CVS 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

2013 Annual Report

8 Medicare Part D

The Company offers Medicare Part D benefits through SilverScript, which has contracted with CMS to be a PDP

and, pursuant to the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (“MMA”), must be

a risk-bearing entity regulated under state insurance laws or similar statutes.

SilverScript is a licensed domestic insurance company under the applicable laws and regulations. Pursuant to these

laws and regulations, SilverScript must file quarterly and annual reports with the National Association of Insurance

Commissioners (“NAIC”) and certain state regulators, must maintain certain minimum amounts of capital and surplus

under a formula established by the NAIC and must, in certain circumstances, request and receive the approval of cer-

tain state regulators before making dividend payments or other capital distributions to the Company. The Company

does not believe these limitations on dividends and distributions materially impact its financial position.

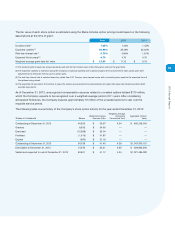

The Company has recorded estimates of various assets and liabilities arising from its participation in the Medicare

Part D program based on information in its claims management and enrollment systems. Significant estimates arising

from its participation in this program include: (i) estimates of low-income cost subsidy, reinsurance amounts, and

coverage gap discount amounts ultimately payable to or receivable from CMS based on a detailed claims reconcilia-

tion that will occur in the following year; (ii) an estimate of amounts receivable from or payable to CMS under a

risk-sharing feature of the Medicare Part D program design, referred to as the risk corridor and (iii) estimates for

claims that have been reported and are in the process of being paid or contested and for our estimate of claims

that have been incurred but have not yet been reported.

As of December 31, 2013 and 2012, amounts due from CMS included in accounts receivable were $2.4 billion and

$0.7 billion, respectively.

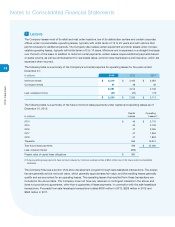

9 Pension Plans and Other Postretirement Benets

Defined Contribution Plans

The Company sponsors voluntary 401(k) savings plans that cover substantially all employees who meet plan eligibility

requirements. The Company makes matching contributions consistent with the provisions of the plans.

At the participant’s option, account balances, including the Company’s matching contribution, can be moved without

restriction among various investment options, including the Company’s common stock fund under one of the defined

contribution plans. The Company also maintains a nonqualified, unfunded Deferred Compensation Plan for certain

key employees. This plan provides participants the opportunity to defer portions of their eligible compensation and

receive matching contributions equivalent to what they could have received under the CVS Caremark 401(k) Plan

absent certain restrictions and limitations under the Internal Revenue Code. The Company’s contributions under

the above defined contribution plans were $235 million, $199 million and $187 million in 2013, 2012 and 2011,

respectively.

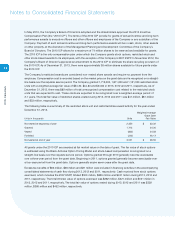

Other Postretirement Benefits

The Company provides postretirement health care and life insurance benefits to certain retirees who meet eligibility

requirements. The Company’s funding policy is generally to pay covered expenses as they are incurred. For retiree

medical plan accounting, the Company reviews external data and its own historical trends for health care costs to

determine the health care cost trend rates. As of December 31, 2013 and 2012, the Company’s other postretirement

benefits have an accumulated postretirement benefit obligation of $27 million and $16 million, respectively. Net

periodic benefit costs related to these other postretirement benefits were approximately $11 million in 2013 and

$1 million in 2012 and 2011. The net periodic benefit costs for 2013 include a settlement loss of $8 million.