Asus 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

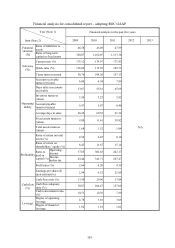

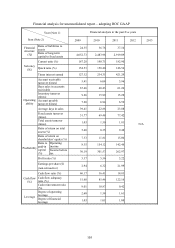

(II) Financial analysis for separate report – adopting IFRSs

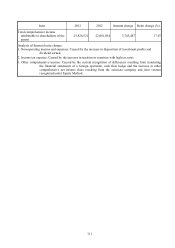

Year (Note 1)

Item (Note 3)

Financial analysis in the past five years 當年度截至

103 年4月

19 日財務

資料

2009 2010 2011 2012 2013

Financial

structure

(%)

Ratio of liabilities to

assets

N/A

39.23 38.80

(Note 2)

Ratio of long-term

capital to Property,

plant and equipment

3,148.28 3,044.80

Solvency

(%)

Current ratio (%) 172.09 165.85

Quick ratio (%) 131.49 130.03

Times interest earned 5,332,951.00 5,112,353.40

Operating

ability

Account receivable

turnover (times) 5.98 5.13

Days sales in

accounts receivable 61.03 71.15

Inventory turnover

(times) 13.69 11.66

Account payable

turnover (times) 6.77 6.04

Average days in sales 26.66 31.30

Property, plant and

equipment turnover

(times)

97.82 84.99

Total assets turnover

(times) 1.93 1.68

Profitability

Ratio of return on

total assets (%) 11.58 10.02

Ratio of return on

equity (%) 18.65 16.42

Ratio of profit

before tax to

Paid-in capital (%)

(Note 7)

354.23 344.15

Profit ratio (%) 5.99 5.98

Earnings per share ($)

(non-retroactive)) 29.84 28.66

Cash flow

(%)

Cash flow ratio (%) 20.92 20.87

Cash flow adequacy

ratio (%) 115.09 114.10

Cash reinvestment

ratio (%) 3.70 1.41

Leverage

Degree of operating

leverage 1.34 1.70

Degree of financial

leverage 1.00 1.00

The root causes of the financial ratio change in the last two years:

Cash reinvestment ratio: The current cash dividend amount issued and long-term investment balance increased when

compared with previous period, causing the current cash reinvestment ratio to decline.

Note: The notes are the same as Financial analysis for consolidated report – adopting IFRSs