Advance Auto Parts 2008 Annual Report Download - page 65

Download and view the complete annual report

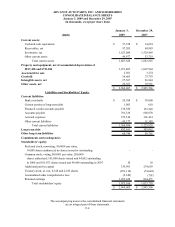

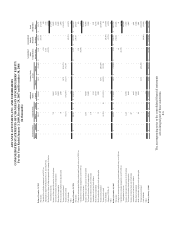

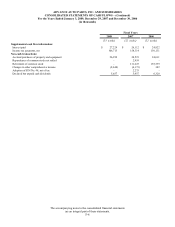

Please find page 65 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-11

circumstances, changes in tax law, successfully settled issues under audit, expirations due to statutes of limitations,

and new federal or state audit activity. Any change in either the Company’s recognition or measurement could result

in the recognition of a tax benefit or an increase to the tax accrual.

The Company also follows guidance provided under FIN 48 on derecognition of benefits, classification, interest

and penalties, accounting in interim periods, disclosure and transition. Refer to Note 12 for a further discussion of

income taxes.

Advertising Costs

The Company expenses advertising costs as incurred in accordance with the American Institute of Certified

Public Accountant’s Statement of Position, or SOP, 93-7, “Reporting on Advertising Costs.” Gross advertising

expense incurred was approximately $75,321, $78,823 and $97,215 in fiscal 2008, 2007 and 2006, respectively.

Self-Insurance

The Company is self-insured for general and automobile liability, workers' compensation and health care claims

of its team members while maintaining stop-loss coverage with third-party insurers to limit its total liability

exposure. Expenses associated with these liabilities are calculated for (i) claims filed and (ii) claims incurred but not

yet reported using actuarial methods followed in the insurance industry as well as the Company’s historical claims

experience.

Warranty Liabilities

The warranty obligation on the majority of merchandise sold by the Company with a manufacturer’s warranty is

the responsibility of the Company’s vendors. However, the Company has an obligation to provide customers free

replacement of merchandise or merchandise at a prorated cost if under a warranty and not covered by the

manufacturer. Merchandise sold with warranty coverage by the Company primarily includes batteries but may also

include other parts such as brakes and shocks. The Company estimates its warranty obligation based on the

historical return experience of the product sold and records any change as income or expense in the period the

product is sold.

Revenue Recognition

The Company recognizes merchandise revenue at the point of sale to customers. The majority of sales are made

for cash and credit with no recourse; however, the Company extends credit to certain Commercial customers

through a third-party provider of private label credit cards. Receivables under the private label credit card program

are generally transferred to a third-party provider with no recourse. On receivables sold with recourse, the Company

provides an allowance for doubtful accounts based upon factors related to credit risk of specific customers, historical

trends and other relevant information.

Sales Returns and Allowances

The Company’s accounting policy for sales returns and allowances consists of establishing reserves for

estimated returns at the time of sale. The Company estimates returns based on current sales levels and the

Company’s historical return experience on a specific product basis. The Company’s reserve for sales returns and

allowances was not material at January 3, 2009 and December 29, 2007.

Sales Taxes

The Company presents sales net of sales taxes in its consolidated statements of operations.