Asus 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

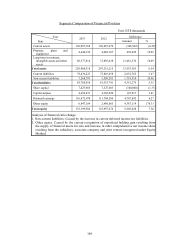

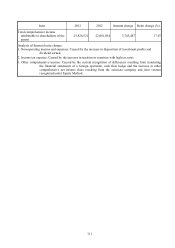

Item 2013 2012 Amount change Ratio change (%)

4. Other comprehensive income: Caused by the current recognition of differences resulting from translating

the financial statements of a foreign operation and the increase in other comprehensive net income share

resulting from the subsidiary, associate company and joint venture recognized under Equity Method.

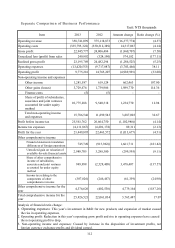

III. Analysis of cash flow

(I) Consolidated liquidity analysis of the last two years

Year

Item

2013 2012 Financial ratio change

Cash flow ratio 19.78% 16.19% 22.17%

Cash flow adequacy ratio 145.59% 130.40% 11.65%

Cash reinvestment ratio 10.03% 7.66% 30.94%

Analysis of financial ratio change:

1. Increase of cash flow ratio this year:

The increase of cash inflow for this year’s operating activities is greater than the

accounts payable and expenses for inbound material inventory as well as other

current liabilities, therefore the cash flow ratio increased.

2. Increase of cash reinvestment ratio this year:

The net cash inflow of this year’s operating activities increased; therefore the cash

reinvestment ratio increased accordingly.

Separate liquidity analysis of the last two years

Year

Item

2013 2012 Financial ratio change

Cash flow ratio 20.87% 20.92% (0.24)%

Cash flow adequacy ratio 114.10% 115.09% (0.86)%

Cash reinvestment ratio 1.41% 3.70% (61.89)%

Analysis of financial ratio change:

Decrease of cash reinvestment ratio this year:

Current cash dividend amount and long-term investment balance increased when compared

with last period, causing the current cash reinvestment ratio to decline.

(II) Analysis of cash liquidity in one year

Unit: NT$100 million

Beginning cash

balance

Expected net

cash flow from

operating activity

of the year

Expected

cash outflow

of the year

Expected cash

surplus

(deficit)

+-

Remedial measures for the

expected insufficient cash

Investing

activity

Financing

activity

242.63 180.04 147.84 274.83 - -