Advance Auto Parts 2008 Annual Report Download - page 66

Download and view the complete annual report

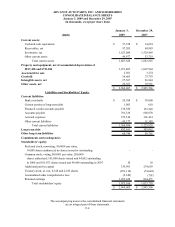

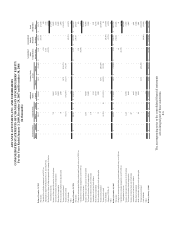

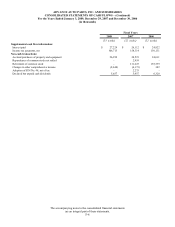

Please find page 66 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-12

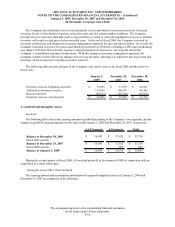

Share-Based Payments

The Company provides share-based compensation to its employees and directors, which it accounts for pursuant

to SFAS 123, “Accounting for Stock-Based Compensation,” as revised by SFAS 123R (revised 2004), “Share-Based

Payment.” In accordance with SFAS 123R, the Company is required to exercise judgment and make estimates when

determining the projected (i) fair value of each award granted and (ii) number of awards expected to vest. The

Company uses the Black-Scholes option-pricing model to value all share-based awards and the straight-line method

to amortize this fair value as compensation cost over the requisite service period.

Earnings Per Share of Common Stock

Basic earnings per share of common stock has been computed based on the weighted-average number of

common shares outstanding during the period, which is reduced by stock held in treasury and shares of nonvested

restricted stock. Diluted earnings per share of common stock reflects the weighted-average number of shares of

common stock outstanding, outstanding deferred stock units and the impact of outstanding stock options, stock

appreciation rights and shares of nonvested restricted stock (collectively “share-based awards”), calculated on the

treasury stock method as modified by the adoption of SFAS 123R. There were antidilutive share-based awards equal

to 3,313, 3,192 and 2,140 shares of common stock for the fiscal years ended January 3, 2009, December 29, 2007

and December 30, 2006, respectively.

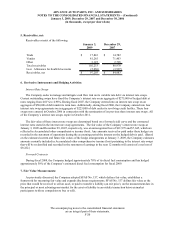

Derivative Instruments and Hedging Activities

Interest Rate Swaps

The Company utilizes interest rate swaps to limit its cash flow risk on its variable rate debt. In accordance with

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” the fair value of the Company’s

outstanding hedges is recorded as an asset or liability in the accompanying condensed consolidated balance sheets at

January 3, 2009 and December 29, 2007, respectively. The Company uses the 90-day adjusted LIBOR interest rate

and has the intent and ability to continue to use this rate on its hedged borrowings. Accordingly, the Company does

not recognize any ineffectiveness on the swaps as allowed under Derivative Implementation Group Issue No. G7,

“Cash Flow Hedges: Measuring the Ineffectiveness of a Cash Flow Hedge under Paragraph 30(b) When the Shortcut

Method Is Not Applied.”

Effective December 30, 2007, the Company adopted FASB Staff Position No. FIN 39-1, “Amendment of FASB

Interpretation No. 39,” or FSP FIN 39-1, without an impact on its financial position, results of operations or cash

flows. FSP FIN 39-1 amends FASB Interpretation No. 39, “Offsetting of Amounts Related to Certain Contracts,”

requiring a reporting entity to offset fair value amounts recognized for the right to reclaim cash collateral (a

receivable) or the obligation to return cash collateral (a payable) against fair value amounts recognized for derivative

instruments executed with the same counterparty under the same master netting arrangement that have been offset in

accordance with FIN 39. FSP FIN 39-1 also amends FIN 39 for certain terminology modifications. Upon adoption

of FSP FIN 39-1, the Company did not change its accounting policy of not offsetting fair value amounts recognized

for derivative instruments under master netting arrangements.

The Company records the effective portion of the changes in fair value of its hedging instruments in

Accumulated other comprehensive income (loss) through the maturity date of the applicable hedge arrangement.

Any amounts received or paid under these hedges will be recorded in the statement of operations as earned or

incurred.

Forward Contracts

The Company utilizes forward commodity contracts to manage the risk of fluctuating fuel prices. The

Company has elected to apply the normal purchase election allowed under SFAS No. 133 and therefore does not

account for these contracts at fair value.