Allstate 2015 Annual Report Download - page 249

Download and view the complete annual report

Please find page 249 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 243

regarding policy coverage; unresolved legal issues regarding the determination, availability and timing of exhaustion

of policy limits; plaintiffs’ evolving and expanding theories of liability; availability and collectability of recoveries from

reinsurance; retrospectively determined premiums and other contractual agreements; estimates of the extent and

timing of any contractual liability; the impact of bankruptcy protection sought by various asbestos producers and other

asbestos defendants; and other uncertainties. There are also complex legal issues concerning the interpretation of

various insurance policy provisions and whether those losses are covered, or were ever intended to be covered, and

could be recoverable through retrospectively determined premium, reinsurance or other contractual agreements. Courts

have reached different and sometimes inconsistent conclusions as to when losses are deemed to have occurred and

which policies provide coverage; what types of losses are covered; whether there is an insurer obligation to defend; how

policy limits are determined; how policy exclusions and conditions are applied and interpreted; and whether clean-up

costs represent insured property damage. Further, insurers and claims administrators acting on behalf of insurers are

increasingly pursuing evolving and expanding theories of reinsurance coverage for asbestos and environmental losses.

Adjudication of reinsurance coverage is predominately decided in confidential arbitration proceedings which may have

limited precedential or predictive value further complicating management’s ability to estimate probable loss for reinsured

asbestos and environmental claims. Management believes these issues are not likely to be resolved in the near future,

and the ultimate costs may vary materially from the amounts currently recorded resulting in material changes in loss

reserves. In addition, while the Company believes that improved actuarial techniques and databases have assisted in

its ability to estimate asbestos, environmental, and other discontinued lines net loss reserves, these refinements may

subsequently prove to be inadequate indicators of the extent of probable losses. Due to the uncertainties and factors

described above, management believes it is not practicable to develop a meaningful range for any such additional net

loss reserves that may be required.

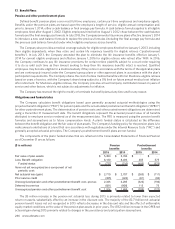

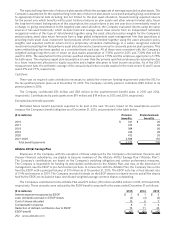

15. Income Taxes

The Company and its domestic subsidiaries file a consolidated federal income tax return. Tax liabilities and benefits

realized by the consolidated group are allocated as generated by the respective entities.

The Internal Revenue Service (“IRS”) is currently examining the Company’s 2013 and 2014 federal income tax returns.

The IRS completed the audit of the Company’s 2011 and 2012 federal income tax returns and issued a final Revenue

Agent’s Report on June 10, 2015. The Company’s tax years prior to 2011 have been examined by the IRS and the statute

of limitations has expired on those years. Any adjustments that may result from IRS examinations of the Company’s

tax returns are not expected to have a material effect on the results of operations, cash flows or financial position of

the Company.

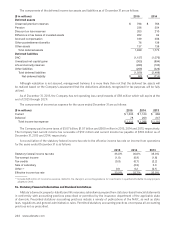

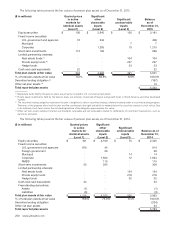

The reconciliation of the change in the amount of unrecognized tax benefits for the years ended December 31 is

as follows:

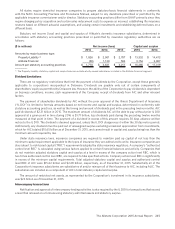

($ in millions) 2015 2014 2013

Balance – beginning of year $ — $ — $ 25

Increase for tax positions taken in a prior year 4 — 1

Decrease for tax positions taken in a prior year — — —

Increase for tax positions taken in the current year 3 — —

Decrease for tax positions taken in the current year — — —

Decrease for settlements — — (26)

Reductions due to lapse of statute of limitations — — —

Balance – end of year $ 7 $ — $ —

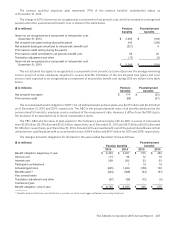

The Company believes it is reasonably possible that the liability balance will not significantly increase within the next

twelve months. Because of the impact of deferred tax accounting, recognition of previously unrecognized tax benefits is

not expected to impact the Company’s effective tax rate.

The Company recognizes interest accrued related to unrecognized tax benefits in income tax expense. The Company

did not record interest income or expense relating to unrecognized tax benefits in income tax expense in 2015, 2014 or

2013. As of December 31, 2015 and 2014, there was no interest accrued with respect to unrecognized tax benefits. No

amounts have been accrued for penalties.