Asus 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Most of the aforementioned manufacturers have been doing business with ASUS for

years.

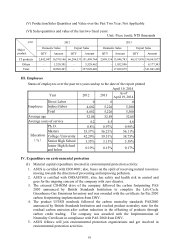

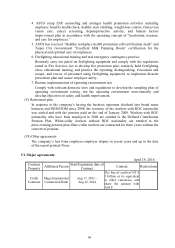

(IV) Major Customers with over 10% net sales and Suppliers with over 10% total purchases

of the last two fiscal years

1. Major Suppliers of the last two fiscal years

Unit: NT$ thousands

2011 2012 2014Q1 (Note 1)

Item Name Amount

Percentage of

net annual

purchase (%)

Relation

with

issuer

Name Amount

Percentage of

net annual

purchase (%)

Relation

with

issuer

Name Amount

Percentage of

net purchase

of Q1 (%)

Relatio

n with

issuer

1 PEGA

131,662,808 24

Invested

company

valued

with

equity

method

PEGA 85,227,822 18

Available

-for-Sale

Financial

Assets

2 T customer 92,514,581 17 None T customer 92,945,629 20 None

3 F customer 75,626,026 14 None F customer 68,088,647 14 None

4 Others

246,770,368 45 Others

228,611,238 48 Others

Net

purchase

amount

546,573,783 100

Net

purchase

amount

474,873,336 100

Net

purchase

amount

100

Note 1: The 2013Q1 financial statements audited by the CPA were not yet available up to the print of annual

report on April 19, 2014.

Note 2: The purchase amount from the last two years included raw material amount purchased for clients.

Note 3: Causes of increase and decrease – for business operation

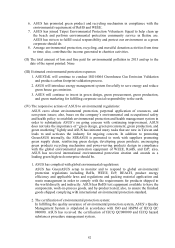

2. Major Customers of the last two fiscal years

Unit: NT$ thousands

2012 2013 2014Q1

(Note 1)

Item Name Amount

Percentage

of annual

net sales

(%)

Relation with

issuer Name Amount

Percentage

of annual

net sales

(%)

Relation

with issuer Name Amount

Percentage

of net sales

of Q1 (%)

Relati

on

with

issuer

1 ASTP 353,448,218 94

Invested

company

valued with

equity method

ASTP 233,229,291 65

Invested

company

valued with

equity

method

2 Others 21,670,655 6 ASGL 105,733,214 29

Invested

company

valued with

equity

method

Others

Others 19,778,594 6 Others

Net sales

amount 375,118,873 100 Net sales

amount 358,741,099 100

Net

sales

amount

Note 1: The 2014Q1 financial statements audited by the CPA were not yet available up to the print of annual

report on April 19, 2014.

Note 2: Causes of increase and decrease – for business operation