Advance Auto Parts 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-35

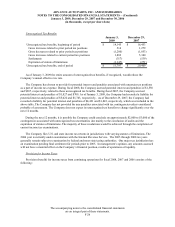

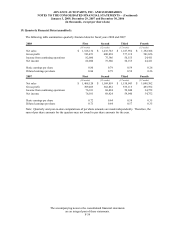

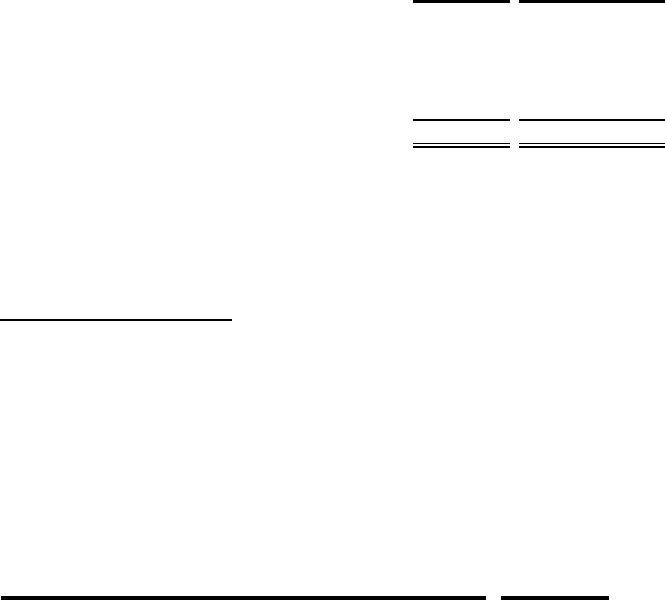

Restricted Stock

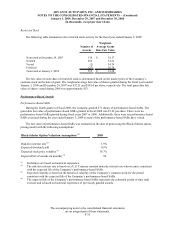

The following table summarizes the restricted stock activity for the fiscal year ended January 3, 2009:

Number of

Awards

Weighted-

Average Grant

Date Fair Value

Nonvested at December 29, 2007 130 38.17$

Granted 454 32.21

Vested (2) 34.74

Forfeited (27) 36.74

Nonvested at January 3, 2009 555 33.28$

The fair value of each share of restricted stock is determined based on the market price of the Company’s

common stock on the date of grant. The weighted average fair value of shares granted during the fiscal years ended

January 3, 2009 and December 29, 2007 was $32.21 and $38.14 per share, respectively. The total grant date fair

value of shares vested during 2008 was approximately $53.

Performance-Based Awards

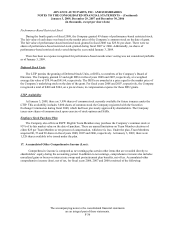

Performance-Based SARs

During the fourth quarter of fiscal 2008, the Company granted 271 shares of performance-based SARs. The

grant date fair value of performance-based SARs granted in fiscal 2008 was $7.62 per share. There were no

performance-based SARs granted during fiscal years 2007 or 2006. Additionally, there were no performance-based

SARs exercised during the year ended January 3, 2009 as none of the performance-based SARs have vested.

The fair value of performance-based SARs was estimated on the date of grant using the Black-Scholes option-

pricing model with the following assumptions:

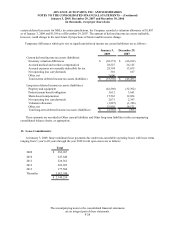

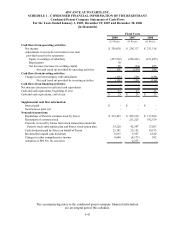

Black-Scholes Option Valuation Assumptions

(1)

2008

Risk-free interest rate

(2)

1.9%

Expected dividend yield 0.9%

Expected stock price volatility

(3)

36.7%

Expected life of awards (in months)

(4)

50

(1) Forfeitures are based on historical experience.

(2) The risk-free interest rate is based on a U.S. Treasury constant maturity interest rate whose term is consistent

with the expected life of the Company’s performance-based SARs.

(3) Expected volatility is based on the historical volatility of the Company’s common stock for the period

consistent with the expected life of the Company’s performance-based SARs.

(4) The expected life of the Company’s performance-based SARs represents the estimated period of time until

exercise and is based on historical experience of previously granted awards.