Allstate 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

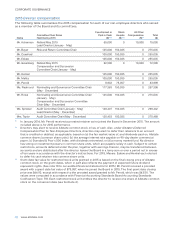

The Allstate Corporation 2016 Proxy Statement 29

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE OVERVIEW

Our Compensation Discussion and Analysis describes Allstate’s executive compensation program, including

total 2015 compensation for our named executives listed below:

Thomas J. Wilson — Chairman and Chief Executive Officer (CEO)

Steven E. Shebik — Executive Vice President and Chief Financial Officer (CFO)

Don Civgin — President, Emerging Businesses of Allstate Insurance Company

Judith P. Greffin — Executive Vice President and Chief Investment Officer of Allstate Insurance Company

Matthew E. Winter — President

See Appendix B for a list of Allstate’s other executive officers. Effective March 31, 2016, Ms. Greffin retired

from Allstate Insurance Company.

Performance Highlights

In 2015, Allstate encountered an industry-wide increase in the frequency of auto accidents causing

management to shift its operating focus to implementing an auto insurance profit improvement plan. At

the same time, however, Allstate continued its strategy to serve customers with unique value propositions

which enabled it to deliver on near-term commitments, invest in sustainable value creation, and advance all

five operating priorities in 2015:

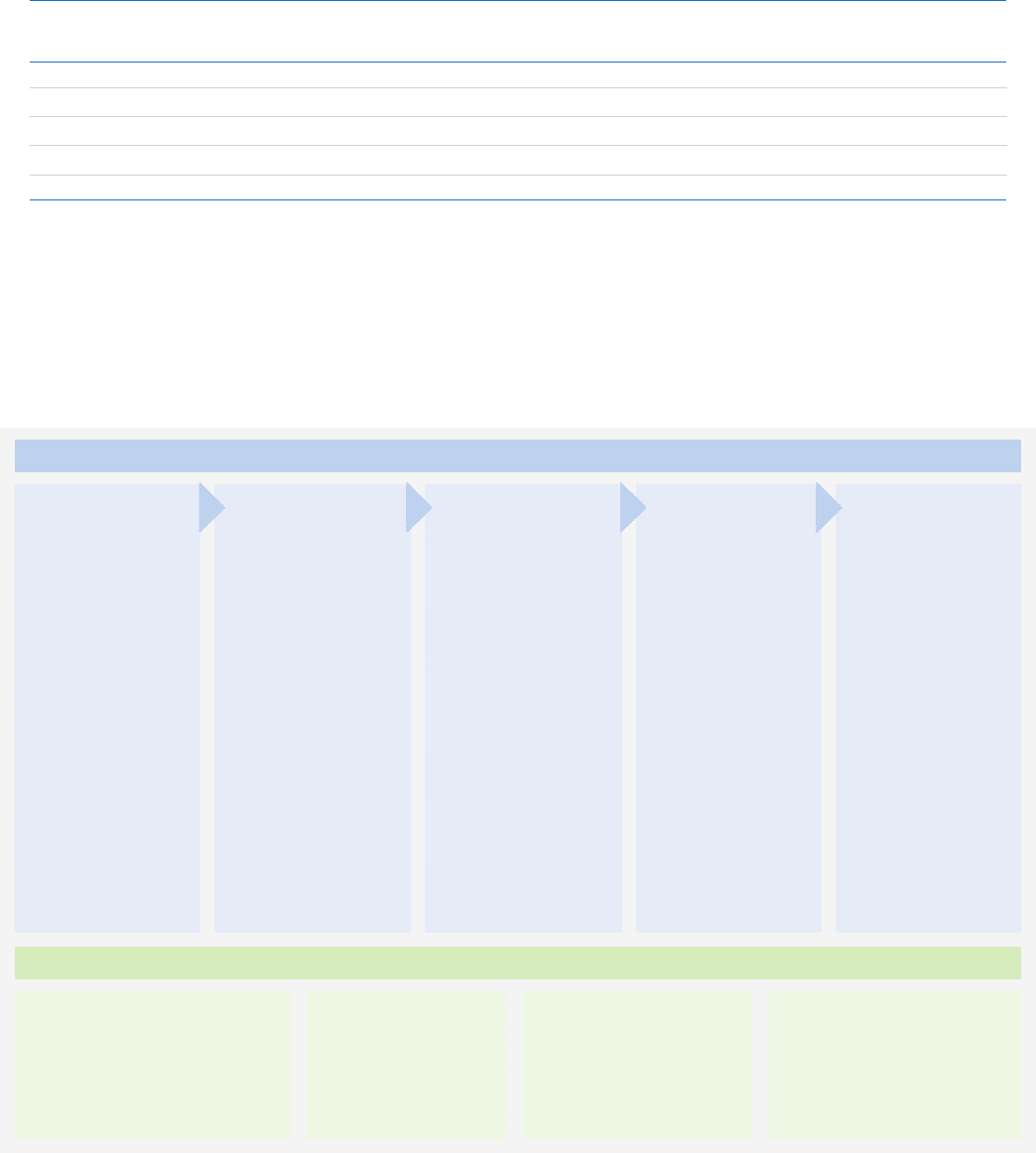

2015 Operating Priorities

Grow Insurance

Policies in Force

Maintain the

Underlying

Combined Ratio*

Proactively Manage

Investments to

Generate Attractive

Risk-Adjusted

Returns

Modernize the

Operating Model

Build Long-Term

Growth Platforms

• Total Protection

policies in force grew

by 449,000 or 1.3%

in 2015

• Property-liability net

written premium

grew by 4.2% to

$30.9 billion in 2015

• Allstate Financial

policies grew by

322,000 or 6.1%

in 2015 driven by

growth at Allstate

Benefits

• The property-liability

underlying combined

ratio was 88.7, within

the annual outlook

range, but 1.5 points

higher than the prior

year as a result of an

industry-wide increase

in the frequency of

auto accidents

• A multifaceted profit

improvement plan was

put in place to improve

auto returns across

underwriting brands

• Allstate brand

homeowner returns

were strong

• Net investment income

achieved target

• Total return was 1.0%

reflecting low interest

rates, higher credit

spreads and a decline

in equity markets

• Reduced interest rate

risk

• Repositioned Allstate

Financial portfolio

supporting long-dated

liabilities to drive higher

long-term returns

• Lowered expense

ratio in part to

address reduced

auto profitability

• Allstate brand

exclusive agencies

continue to evolve to

trusted advisors

• Expanded

continuous

improvement

programs

• Esurance expanded

geographic

reach and

product portfolio;

homeowners now in

25 states

• Allstate’s Drivewise®

and Esurance’s

DriveSense®

telematics offerings

had over 1 million

active users as of

year-end 2015

• Allstate Benefits

grew premiums and

contract charges by

6.0% and policies by

11.1% in 2015

Results

• Achieved full-year 2015

underlying combined ratio

outlook range by increasing

auto insurance prices,

tightening underwriting

standards, maintaining a strong

homeowners business, and

reducing expenses

• Operating earnings*

per share declined by

3.9% from $5.40 to

$5.19

• Property-liability net

written premiums

increased by $1.3 billion,

resulting from the

additional policies in

force and higher average

premiums per policy

• Common shareholders

received $3.3 billion in cash

returns in 2015 through

common stock dividends and

share repurchases

* The underlying combined ratio and operating earnings measures are not based on accounting principles

generally accepted in the United States of America (“non-GAAP”) and are defined and reconciled to the most

directly comparable GAAP measures in Appendix C.