Allstate 2015 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.190 www.allstate.com

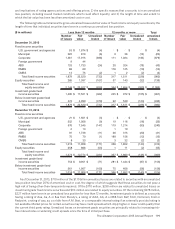

Legal contingencies

The Company reviews its lawsuits, regulatory inquiries, and other legal proceedings on an ongoing basis. The

Company establishes accruals for such matters at management’s best estimate when the Company assesses that it

is probable that a loss has been incurred and the amount of the loss can be reasonably estimated. The Company’s

assessment of whether a loss is reasonably possible or probable is based on its assessment of the ultimate outcome

of the matter following all appeals. The Company does not include potential recoveries in its estimates of reasonably

possible or probable losses. Legal fees are expensed as incurred.

Long-term debt

Long-term debt includes senior notes, senior debentures, subordinated debentures and junior subordinated

debentures issued by the Corporation. Unamortized debt issuance costs are reported in long-term debt and are amortized

over the expected period the debt will remain outstanding.

Deferred Employee Stock Ownership Plan (“ESOP”) expense

Deferred ESOP expense represents the remaining unrecognized cost of shares acquired by the Allstate ESOP to pre-

fund a portion of the Company’s contribution to the Allstate 401(k) Savings Plan.

Equity incentive plans

The Company has equity incentive plans under which the Company grants nonqualified stock options, restricted

stock units and performance stock awards (“equity awards”) to certain employees and directors of the Company. The

Company measures the fair value of equity awards at the award date and recognizes the expense over the shorter of the

period in which the requisite service is rendered or retirement eligibility is attained. The expense for performance stock

awards is adjusted each period to reflect the performance factor most likely to be achieved at the end of the performance

period. The Company uses a binomial lattice model to determine the fair value of employee stock options.

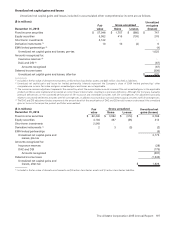

Off-balance sheet financial instruments

Commitments to invest, commitments to purchase private placement securities, commitments to extend loans,

financial guarantees and credit guarantees have off-balance sheet risk because their contractual amounts are not

recorded in the Company’s Consolidated Statements of Financial Position (see Note 7 and Note 14).

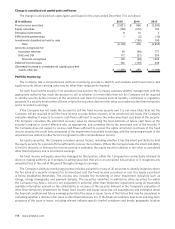

Consolidation of variable interest entities (“VIEs”)

The Company consolidates VIEs when it is the primary beneficiary. A primary beneficiary is the variable interest holder

in a VIE with both the power to direct the activities of the VIE that most significantly impact the economic performance of

the VIE and the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE.

Foreign currency translation

The local currency of the Company’s foreign subsidiaries is deemed to be the functional currency of the country in

which these subsidiaries operate. The financial statements of the Company’s foreign subsidiaries are translated into U.S.

dollars at the exchange rate in effect at the end of a reporting period for assets and liabilities and at average exchange

rates during the period for results of operations. The unrealized gains and losses from the translation of the net assets

are recorded as unrealized foreign currency translation adjustments and included in accumulated other comprehensive

income. Changes in unrealized foreign currency translation adjustments are included in other comprehensive income.

Gains and losses from foreign currency transactions are reported in operating costs and expenses and have not been

material.

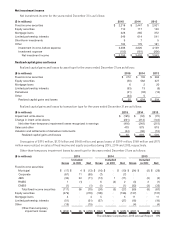

Earnings per common share

Basic earnings per common share is computed using the weighted average number of common shares outstanding,

including unvested participating restricted stock units. Diluted earnings per common share is computed using the

weighted average number of common and dilutive potential common shares outstanding. For the Company, dilutive

potential common shares consist of outstanding stock options and unvested non-participating restricted stock units and

contingently issuable performance stock awards.