Allstate 2015 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.242 www.allstate.com

Romero I and II consolidated proceedings: In 2004, the court ruled that the release was voidable and certified classes

of agents, including a mandatory class of agents who had signed the release, for purposes of effectuating the court’s

declaratory judgment that the release was voidable. In 2007, the court vacated its ruling and granted the Company’s

motion for summary judgment on all claims. Plaintiffs appealed and in July 2009, the U.S. Court of Appeals for the Third

Circuit vacated the trial court’s entry of summary judgment in the Company’s favor, remanded the case to the trial court

for additional discovery, and instructed the trial court to first address the validity of the release after additional discovery.

Following the completion of discovery limited to the validity of the release, the parties filed cross motions for summary

judgment with respect to the validity of the release. On February 28, 2014, the trial court denied plaintiffs’ and the

Company’s motions for summary judgment, concluding that the question of whether the releases were knowingly and

voluntarily signed under a totality of circumstances test raised disputed issues of fact to be resolved at trial. Among other

things, the court also held that the release, if valid, would bar all claims in Romero I and II. On May 23, 2014, plaintiffs moved

to certify a class as to certain issues relating to the validity of the release. The court denied plaintiffs’ class certification

motion on October 6, 2014, stating, among other things, that individual factors and circumstances must be considered to

determine whether each release signer entered into the release knowingly and voluntarily. The court entered an order on

December 11, 2014, (a) stating that the court’s October 6, 2014 denial of class certification as to release-related issues

did not resolve whether issues relating to the merits of plaintiffs’ claims may be subject to class certification at a later

time, and (b) holding that the court’s October 6, 2014 order restarted the running of the statute of limitation for any

former employee agent who wished to challenge the validity of the release. In an order entered January 7, 2015, the court

denied reconsideration of its December 11, 2014 order and clarified that all statutes of limitations to challenge the release

would resume running on March 2, 2015. Since the Court’s January 7, 2015 order, a total of 459 additional individual

plaintiffs have filed separate lawsuits similar to Romero I or sought to intervene in the Romero I action. Trial proceedings

have commenced to determine the question of whether the releases of the original named plaintiffs in Romero I and II

were knowingly and voluntarily signed. Additionally, plaintiffs asserted two equitable defenses to the release which were

to be determined by the court and not the jury. As to the first trial proceeding involving ten plaintiffs, the jury reached

verdicts on June 17, 2015 finding that two plaintiffs signed their releases knowingly and voluntarily and eight plaintiffs

did not sign their releases knowingly and voluntarily. On January 28, 2016, the court entered its opinion and judgment

finding in Allstate’s favor as to all ten plaintiffs on the two equitable defenses to the release. The trial result is not yet

final and may be subject to further proceedings. The remaining two trials for the original Romero I and II plaintiffs were

scheduled to commence in the fourth quarter of 2015; however, these trials have been postponed. No new trial dates

have been set and no other trials are currently scheduled. The Court has not yet addressed a schedule for deciding the

validity of the release signed by the new plaintiffs. In the fourth quarter of 2015, the Court granted defendants’ motions

for partial dismissal and dismissed plaintiffs’ state law claims and federal retaliation claims. Plaintiffs’ other claims under

the ADEA and ERISA remain. The Court’s orders are subject to further proceedings. On February 1, 2016, these cases

were reassigned to a new judge.

Based on the trial court’s February 28, 2014 order in Romero I and II, if the validity of the release is decided in favor

of the Company for any plaintiff, that would preclude any damages or other relief being awarded to that plaintiff. If the

validity of the release is decided in favor of a plaintiff, further proceedings with respect to the merits of that plaintiff’s

claims relating to the reorganization would have to occur before there could be any determination of liability or award

of damages in either Romero I or Romero II. The final resolution of these matters is subject to various uncertainties and

complexities including how individual trials, post trial motions and possible appeals with respect to the validity of the

release will be resolved. Depending upon how these issues are resolved, the Company may or may not have to address

the merits of plaintiffs’ claims relating to the reorganization and amendments to the Agents Pension Plan described

herein. In the Company’s judgment, a loss is not probable.

Asbestos and environmental

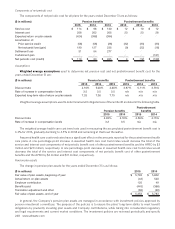

Allstate’s reserves for asbestos claims were $960 million and $1.01 billion, net of reinsurance recoverables of

$458 million and $478 million, as of December 31, 2015 and 2014, respectively. Reserves for environmental claims

were $179 million and $203 million, net of reinsurance recoverables of $43 million and $64 million, as of December 31,

2015 and 2014, respectively. Approximately 57% and 57% of the total net asbestos and environmental reserves as of

December 31, 2015 and 2014, respectively, were for incurred but not reported estimated losses.

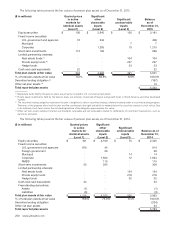

Management believes its net loss reserves for asbestos, environmental and other discontinued lines exposures are

appropriately established based on available facts, technology, laws and regulations. However, establishing net loss

reserves for asbestos, environmental and other discontinued lines claims is subject to uncertainties that are much greater

than those presented by other types of claims. The ultimate cost of losses may vary materially from recorded amounts,

which are based on management’s best estimate. Among the complications are lack of historical data, long reporting

delays, uncertainty as to the number and identity of insureds with potential exposure and unresolved legal issues