rapidly rising costs.

CVS Caremark has assembled what we believe to be

the most complete and coordinated solution in our industry

to address the needs of specialty patients and payors.

Our solutions include comprehensive trend management

in which CVS Caremark aggressively manages all drugs

irrespective of route of administration or site of service,

or whether a drug is covered by the medical or phar-

macy benefit. Our acquisition of the NovoLogix technol-

ogy gives us automated medical claims management

capabilities that no other large PBM offers.

Our differentiated clinical care model integrates our

Accordant® rare disease care management services to

enhance care and reduce costs. Our clinical model can

reduce total health care spending for specialty patients

by as much as 11 percent. Through our Specialty

Connect™ integrated delivery option, patients also have

the flexibility to receive their drugs by mail or at one of

our stores. This program is analogous to Maintenance

Choice. Our pilot launch of Specialty Connect has

revealed that half of specialty patients prefer to pick up

their drugs at a CVS/pharmacy location and that this

program is helping to drive improved adherence rates.

Finally, our acquisition of Coram has significantly

expanded our capabilities in the infusion market. Coram

serves 165,000 patients annually through its 85 branch

locations and 600 home infusion nurses around the

country. Coram also complements our existing specialty

competencies, creating cross-selling opportunities and

making us a compelling option for narrow networks that

are trying to improve outcomes while driving down costs.

CVS/pharmacy® stores are in the right growth

markets and outperforming competitors on

medication adherence

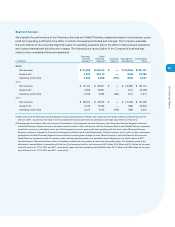

Our retail business posted solid results in 2013,

especially given the continued evidence of a cautious

consumer. Same-store sales grew by 1.7 percent

overall, with the pharmacy up 2.6 percent and the front

of the store down 0.5 percent.

Our stores now command a 21.3 percent share of the

U.S. retail prescription drug market, and we are poised

to capitalize on health care reform over the next few

years. With 30 million Americans expected to gain health

care coverage through the public exchanges and the

expansion of Medicaid, we believe that we are well-posi-

tioned with the power and reach of our brand, as well as

the trusting relationships that exist between our 23,000

pharmacists and millions of patients.

Turning to our real estate program, we opened 247 new

or relocated stores in 2013. Factoring in closings, net

units increased by 156 stores. That equates to 2.4 per-

cent retail square footage growth for the year, in line with

our annual goal. We expect to continue to expand our

retail square footage at roughly the same pace going

forward. Looking at just the top 10 states that are expect-

ed to see the largest increases in their insurance rolls –

California, Texas, and Florida topping the list – we already

have strong market positions with plans to expand in

counties where the greatest opportunities exist.