Advance Auto Parts 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

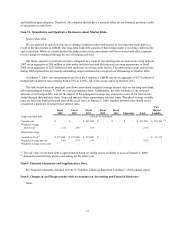

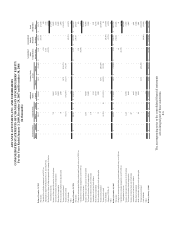

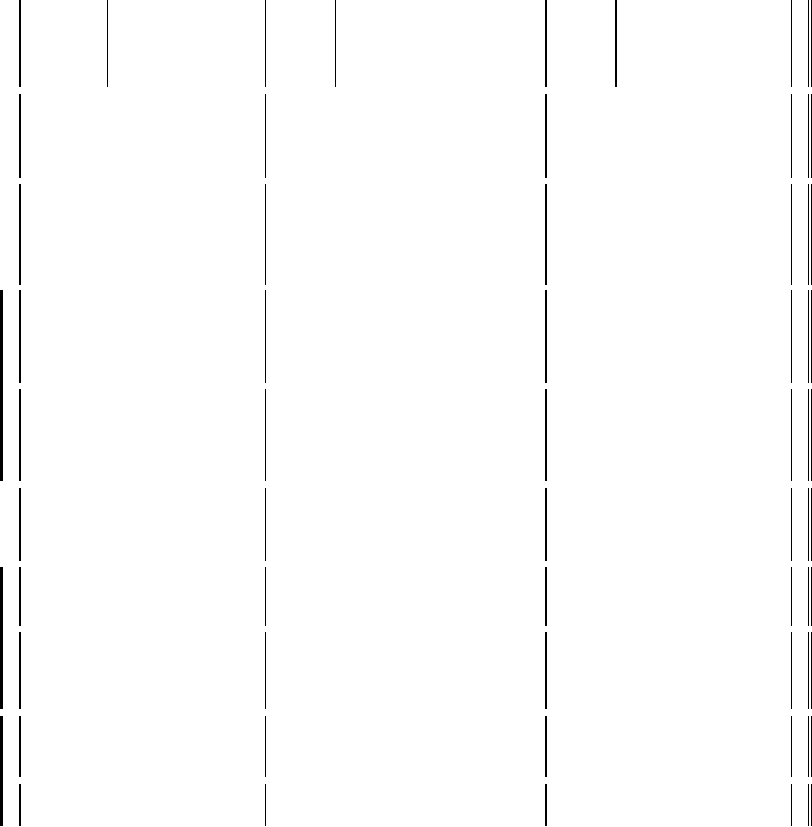

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Years Ended January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-6

Accumulated (Accumulated

Additional Other Deficit) Total

Paid-in Comprehensive Retained Stockholders'

Shares Amount Shares Amount Capital Shares Amount Income (Loss) Earnings Equity

Balance, December 31, 2005 - -$ 109,637 11$ 564,965$ 1,439 (55,668)$ 3,090$ 407,373$ 919,771$

Net income - - - - - - - - 231,318 231,318

Unrealized loss on hedge arrangement, net of $12 tax - - - - - - - (61) - (61)

Adjustment to adopt FASB Statement No. 158, net of $2,041 tax - - - - - - - 3,316 - 3,316

Reclassification of gain on hedge arrangements into earnings, before tax - - - - - - - (2,873) - (2,873)

Comprehensive income 231,700

Issuance of shares upon the exercise of stock options - - 741 - 14,043 - - - - 14,043

Tax benefit from share-based compensation - - - - 5,272 - - - - 5,272

Share-based compensation - - - - 19,052 - - - - 19,052

Stock issued under employee stock purchase plan - - 90 - 2,908 - - - - 2,908

Treasury stock purchased - - - - - 3,678 (136,671) - - (136,671)

Treasury stock retired - - (5,117) - (192,339) (5,117) 192,339 - - -

Cash dividends - - - - - - - - (25,473) (25,473)

Other - - - - 252 - - - - 252

Balance, December 30, 2006 - -$ 105,351 11$ 414,153$ - -$ 3,472$ 613,218$ 1,030,854$

Net income - - - - - - - - 238,317 238,317

Changes in net unrecognized other postretirement benefit costs, net of $414 tax - - - - - - - 636 - 636

Unrealized loss on hedge arrangement, net of $3,087 tax - - - - - - - (4,809) - (4,809)

Comprehensive income 234,144

Issuance of shares upon the exercise of stock options - - 1,867 - 40,468 - - - - 40,468

Tax benefit from share-based compensation - - - - 11,088 - - - - 11,088

Issuance of restricted stock, net of forfeitures - - 130 - - - - - - -

Amortization of restricted stock balance - - - - 1,341 - - - - 1,341

Share-based compensation - - - - 16,755 - - - - 16,755

Stock issued under employee stock purchase plan - - 53 - 1,888 - - - - 1,888

Treasury stock purchased - - - - - 8,341 (285,869) - - (285,869)

Treasury stock retired - - (6,329) (1) (211,225) (6,329) 211,225 - - (1)

Cash dividends - - - - - - - - (24,789) (24,789)

Adoption of FIN No. 48 - - - - - - - - (2,275) (2,275)

Other - - - - 191 - - - - 191

Balance, December 29, 2007 - -$ 101,072 10$ 274,659$ 2,012 (74,644)$ (701)$ 824,471$ 1,023,795$

Net income - - - - - - - - 238,038 238,038

Changes in net unrecognized other postretirement benefit costs, net of $52 tax - - - - - - - 81 - 81

Unrealized loss on hedge arrangement, net of $5,605 tax - - - - - - - (8,729) - (8,729)

Comprehensive income 229,390

Issuance of shares upon the exercise of stock options - - 1,421 - 31,989 - - - - 31,989

Tax benefit from share-based compensation - - - - 8,405 - - - - 8,405

Issuance of restricted stock, net of forfeitures - - 427 - - - - - - -

Amortization of restricted stock balance - - - - 4,661 - - - - 4,661

Share-based compensation - - - - 13,046 - - - - 13,046

Stock issued under employee stock purchase plan - - 80 - 2,801 - - - - 2,801

Treasury stock purchased - - - - - 6,136 (216,470) - - (216,470)

Cash dividends - - - - - - - - (22,881) (22,881)

Other - - - - 430 - - - - 430

Balance, January 3, 2009 - -$ 103,000 10$ 335,991$ 8,148 (291,114)$ (9,349)$ 1,039,628$ 1,075,166$

Treasury Stock,

Preferred Stock Common Stock at cost