Allstate 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 www.allstate.com

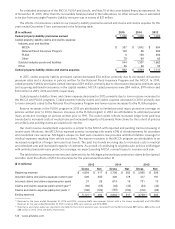

For a detailed description of the MCCA, PLIGA and Lloyd’s, see Note 10 of the consolidated financial statements. As

of December 31, 2015, other than the recoverable balances listed in the table above, no other amount due or estimated

to be due from any single Property-Liability reinsurer was in excess of $21 million.

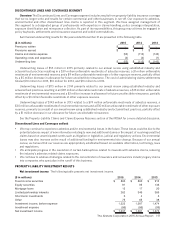

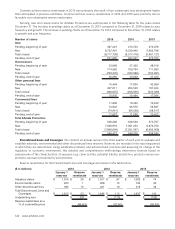

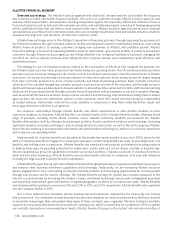

The effects of reinsurance ceded on our property-liability premiums earned and claims and claims expense for the

years ended December 31 are summarized in the following table.

($ in millions) 2015 2014 2013

Ceded property-liability premiums earned $ 1,006 $ 1,030 $ 1,069

Ceded property‑liability claims and claims expense

Industry pool and facilities

MCCA $ 337 $ 1,042 $ 954

National Flood Insurance Program 120 38 289

PLIGA 9 158 356

Other 78 69 63

Subtotal industry pools and facilities 544 1,307 1,662

Other 58 86 55

Ceded property-liability claims and claims expense $ 602 $ 1,393 $ 1,717

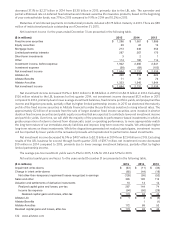

In 2015, ceded property-liability premiums earned decreased $24 million, primarily due to decreased reinsurance

premium rates and a decrease in policies written for the National Flood Insurance Program and the MCCA. In 2014,

ceded property-liability premiums earned decreased $39 million, primarily due to decreased reinsurance premium rates

and acquiring additional reinsurance in the capital markets. MCCA ceded premiums were $84 million, $99 million and

$101 million in 2015, 2014 and 2013, respectively.

Ceded property-liability claims and claims expense decreased in 2015 primarily due to lower reserve increases for

the MCCA and PLIGA programs. Ceded property-liability claims and claims expense decreased in 2014 primarily due

to lower amounts ceded to the National Flood Insurance Program and lower reserve increases for the PLIGA program.

Reserve increases in the PLIGA program in 2015 are attributable to limited personal injury protection coverage on

policies written prior to 2004. Reserve increases in the PLIGA program in 2014 are attributable to unlimited personal

injury protection coverage on policies written prior to 1991. The ceded claims reflects increased longer term paid loss

trends due to increased costs of medical care and increased longevity of claimants. New claims for this cohort of policies

are unlikely and pending claims are expected to decline.

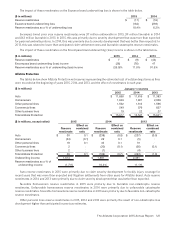

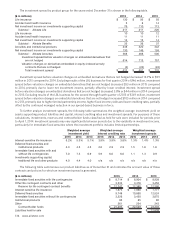

Our claim reserve development experience is similar to the MCCA with reported and pending claims increasing in

recent years. Moreover, the MCCA has reported severity increasing with nearly 60% of reimbursements for attendant

and residential care services. Michigan’s unique no-fault auto insurance law provides unlimited lifetime coverage for

medical expenses resulting from vehicle accidents. The reserve increases in the MCCA program are attributable to an

increased recognition of longer term paid loss trends. The paid loss trends are rising due to increased costs in medical

and attendant care and increased longevity of claimants. As a result of continuing to originate auto policies in Michigan

with unlimited personal injury protection coverage, we expect pending MCCA covered losses to increase each year.

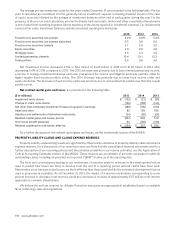

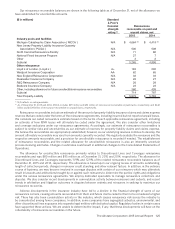

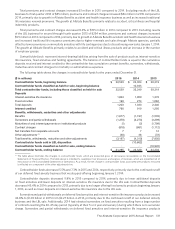

The table below summarizes reserves and claim activity for Michigan personal injury protection claims before (gross)

and after (net) the effects of MCCA reinsurance for the years ended December 31.

($ in millions) 2015 2014 2013

Gross Net Gross Net Gross Net

Beginning reserves $ 4,804 $ 417 $ 3,798 $ 365 $ 2,866 $ 299

Incurred claims and claims expense‑current year 526 200 420 178 417 181

Incurred claims and claims expense‑prior years 37 26 819 19 731 13

Claims and claims expense paid‑current year (2) (56) (55) (46) (45) (44) (42)

Claims and claims expense paid‑prior years (2) (190) (102) (187) (100) (172) (86)

Ending reserves $ 5,121 (1) $486 $4,804 (1) $417 $3,798 (1) $365

(1) Reserves for the years ended December 31, 2015 and 2014, comprise 86% case reserves (claims with a file review conducted) and 14% IBNR.

Reserves for the year ended December 31, 2013 comprise 66% case reserves and 34% IBNR.

(2) Paid claims and claims expenses, reported in the table for the current and prior year, recovered from the MCCA totaled $89 million, $88 million and

$88 million in 2015, 2014 and 2013, respectively.