Asus 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

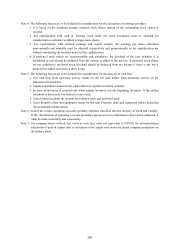

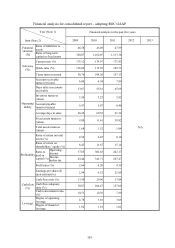

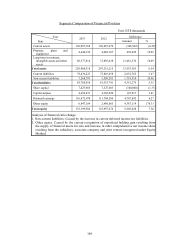

The root causes of the financial ratio change in the last two years:

Times interest earned: At the expiration of current CB, the reduction in amortized value decreased (the CB and

ECB issued by the company does not pay out relevant interests. However, to cooperate with the

regulations of new Financial Reporting, the amortized expense resulting from the discount on

b

onds is recognized as interest expense without the actual cash payout) has caused the interest

protection multiples to increase.

Account receivable turnover (times): The range of decline in average account receivable was higher than that of

operating amount, causing the current account receivable turnover to go up.

Account payable turnover (times): The range of decline in average account payable was higher than that of sale

costs, causing the current account payable to go up.

Fixed assets turnover (times): The decline in current average fixed assets net value caused the current fixed asset

turnover to go up.

Total assets turnover (times): The decline in current average total assets caused the current total assets turnover to

go up.

Ratio of return on total assets (%): The decline in current average total assets caused the ratio of return on total

assets to go up.

Ratio of return on shareholders’ equity: This range of decline in current profit/loss after tax was lower than that of

the decline in average shareholder equity, causing the current ratio of return on shareholders’

equity to go up.

Cash flow ratio: The net cash flow from current operating activities declined while the balance of current liabilities

went up, causing the current cash flow ratio to go down.

Cash flow adequacy ratio (%): The rise in the net cash flow from latet 5 eyars of operating activities caused the

current cash flow adequacy ratio to go up.

Cash reinvestment ratio: The decline net cash flow of current operating activities caused decline in current cash

reinvestment ratio.

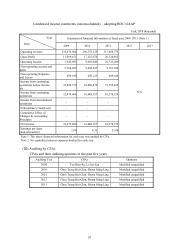

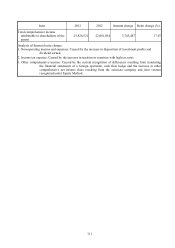

Note 1: The financial information is audited by CPA.

Note 2: Equations:

1. Financial structure

(1) Ratio of liabilities to assets = Total liability/Total assets

(2) Ratio of long-Term capital to fixed assets = (Net shareholders’ equity + Long-term liability) / Net

fixed assets

2. Solvency

(1) Current ratio = Current assets / current liability

(2) Quick ratio = (Current assets – Inventory – Prepaid expense) / Current liability

(3) Times interest earned = Net income before tax and interest expense / Interest expense of the year

3. Operating ability

(1) Account receivable turnover (including accounts receivable and notes receivable derived from

business operation) = Net sales / Average accounts receivable (including accounts receivable and

notes receivable derived from business operation)

(2) Days sales in accounts receivable = 365 / Account receivable turnover

(3) Inventory turnover = Cost of goods sold / Average inventory amount

(4) Account payable turnover (including accounts payable and notes payable derived from business

operation) = Cost of goods sold/ Average accounts payable (including accounts payable and notes

payable derived from business operation)

(5) Average days in sales = 365 / Inventory turnover

(6) Fixed assts turnover = Net sales / Net fixed assets

(7) Total assets turnover = Net sales / Total assets

4. Profitability

(1) Ratio of return on total assets = [Net income (loss) + interest expense x (1-tax rate)] / Average total

assets

(2) Ratio of return on shareholders’ equity = Net income (loss) / Net average shareholders’ equity

(3) Ratio to paid-in capital = Net income before tax / Paid-in capital

(4) Profit ratio = Net income (loss) / Net sales

(5) Earnings per share = (Net income – preferred stock dividend) / Weighted average stock shares issued

(Note4)