Allstate 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 www.allstate.com

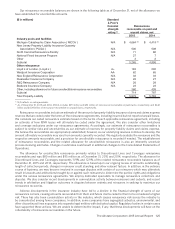

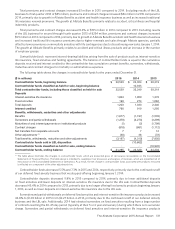

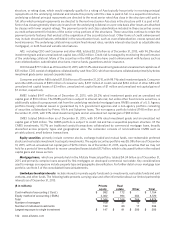

The investment spread by product group for the years ended December 31 is shown in the following table.

($ in millions) 2015 2014 2013

Life insurance $ 130 $ 93 $ 93

Accident and health insurance 5 8 14

Net investment income on investments supporting capital 76 110 113

Subtotal — Allstate Life 211 211 220

Life insurance 10 10 12

Accident and health insurance 11 11 11

Net investment income on investments supporting capital 14 15 14

Subtotal — Allstate Benefits 35 36 37

Annuities and institutional products 238 320 342

Net investment income on investments supporting capital 130 146 158

Subtotal — Allstate Annuities 368 466 500

Investment spread before valuation changes on embedded derivatives that

are not hedged 614 713 757

Valuation changes on derivatives embedded in equity‑indexed annuity

contracts that are not hedged (2) (22) (24)

Total investment spread $ 612 $ 691 $ 733

Investment spread before valuation changes on embedded derivatives that are not hedged decreased 13.9% or $99

million in 2015 compared to 2014. Excluding results of the LBL business for first quarter 2014 of $46 million, investment

spread before valuation changes on embedded derivatives that are not hedged decreased $53 million in 2015 compared

to 2014, primarily due to lower net investment income, partially offset by lower credited interest. Investment spread

before valuation changes on embedded derivatives that are not hedged decreased 5.8% or $44 million in 2014 compared

to 2013. Excluding results of the LBL business for the second through fourth quarter of 2013 of $149 million, investment

spread before valuation changes on embedded derivatives that are not hedged increased $105 million in 2014 compared

to 2013, primarily due to higher limited partnership income, higher fixed income yields and lower crediting rates, partially

offset by the continued managed reduction in our spread-based business in force.

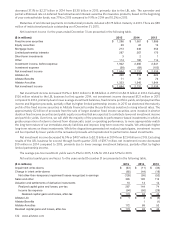

To further analyze investment spreads, the following table summarizes the weighted average investment yield on

assets supporting product liabilities and capital, interest crediting rates and investment spreads. For purposes of these

calculations, investments, reserves and contractholder funds classified as held for sale were included for periods prior

to April 1, 2014. Investment spreads may vary significantly between periods due to the variability in investment income,

particularly for immediate fixed annuities where the investment portfolio includes limited partnerships.

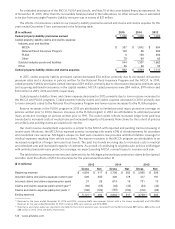

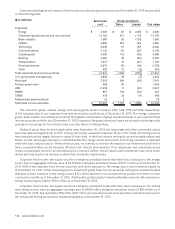

Weighted average

investment yield

Weighted average

interest crediting rate

Weighted average

investment spreads

2015 2014 2013 2015 2014 2013 2015 2014 2013

Interest‑sensitive life insurance 5.2% 5.3% 5.1% 3.9% 3.9% 3.8% 1.3% 1.4% 1.3%

Deferred fixed annuities and

institutional products 4.3 4.5 4.5 2.8 2.9 2.9 1.5 1.6 1.6

Immediate fixed annuities with and

without life contingencies 7.0 7.3 6.9 5.9 6.0 6.0 1.1 1.3 0.9

Investments supporting capital,

traditional life and other products 4.0 4.4 4.0 n/a n/a n/a n/a n/a n/a

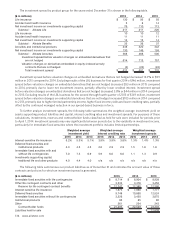

The following table summarizes our product liabilities as of December 31 and indicates the account value of those

contracts and policies for which an investment spread is generated.

($ in millions) 2015 2014 2013

Immediate fixed annuities with life contingencies $ 8,714 $ 8,904 $ 8,928

Other life contingent contracts and other 3,533 3,476 3,458

Reserve for life‑contingent contract benefits $ 12,247 $ 12,380 $ 12,386

Interest‑sensitive life insurance $ 7,975 $ 7,880 $ 7,777

Deferred fixed annuities 9,748 10,860 12,524

Immediate fixed annuities without life contingencies 3,226 3,450 3,675

Institutional products 85 85 85

Other 261 254 243

Contractholder funds $ 21,295 $ 22,529 $ 24,304

Liabilities held for sale $ — $ — $ 12,839