Allstate 2015 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 157

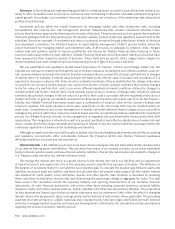

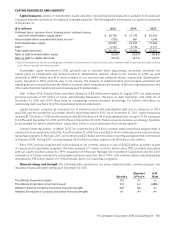

CAPITAL RESOURCES AND LIQUIDITY

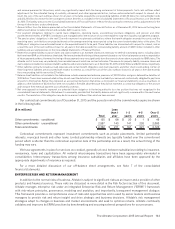

Capital resources consist of shareholders’ equity and debt, representing funds deployed or available to be deployed

to support business operations or for general corporate purposes. The following table summarizes our capital resources as

of December 31.

($ in millions) 2015 2014 2013

Preferred stock, common stock, treasury stock, retained income

and other shareholders’ equity items $ 20,780 $ 21,743 $ 20,434

Accumulated other comprehensive (loss) income (755) 561 1,046

Total shareholders’ equity 20,025 22,304 21,480

Debt (1) 5,124 5,140 6,141

Total capital resources $ 25,149 $ 27,444 $ 27,621

Ratio of debt to shareholders’ equity 25.6% 23.0% 28.6%

Ratio of debt to capital resources 20.4% 18.7% 22.2%

(1) Due to the adoption of new accounting guidance related to the presentation of debt issuance costs, long-term debt is reported net of debt issuance

costs. All prior periods have been adjusted.

Shareholders’ equity decreased in 2015, primarily due to common share repurchases, decreased unrealized net

capital gains on investments and dividends paid to shareholders, partially offset by net income. In 2015, we paid

dividends of $483 million and $116 million related to our common and preferred shares, respectively. Shareholders’

equity increased in 2014, primarily due to net income, the issuance of preferred stock and increased unrealized net

capital gains on investments, partially offset by common share repurchases, an increase in the unrecognized pension and

other postretirement benefit cost and dividends paid to shareholders.

Debt In May 2015, Federal Home Loan Bank advances of $8 million were repaid. In August 2015, we repurchased

principal amounts of $11 million of Junior Subordinated Debentures. We have no debt maturities until 2018. As of

December 31, 2015 and 2014, there were no outstanding commercial paper borrowings. For further information on

outstanding debt, see Note 12 of the consolidated financial statements.

Capital resources comprise an increased mix of preferred stock and subordinated debt due to issuances in 2013

and 2014 and the completion of a tender offer to repurchase debt in 2013. As of December 31, 2015, capital resources

includes $1.75 billion or 7.0% of preferred stock and $2.04 billion or 8.1% of subordinated debt, a total of 15.1% compared

to 13.8% as of December 31, 2014 and 10.2% as of December 31, 2013. These resources increase our strategic flexibility

by decreasing our debt to shareholders’ equity ratio, which is one determinant of borrowing capacity.

Common share repurchases In March 2015, we commenced a $3 billion common share repurchase program that is

expected to be completed by July 2016. As of December 31, 2015, there was $532 million remaining on the common share

repurchase program. In February 2015, we completed a $2.5 billion common share repurchase program that commenced

in February 2014. During 2015, we repurchased 42.8 million common shares for $2.80 billion in the market.

Since 1995, we have acquired 645 million shares of our common stock at a cost of $28.23 billion, primarily as part

of various stock repurchase programs. We have reissued 127 million common shares since 1995, primarily associated

with our equity incentive plans, the 1999 acquisition of American Heritage Life Investment Corporation and the 2001

redemption of certain mandatorily redeemable preferred securities. Since 1995, total common shares outstanding has

decreased by 518 million shares or 57.6%, primarily due to our repurchase programs.

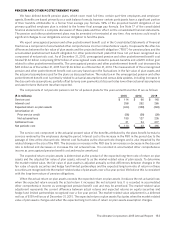

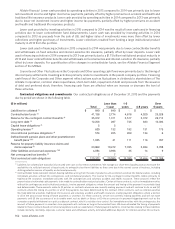

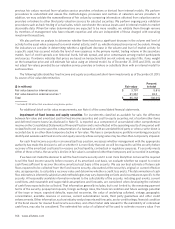

Financial ratings and strength The following table summarizes our senior long-term debt, commercial paper and

insurance financial strength ratings as of December 31, 2015.

Moody’s

Standard

& Poor’s

A.M.

Best

The Allstate Corporation (debt) A3 A‑ a‑

The Allstate Corporation (short‑term issuer) P‑2 A‑1 AMB‑1

Allstate Insurance Company (insurance financial strength) Aa3 AA‑ A+

Allstate Life Insurance Company (insurance financial strength) A1 A+ A+