CVS 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

CVS Caremark

Notes to Consolidated Financial Statements

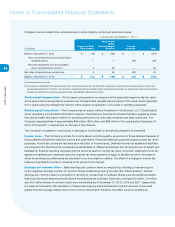

Changes in accumulated other comprehensive income (loss) by component are shown below:

YEAR ENDED DECEMBER 31, 2013 (1)

Pension and

Other

Losses on Cash Postretirement Foreign

In millions

Flow Hedges Benefits Currency Total

Balance, December 31, 2012 $ (16) $ (165) $ — $ (181)

Other comprehensive income (loss) before

reclassifications — — (30) (30)

Amounts reclassified from accumulated

other comprehensive income (2) 3 59 — 62

Net other comprehensive income (loss) 3 59 (30) 32

Balance, December 31, 2013

$ (13) $ (106) $ (30) $ (149)

(1) All amounts are net of tax.

(2) The amounts reclassified from accumulated other comprehensive income for cash flow hedges are recorded within interest expense, net on the

consolidated statement of income. The amounts reclassified from accumulated other comprehensive income for pension and other postretirement

benefits are included in operating expenses on the consolidated statement of income.

Stock-based compensation – Stock-based compensation is measured at the grant date based on the fair value

of the award and is recognized as expense over the applicable requisite service period of the stock award (generally

3 to 5 years) using the straight-line method. Stock-based compensation is included in operating expenses.

Related party transactions – The Company has an equity method investment in SureScripts, LLC (“SureScripts”),

which operates a clinical health information network. The Pharmacy Services and Retail Pharmacy segments utilize

this clinical health information network in providing services to its client plan members and retail customers. The

Company expensed fees of approximately $48 million, $32 million and $28 million in the years ended December 31,

2013, 2012 and 2011, respectively, for the use of this network.

The Company’s investment in and equity in earnings in SureScripts for all periods presented is immaterial.

Income taxes – The Company provides for income taxes currently payable, as well as for those deferred because of

timing differences between reported income and expenses for financial statement purposes versus income tax return

purposes. Income tax credits are recorded as a reduction of income taxes. Deferred income tax assets and liabilities

are recognized for the future tax consequences attributable to differences between the carrying amount of assets and

liabilities for financial reporting purposes and the amounts used for income tax return purposes. Deferred income tax

assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in

which those temporary differences are expected to be recoverable or settled. The effect of a change in income tax

rates is recognized as income or expense in the period of the change.

Earnings per common share – Basic earnings per common share is computed by dividing: (i) net earnings by

(ii) the weighted average number of common shares outstanding during the year (the “Basic Shares”). Diluted

earnings per common share is computed by dividing: (i) net earnings by (ii) Basic Shares plus the additional shares

that would be issued assuming that all dilutive stock awards are exercised. Options to purchase 6.2 million, 5.9 million

and 30.5 million shares of common stock were outstanding as of December 31, 2013, 2012 and 2011, respectively,

but were not included in the calculation of diluted earnings per share because the options’ exercise prices were

greater than the average market price of the common shares and, therefore, the effect would be antidilutive.