Allstate 2015 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 149

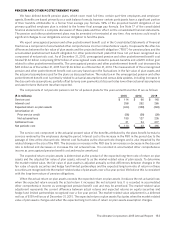

Performance-based long-term investments primarily include private equity, real estate, infrastructure, timber and

agriculture-related assets and are materially reflected through our limited partnership investments.

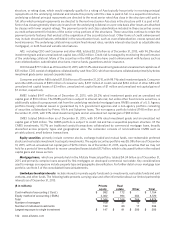

The following table presents investment income and realized capital gains and losses for PBLT investments for the

years ended December 31.

($ in millions)

Investment

income

Realized capital

gains

and losses

2015 2014 2015 2014

Limited partnerships

Private equity $ 402 $ 391 $ (46) $ (40)

Real estate 158 211 (4) 53

Timber and agriculture‑related (1) — — —

PBLT ‑ limited partnerships (1) 559 602 (50) 13

Other

Private equity 1 — 6 —

Real estate 22 14 (3) 7

Timber and agriculture‑related 7 9 1 —

PBLT ‑ other 30 23 4 7

Total

Private equity 403 391 (40) (40)

Real estate 180 225 (7) 60

Timber and agriculture‑related 6 9 1 —

Total PBLT $ 589 $ 625 $ (46) $ 20

Asset level operating expenses (2) $ (19) $ (14)

(1) Other limited partnership interests are located in the market-based core investing strategy and are not included in the performance-based long-term

table above. Investment income was $(10) million and $12 million and realized capital gains and losses were $(43) million and zero in 2015 and 2014,

respectively, for these limited partnership interests.

(2) Asset level operating expenses are netted against income for directly held real estate, timber and other consolidated investments for purposes of the

pre-tax yield calculations.

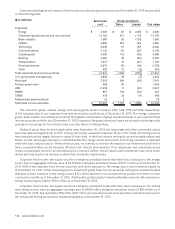

PBLT investments produced investment income of $589 million in 2015 compared to $625 million in 2014. The decrease

primarily related to lower income on real estate investments due to modest returns compared to significant returns in 2014.

Partially offsetting the decrease was higher income on private equity investments due to net returns from the diversified

portfolio along with strong distributions as acquirer access to financing and an active global merger and acquisition market

facilitated the sales of underlying investments, which more than offset a decline in valuations of investments with exposure to

the energy sector.

Realized capital losses on PBLT investments in 2015 were $46 million compared to realized capital gains of $20

million in 2014. Included in 2015 were impairment write-downs primarily related to two energy related investments that

have been impacted by a decline in natural gas prices.

Economic conditions and equity market performance are reflected in PBLT investment results and we continue to

expect this income to vary significantly between periods.

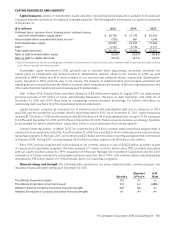

MARKET RISK

Market risk is the risk that we will incur losses due to adverse changes in interest rates, credit spreads, equity prices

or currency exchange rates. Adverse changes to these rates and prices may occur due to changes in fiscal policy, the

economic climate, the liquidity of a market or market segment, insolvency or financial distress of key market makers

or participants or changes in market perceptions of credit worthiness and/or risk tolerance. Our primary market risk

exposures are to changes in interest rates, credit spreads and equity prices.

The active management of market risk is integral to our results of operations. We may use the following approaches

to manage exposure to market risk within defined tolerance ranges: 1) rebalancing existing asset or liability portfolios,

2) changing the type of investments purchased in the future and 3) using derivative instruments to modify the market

risk characteristics of existing assets and liabilities or assets expected to be purchased. For a more detailed discussion of

our use of derivative financial instruments, see Note 7 of the consolidated financial statements.