Allstate 2015 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Allstate Corporation 2015 Annual Report 187

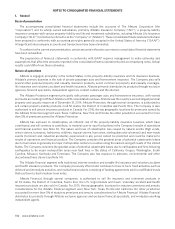

For traditional life insurance, DAC is amortized over the premium paying period of the related policies in proportion

to the estimated revenues on such business. Assumptions used in the amortization of DAC and reserve calculations are

established at the time the policy is issued and are generally not revised during the life of the policy. Any deviations from

projected business in force resulting from actual policy terminations differing from expected levels and any estimated

premium deficiencies may result in a change to the rate of amortization in the period such events occur. Generally,

the amortization periods for these policies approximates the estimated lives of the policies. The Company periodically

reviews the recoverability of DAC for these policies on an aggregate basis using actual experience. The Company

aggregates all traditional life insurance products and immediate annuities with life contingencies in the analysis. If actual

experience is significantly adverse compared to the original assumptions and a premium deficiency is determined to

exist, any remaining unamortized DAC balance would be expensed to the extent not recoverable and the establishment

of a premium deficiency reserve may be required.

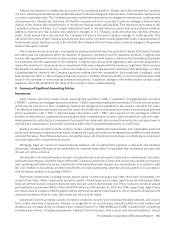

For interest-sensitive life insurance and fixed annuities, DAC and DSI are amortized in proportion to the incidence

of the total present value of gross profits, which includes both actual historical gross profits (“AGP”) and estimated

future gross profits (“EGP”) expected to be earned over the estimated lives of the contracts. The amortization is net of

interest on the prior period DAC balance using rates established at the inception of the contracts. Actual amortization

periods generally range from 15-30 years; however, incorporating estimates of the rate of customer surrenders, partial

withdrawals and deaths generally results in the majority of the DAC being amortized during the surrender charge period,

which is typically 10-20 years for interest-sensitive life and 5-10 years for fixed annuities. The cumulative DAC and

DSI amortization is reestimated and adjusted by a cumulative charge or credit to income when there is a difference

between the incidence of actual versus expected gross profits in a reporting period or when there is a change in total

EGP. When DAC or DSI amortization or a component of gross profits for a quarterly period is potentially negative (which

would result in an increase of the DAC or DSI balance) as a result of negative AGP, the specific facts and circumstances

surrounding the potential negative amortization are considered to determine whether it is appropriate for recognition in

the consolidated financial statements. Negative amortization is only recorded when the increased DAC or DSI balance

is determined to be recoverable based on facts and circumstances. Recapitalization of DAC and DSI is limited to the

originally deferred costs plus interest.

AGP and EGP primarily consist of the following components: contract charges for the cost of insurance less mortality

costs and other benefits; investment income and realized capital gains and losses less interest credited; and surrender

and other contract charges less maintenance expenses. The principal assumptions for determining the amount of EGP

are persistency, mortality, expenses, investment returns, including capital gains and losses on assets supporting contract

liabilities, interest crediting rates to contractholders, and the effects of any hedges. For products whose supporting

investments are exposed to capital losses in excess of the Company’s expectations which may cause periodic AGP to

become temporarily negative, EGP and AGP utilized in DAC and DSI amortization may be modified to exclude the excess

capital losses.

The Company performs quarterly reviews of DAC and DSI recoverability for interest-sensitive life and fixed annuity

contracts in the aggregate using current assumptions. If a change in the amount of EGP is significant, it could result in the

unamortized DAC or DSI not being recoverable, resulting in a charge which is included as a component of amortization

of deferred policy acquisition costs or interest credited to contractholder funds, respectively.

The DAC and DSI balances presented include adjustments to reflect the amount by which the amortization of

DAC and DSI would increase or decrease if the unrealized capital gains or losses in the respective product investment

portfolios were actually realized. The adjustments are recorded net of tax in accumulated other comprehensive income.

DAC, DSI and deferred income taxes determined on unrealized capital gains and losses and reported in accumulated

other comprehensive income recognize the impact on shareholders’ equity consistently with the amounts that would be

recognized in the income statement on realized capital gains and losses.

Customers of the Company may exchange one insurance policy or investment contract for another offered by the

Company, or make modifications to an existing investment, life or property-liability contract issued by the Company.

These transactions are identified as internal replacements for accounting purposes. Internal replacement transactions

determined to result in replacement contracts that are substantially unchanged from the replaced contracts are accounted

for as continuations of the replaced contracts. Unamortized DAC and DSI related to the replaced contracts continue

to be deferred and amortized in connection with the replacement contracts. For interest-sensitive life and investment

contracts, the EGP of the replacement contracts are treated as a revision to the EGP of the replaced contracts in the

determination of amortization of DAC and DSI. For traditional life and property-liability insurance policies, any changes

to unamortized DAC that result from replacement contracts are treated as prospective revisions. Any costs associated

with the issuance of replacement contracts are characterized as maintenance costs and expensed as incurred. Internal

replacement transactions determined to result in a substantial change to the replaced contracts are accounted for