Advance Auto Parts 2008 Annual Report Download - page 98

Download and view the complete annual report

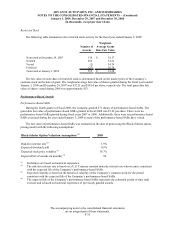

Please find page 98 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC.

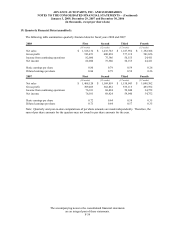

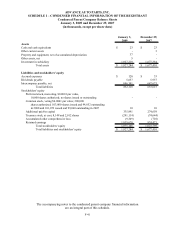

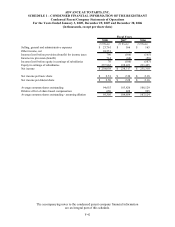

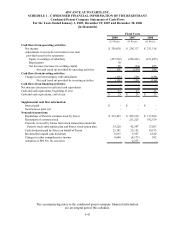

SCHEDULE I – CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

Notes to the Condensed Parent Company Statements

December 29, 2007 and December 30, 2006

(in thousands, except per share data)

See Notes to the Consolidated Financial Statements for Additional Disclosures.

F-44

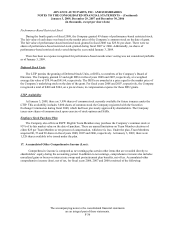

1. Presentation

These condensed financial statements have been prepared pursuant to the rules and regulations of the Securities

and Exchange Commission. Certain information and note disclosures normally included in annual financial

statements prepared in accordance with accounting principles generally accepted in the United States of America

have been condensed or omitted pursuant to those rules and regulations, although management believes that the

disclosures made are adequate to make the information presented not misleading.

2. Organization

Advance Auto Parts, Inc. (“the Company”) is a holding company, which is the 100% shareholder of Advance

Stores Company, Incorporated and its subsidiaries ("Stores") during the periods presented. The parent/subsidiary

relationship between the Company and Stores includes certain related party transactions. These transactions consist

primarily of interest on intercompany advances, dividends, capital contributions and allocations of certain costs.

Deferred income taxes have not been provided for financial reporting and tax basis differences on the undistributed

earnings of the subsidiaries. Effective fiscal 2008, the Company and its subsidiaries realigned duties and

responsibilities within its overall organization that resulted in certain operating expenses being included in and

recognized at the parent company level.

The Company fully and unconditionally guarantees the term loan and revolving credit facility of Stores. These

debt agreements do not contain restrictions on the payment of dividends, loans or advances between the Company

and Stores and Stores’ subsidiaries. Therefore, there are no such restrictions as of January 3, 2009 and December 29,

2007.

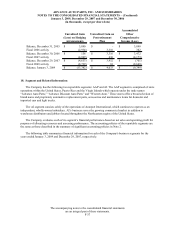

3. Summary of Significant Accounting Policies

Accounting Period

The Company's fiscal year ends on the Saturday nearest the end of December, which results in an extra week

every several years. Accordingly, fiscal 2008 includes 53 weeks of operations. All other fiscal years presented

included 52 weeks of operations.

New Accounting Pronouncements

In June 2008, the Financial Accounting Standards Board, or FASB, issued FASB Staff Position, or FSP, EITF

03-6-1, “Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating

Securities.” FSP EITF 03-6-1 addresses whether instruments granted in share-based payment transactions are

participating securities prior to vesting, and therefore need to be included in the earnings allocation in computing

earnings per share under the two-class method as described in Statement of Financial Accounting Standards, or

SFAS, No. 128, “Earnings per Share.” Under the guidance of FSP EITF 03-6-1, nonvested share-based payment

awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are

participating securities and shall be included in the computation of earnings-per-share pursuant to the two-class

method. FSP EITF 03-6-1 is effective for financial statements issued for fiscal years beginning after

December 15, 2008 and all prior-period earnings per share data presented shall be adjusted retrospectively.

Early application is not permitted. The Company does not anticipate the adoption of FSP EITF 03-6-1 will have an

impact on its earnings per share.

In April 2008, the FASB issued FASB Staff Position No. FAS 142-3, “Determination of the Useful Life of

Intangible Assets”, which amends the factors that must be considered in developing renewal or extension

assumptions used to determine the useful life over which to amortize the cost of a recognized intangible asset under

SFAS 142, “Goodwill and Other Intangible Assets.” The FSP requires an entity to consider its own assumptions

about renewal or extension of the term of the arrangement, consistent with its expected use of the asset, and is an