Allstate 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 143

Short-term investments totaled $2.12 billion as of December 31, 2015.

Other investments primarily comprise $1.57 billion of bank loans, $905 million of policy loans, $422 million of agent

loans (loans issued to exclusive Allstate agents) and $53 million of derivatives as of December 31, 2015. For further detail

on our use of derivatives, see Note 7 of the consolidated financial statements.

Unrealized net capital gains totaled $1.03 billion as of December 31, 2015 compared to $3.17 billion as of December

31, 2014. The decrease for fixed income securities was primarily due to wider credit spreads, an increase in risk-free interest

rates and the realization of unrealized net capital gains through sales. The decrease for equity securities was primarily due

to negative equity market performance and the realization of unrealized net capital gains through sales, partially offset by

the realization of unrealized net capital losses through write-downs.

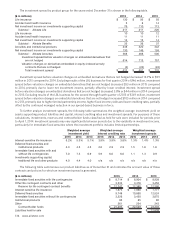

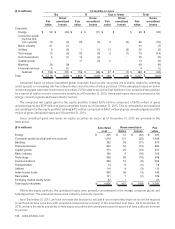

The following table presents unrealized net capital gains and losses as of December 31.

($ in millions) 2015 2014

U.S. government and agencies $ 86 $ 136

Municipal 369 620

Corporate 153 1,758

Foreign government 50 102

ABS (32) 7

RMBS 90 99

CMBS 28 42

Redeemable preferred stock 3 4

Fixed income securities 747 2,768

Equity securities 276 412

Derivatives 6 (2)

EMA limited partnerships (4) (5)

Unrealized net capital gains and losses, pre‑tax $ 1,025 $ 3,173

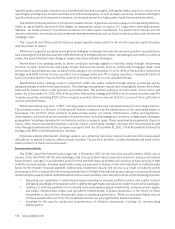

We have a comprehensive portfolio monitoring process to identify and evaluate each fixed income and equity

security that may be other-than-temporarily impaired. The process includes a quarterly review of all securities to identify

instances where the fair value of a security compared to its amortized cost (for fixed income securities) or cost (for equity

securities) is below established thresholds. The process also includes the monitoring of other impairment indicators such

as ratings, ratings downgrades and payment defaults. The securities identified, in addition to other securities for which

we may have a concern, are evaluated for potential other-than-temporary impairment using all reasonably available

information relevant to the collectability or recovery of the security. Inherent in our evaluation of other-than-temporary

impairment for these fixed income and equity securities are assumptions and estimates about the financial condition

and future earnings potential of the issue or issuer. Some of the factors that may be considered in evaluating whether

a decline in fair value is other than temporary are: 1) the financial condition, near-term and long-term prospects of the

issue or issuer, including relevant industry specific market conditions and trends, geographic location and implications

of rating agency actions and offering prices; 2) the specific reasons that a security is in an unrealized loss position,

including overall market conditions which could affect liquidity; and 3) the length of time and extent to which the fair

value has been less than amortized cost or cost. All investments in an unrealized loss position as of December 31, 2015

were included in our portfolio monitoring process for determining whether declines in value were other than temporary.

The unrealized net capital gain for the fixed income portfolio totaled $747 million, comprised of $1.71 billion of gross

unrealized gains and $960 million of gross unrealized losses as of December 31, 2015. This is compared to an unrealized

net capital gain for the fixed income portfolio totaling $2.77 billion, comprised of $3.08 billion of gross unrealized gains

and $314 million of gross unrealized losses as of December 31, 2014.