Allstate 2015 Annual Report Download - page 234

Download and view the complete annual report

Please find page 234 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.228 www.allstate.com

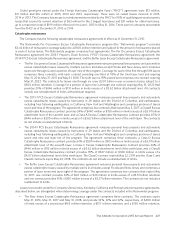

respectively. The contracts reinsure personal lines property and automobile excess catastrophe losses in New

Jersey. All contracts contain one reinstatement of limits each year. The reinsurance premium and retention

applicable to the agreement are subject to redetermination for exposure changes annually.

• The Kentucky Earthquake Excess Catastrophe Reinsurance agreement provides coverage for Allstate Protection

personal lines property excess catastrophe losses in the state for earthquakes and fires following earthquakes

effective June1, 2014 to May31, 2017. The agreement provides three limits of $25 million excess of a $5 million

retention subject to two limits being available in any one contract year and is 95% placed.

• The E&S Earthquake agreement comprises one three year term contract which reinsures personal lines property

catastrophe losses in California caused by the peril of earthquake and insured by our excess and surplus lines

insurer. The contract expires June 30, 2018. Unlike the contracts comprising the Nationwide Program, the E&S

Earthquake agreement provides reinsurance on a 100% quota share basis with no retention. The contract allows

for cession of policies providing earthquake coverage so long as the total amount of in-force building limits

provided by those policies does not exceed $400 million. This cap limits the policies that are covered by the

reinsurance and not the amount of loss eligible for cession which includes losses to dwellings, other structures,

personal property, and additional living expenses on policies covered by this program. The agreement reinsures

only shake damage resulting from earthquake peril.

• The Pennsylvania Excess Catastrophe Reinsurance agreement comprises a three-year term contract that provides

coverage for Allstate Protection personal lines property excess catastrophe losses in the state for multi-perils

effective June1, 2015 through May31, 2018. The agreement provides three limits of $100 million excess of a $100

million retention subject to two limits being available in any one contract year and is 95% placed. The reinsurance

premium and retention are not subject to redetermination for exposure changes.

• The Florida Excess Catastrophe Reinsurance agreement comprises six contracts and includes our subsidiaries

Castle Key Insurance Company (“CKIC”) and Castle Key Indemnity Company’s (“CKI”, and together with CKIC,

“Castle Key”) participation in the mandatory Florida Hurricane Catastrophe Fund (“FHCF”). The agreement

reinsures Castle Key for personal lines property excess catastrophe losses in Florida. All contracts constituting

the agreement, except one, the Sanders Re 2014-2 Class A contract, provide a one year term effective June1,

2015 through May31, 2016 with reinsurance premium subject to redetermination for exposure changes. The

Sanders Re 2014-2 contract is a three-year term contract with a risk period effective June 1, 2014 through

May31, 2017. With the exception of the mandatory FHCF contracts and the Sanders Re 2014-2 contract, all

contracts provide reinsurance for qualifying losses to personal lines property arising out of multiple perils in

addition to hurricanes. The mandatory FHCF contracts reinsure qualifying personal lines property losses caused

by storms the National Hurricane Center declares to be hurricanes, and the Sanders Re 2014-2 contract reinsures

qualifying losses to personal lines property caused by a named storm event, a severe thunderstorm event, or an

earthquake event. These events are defined in the Sanders Re 2014-2 contract as events declared by various

reporting agencies, including PCS, and in the case of a severe thunderstorm event, should PCS cease to report

on severe thunderstorms, then such event will be deemed a severe thunderstorm if Castle Key has assigned a

catastrophe code to such severe thunderstorm. The mandatory FHCF contracts include an estimated maximum

provisional limit of 90% of $181 million or $163 million, in excess of a provisional retention of $66 million, and also

include reimbursement of up to 5% eligible loss adjustment expenses. The limit and retention of the mandatory

FHCF contracts were subject to re-measurement based on June 30, 2015 exposure data. In addition, the FHCF’s

retention is subject to adjustment upward or downward to an actual retention based on submitted exposures to

the FHCF by all participants. For each of the two largest hurricanes, the provisional retention is $66 million and

a retention equal to one-third of that amount, or approximately $22 million, is applicable to all other hurricanes

for the season beginning June 1, 2015. All contracts comprising the Florida Excess Catastrophe Reinsurance

agreement, including the mandatory FHCF contracts, provide an estimated provisional limit of $707 million

excess of a provisional $15 million retention.

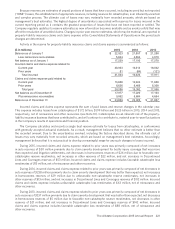

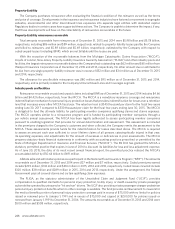

The Company ceded premiums earned of $414 million, $437 million and $471 million under catastrophe reinsurance

agreements in 2015, 2014 and 2013, respectively.

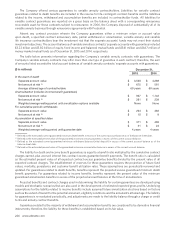

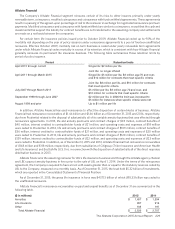

Asbestos, environmental and other

Reinsurance recoverables include $183 million and $202 million from Lloyd’s of London as of December31, 2015 and

2014, respectively. Lloyd’s of London, through the creation of Equitas Limited, implemented a restructuring to solidify

its capital base and to segregate claims for years prior to 1993. In 2007, Berkshire Hathaway’s subsidiary, National

Indemnity Company, assumed responsibility for the Equitas claim liabilities through a loss portfolio transfer reinsurance

agreement and continues to runoff the Equitas claims.