Advance Auto Parts 2008 Annual Report Download - page 64

Download and view the complete annual report

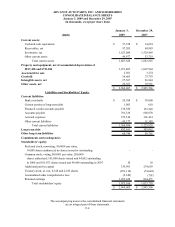

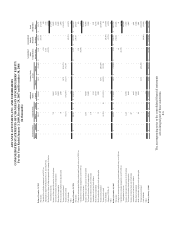

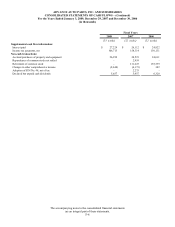

Please find page 64 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-10

Vendor Incentives

The Company receives incentives in the form of reductions to amounts owed and/or payments from vendors

related to cooperative advertising allowances, volume rebates and other promotional considerations. The Company

accounts for vendor incentives in accordance with Emerging Issues Task Force, or EITF, No. 02-16, “Accounting by

a Customer (Including a Reseller) for Certain Consideration Received from a Vendor.” Many of these incentives are

under long-term agreements (terms in excess of one year), while others are negotiated on an annual basis or less

(short-term). Both cooperative advertising allowances and volume rebates are earned based on inventory purchases

and initially recorded as a reduction to inventory. These deferred amounts are included as a reduction to cost of sales

as the inventory is sold since these payments do not represent reimbursements for specific, incremental and

identifiable costs. Total deferred vendor incentives included in Inventory, net was $50,527 and $39,118 at January 3,

2009 and December 29, 2007, respectively.

Similarly, the Company recognizes other promotional incentives earned under long-term agreements as a

reduction to cost of sales. However, these incentives are recognized based on the cumulative net purchases as a

percentage of total estimated net purchases over the life of the agreement. The Company's margins could be

impacted positively or negatively if actual purchases or results from any one year differ from its estimates; however,

the impact over the life of the agreement would be the same. Short-term incentives (terms less than one year) are

generally recognized as a reduction to cost of sales over the duration of any short-term agreements.

Amounts received or receivable from vendors not yet earned are reflected as deferred revenue in the

accompanying consolidated balance sheets. Management's estimate of the portion of deferred revenue that will be

realized within one year of the balance sheet date has been included in Other current liabilities in the accompanying

consolidated balance sheets. Total deferred revenue was $12,266 and $9,238 at January 3, 2009 and December 29,

2007, respectively. Earned amounts that are receivable from vendors are included in Receivables, net except for that

portion expected to be received after one year, which is included in Other assets, net on the accompanying

consolidated balance sheets.

Preopening Expenses

Preopening expenses, which consist primarily of payroll and occupancy costs related to the opening of new

stores, are expensed as incurred.

Income Taxes

The Company accounts for income taxes under the asset and liability method in accordance with SFAS No.

109, “Accounting for Income Taxes,” which requires the recognition of deferred tax assets and liabilities for the

expected future tax consequences of events that have been included in the financial statements. Under the asset and

liability method, deferred tax assets and liabilities are determined based on the differences between the financial

statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences

are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in

income in the period of the enactment date.

The Company accounts for uncertainties in income taxes pursuant to Financial Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes,” or FIN 48, which clarifies the accounting for uncertainty in income

taxes recognized in the financial statements under SFAS No. 109. The Company recognizes tax benefits and/or tax

liabilities for uncertain income tax positions pursuant to FIN 48 based on a two-step process. The first step is to

evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more

likely than not that the position will be sustained on audit, including resolution of related appeals or litigation

processes, if any. The second step requires the Company to estimate and measure the tax benefit as the largest

amount that is more than 50% likely to be realized upon ultimate settlement. It is inherently difficult and subjective

to estimate such amounts, as the Company must determine the probability of various possible outcomes. We

reevaluate these uncertain tax positions on a quarterly basis or when new information becomes available to

management. The reevaluations are based on many factors, including but not limit to, changes in facts or