Allstate 2015 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2015 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Allstate Corporation 2015 Annual Report 221

Because reserves are estimates of unpaid portions of losses that have occurred, including incurred but not reported

(“IBNR”) losses, the establishment of appropriate reserves, including reserves for catastrophes, is an inherently uncertain

and complex process. The ultimate cost of losses may vary materially from recorded amounts, which are based on

management’s best estimates. The highest degree of uncertainty is associated with reserves for losses incurred in the

current reporting period as it contains the greatest proportion of losses that have not been reported or settled. The

Company regularly updates its reserve estimates as new information becomes available and as events unfold that may

affect the resolution of unsettled claims. Changes in prior year reserve estimates, which may be material, are reported in

property-liability insurance claims and claims expense in the Consolidated Statements of Operations in the period such

changes are determined.

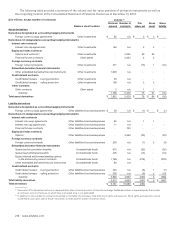

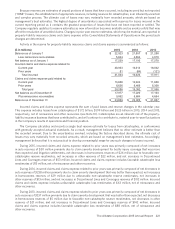

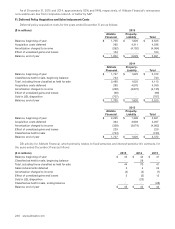

Activity in the reserve for property-liability insurance claims and claims expense is summarized as follows:

($ in millions) 2015 2014 2013

Balance as of January 1 $ 22,923 $ 21,857 $ 21,288

Less reinsurance recoverables 5,694 4,664 4,010

Net balance as of January 1 17,229 17,193 17,278

Incurred claims and claims expense related to:

Current year 20,953 19,512 18,032

Prior years 81 (84) (121)

Total incurred 21,034 19,428 17,911

Claims and claims expense paid related to:

Current year 13,660 12,924 11,658

Prior years 6,626 6,468 6,338

Total paid 20,286 19,392 17,996

Net balance as of December 31 17,977 17,229 17,193

Plus reinsurance recoverables 5,892 5,694 4,664

Balance as of December 31 $ 23,869 $ 22,923 $ 21,857

Incurred claims and claims expense represents the sum of paid losses and reserve changes in the calendar year.

This expense includes losses from catastrophes of $1.72 billion, $1.99 billion and $1.25 billion in 2015, 2014 and 2013,

respectively, net of reinsurance and other recoveries (see Note10). Catastrophes are an inherent risk of the property-

liability insurance business that have contributed to, and will continue to contribute to, material year-to-year fluctuations

in the Company’s results of operations and financial position.

The Company calculates and records a single best reserve estimate for losses from catastrophes, in conformance

with generally accepted actuarial standards. As a result, management believes that no other estimate is better than

the recorded amount. Due to the uncertainties involved, including the factors described above, the ultimate cost of

losses may vary materially from recorded amounts, which are based on management’s best estimates. Accordingly,

management believes that it is not practical to develop a meaningful range for any such changes in losses incurred.

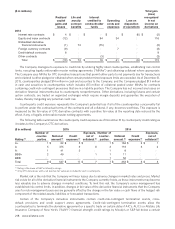

During 2015, incurred claims and claims expense related to prior years was primarily composed of net increases

in auto reserves of $30 million primarily due to claim severity development for bodily injury coverage that was more

than expected and litigation settlements, net decreases in homeowners reserves of $24 million due to favorable non-

catastrophe reserve reestimates, net increases in other reserves of $22 million, and net increases in Discontinued

Lines and Coverages reserves of $53 million. Incurred claims and claims expense includes favorable catastrophe loss

reestimates of $15 million, net of reinsurance and other recoveries.

During 2014, incurred claims and claims expense related to prior years was primarily composed of net decreases in

auto reserves of $238 million primarily due to claim severity development that was better than expected, net increases

in homeowners reserves of $29 million due to unfavorable non-catastrophe reserve reestimates, net increases in

other reserves of $13 million, and net increases in Discontinued Lines and Coverages reserves of $112 million. Incurred

claims and claims expense includes unfavorable catastrophe loss reestimates of $43 million, net of reinsurance and

other recoveries.

During 2013, incurred claims and claims expense related to prior years was primarily composed of net decreases in

auto reserves of $237 million primarily due to claim severity development that was better than expected, net decreases

in homeowners reserves of $5 million due to favorable non-catastrophe reserve reestimates, net decreases in other

reserves of $21 million, and net increases in Discontinued Lines and Coverages reserves of $142 million. Incurred

claims and claims expense includes favorable catastrophe loss reestimates of $88 million, net of reinsurance and

other recoveries.