Asus 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

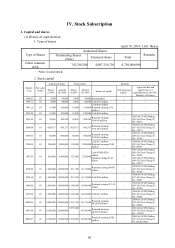

63

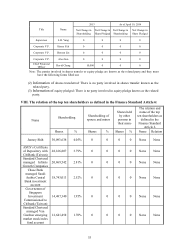

Shareholding

Shareholder’s Name

Shareholding Shareholding Ratio (%)

ASUS’s Certificate of Depository with CitiBank

(Taiwan) 28,166,807 3.79%

Standard Chartered managed Infinite Growth

Companies 20,869,542 2.81%

Chase Bank managed Saudi Arabia Central Bank

investment account 18,743,013 2.52%

Governemnt of Singapore Investment

Commissioned to Citibank (Taiwan) 14,487,340 1.95%

Standard Chartered managed Van Gardner

emerging market stock index fund account 12,641,458 1.70%

Labor Insurance Funds 11,939,040 1.61%

ASUS’s Royal Bank of Scotland FS Pacific

Investment Account with CitiBank 10,548,000 1.42%

Invesco Greater China Equity Fund with JPM

Invesco Funds 9,715,000 1.31%

Abu Dhabi Investment Authority Account with

JPMorgan Chase & Co., 8,925,613 1.20%

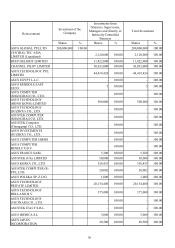

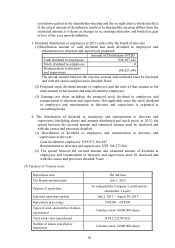

(5) Market Price, Net Worth, Earnings & Dividend per Share of the Last Two Years

Market Price, Net Worth, Earnings & Dividend per Share

Unit: NT$/Share

Fiscal year

Item 2012 2013

As of March 31,

2014 (Note 9)

Market price per

share

(Note 1) (Note 3)

Max. 342 382 304

Min. 212 204 267

Average 287.28 288.64 287.35

Net worth per

share (Note 2)

Before appropriation 167.38 182.02 -

After appropriation 148.38 (Note 8)

Earnings per share

Weighted average shares

(Note 3)

752,760

thousand

shares

748,395

thousand

shares

-

Earnings per

shares (Note 3)

Before adjustment 29.84 28.66 -

After adjustment 29.84 (Note 8)

Dividends per

share

Cash dividends 19.00 (Note 8) -

Stock

dividends

Stock dividends

from Retained

earnings

0(Note 8) -

Stock dividends

from Additional

paid-in capital

0(Note 8) -

Accumulated unpaid dividends

(Note 4) - - -

Analysis of return

on investment

Price/Earning Ratio (Note 5) 9.63 10.07 -

Price/Dividend Ratio (Note 6) 15.12 (Note 8) -

Cash dividends yield rate (Note 7) 6.61%(Note 8) -

Note 1: List the highest and lowest market price per share; also, calculate the average market price per share in accordance

with the trade amount and shares.

Note 2: Please base the information on the shares issued at yearned and the resolution for stock distribution in shareholders

meeting. Re-calculated according to IFRS.

Note 3: If the stock dividend is to be adjusted retroactively, please list the earnings per share before and after the