Allstate 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.164 www.allstate.com

Our risk-return principles define how we operate and guide decision-making around risk and return. These principles

state that, first and foremost, our priority is to protect solvency, comply with laws and act with integrity. Building upon

this foundation, we strive to build strategic value and optimize risks and returns.

ERRM governance includes board oversight, an executive management committee structure, and chief risk officers

(“CROs”). The Allstate Corporation Board of Directors (“Allstate Board”) has overall responsibility for oversight of

management’s design and implementation of ERRM, including integration with strategy and operations. The Risk and Return

Committee of the Allstate Board oversees effectiveness of the ERRM framework, governance structure and decision-making,

while focusing on the Company’s risk and return position. The Audit Committee oversees effectiveness of management’s

control framework for risks. The Enterprise Risk & Return Council (“ERRC”) is Allstate’s senior risk management committee

that directs ERRM by establishing risk-return targets, determining economic capital levels and directing integrated strategies

and actions from an enterprise perspective. The ERRC consists of Allstate’s chief executive officer, president, business

unit presidents, chief investment officer, enterprise and business unit chief risk officers and chief financial officers, general

counsel and treasurer.

CROs are appointed for the enterprise and for Allstate Protection, Allstate Financial, Allstate Investments, and Allstate’s

technology organization. Collectively, the CROs create an integrated approach to risk and return management to ensure

risk management practices and strategies are aligned with Allstate’s overall enterprise objectives. Various enterprise risk

and return committees with CRO, senior management and cross-functional business representation govern management

of key risks. The shared ERRM framework establishes a basis for transparency and dialogue across the organization and

for continuous learning by embedding the risk and return management culture of identifying, measuring, managing,

monitoring and reporting risks.

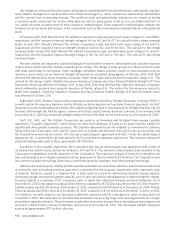

Our ERRM governance is supported with an analytic framework to manage significant insurance, investment, financial,

strategic, and operational risk exposures and optimize returns on risk-adjusted capital. Management and the ERRC use

enterprise stochastic modeling, risk expertise and judgment to determine an appropriate level of targeted enterprise

economic capital to hold considering a broad range of risk objectives and external constraints. These include limiting risks

of financial stress, insolvency, likelihood of capital stress and volatility, maintaining stakeholder value and financial strength

ratings and satisfying regulatory and rating agency risk-based capital requirements. Potential risk events that we consider

for capital evaluations include catastrophe and pandemic events and investment market shocks. We generally assess

solvency on a statutory accounting basis, but also consider GAAP volatility. Current enterprise economic capital, which

exceeds targeted levels, approximates a combination of total statutory surplus and deployable invested assets at the parent

holding company level which were $16.49 billion and $2.62 billion, respectively, as of December 31, 2015.

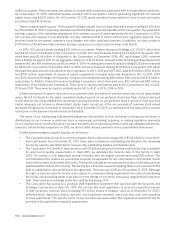

Using our governance and analytic framework, Allstate designs business and enterprise strategies that seek to

optimize returns on risk-adjusted capital. Examples include reducing exposure to rising interest rates; improving auto

profitability; shifting our investment portfolio mix over time to have less reliance on investments with returns that

come primarily from interest payments to investments in which we have ownership interests and a greater proportion

of return is derived from idiosyncratic asset or operating performance; and accelerating homeowners growth while

maintaining profitability.

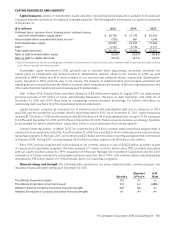

APPLICATION OF CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to adopt accounting policies

and make estimates and assumptions that affect amounts reported in the consolidated financial statements. The most

critical estimates, presented in the order they appear in the Consolidated Statements of Financial Position, include those

used in determining:

• Fair value of financial assets

• Impairment of fixed income and equity securities

• Deferred policy acquisition costs amortization

• Reserve for property-liability insurance claims and claims expense estimation

• Reserve for life-contingent contract benefits estimation

In making these determinations, management makes subjective and complex judgments that frequently require

estimates about matters that are inherently uncertain. Many of these policies, estimates and related judgments are

common in the insurance and financial services industries; others are specific to our businesses and operations. It is

reasonably likely that changes in these estimates could occur from period to period and result in a material impact on

our consolidated financial statements.