Advance Auto Parts 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

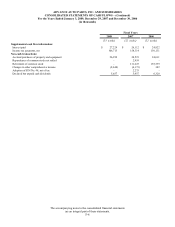

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-15

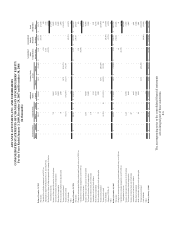

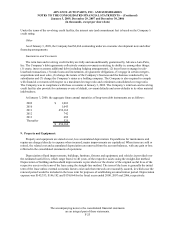

Cost of Sales and Selling, General and Administrative Expenses

The following table illustrates the primary costs classified in each major expense category:

●Total cost of merchandise sold including: ●Payroll and benefit costs for retail and corporate

–Freight expenses associated with moving team members;

merchandise inventories from our vendors to ●Occupancy costs of retail and corporate facilities;

our distribution center, ●Depreciation related to retail and corporate assets;

–Vendor incentives, and ●Advertising;

–Cash discounts on payments to vendors; ●Costs associated with our commercial delivery

●Inventory shrinkage; program, including payroll and benefit costs,

●Defective merchandise and warranty costs; and transportation expenses associated with moving

●Costs associated with operating our distribution merchandise inventories from our retail stores to

network, including payroll and benefit costs, our customer locations;

occupancy costs and depreciation; and ●Freight expenses associated with moving

●Freight expenses associated with moving merchandise inventories from other centralized

merchandise inventories from our distribution stores and Parts Delivered Quickly warehouses,

center to our retail stores. or PDQs

®

, to our retail stores after the customer

has special-ordered the merchandise;

●Self-insurance costs;

●Professional services; and

●Other administrative costs, such as credit card

service fees, supplies, travel and lodging.

Cost of Sales SG&A

New Accounting Pronouncements

In June 2008, the Financial Accounting Standards Board, or FASB, issued FASB Staff Position, or FSP, EITF

03-6-1, “Determining Whether Instruments Granted in Share-Based Payment Transactions Are Participating

Securities.” FSP EITF 03-6-1 addresses whether instruments granted in share-based payment transactions are

participating securities prior to vesting, and therefore need to be included in the earnings allocation in computing

earnings per share under the two-class method as described in Statement of Financial Accounting Standards, or

SFAS, No. 128, “Earnings per Share.” Under the guidance of FSP EITF 03-6-1, nonvested share-based payment

awards that contain nonforfeitable rights to dividends or dividend equivalents (whether paid or unpaid) are

participating securities and shall be included in the computation of earnings-per-share pursuant to the two-class

method. FSP EITF 03-6-1 is effective for financial statements issued for fiscal years beginning after

December 15, 2008 and all prior-period earnings per share data presented shall be adjusted retrospectively. Early

application is not permitted. The Company does not anticipate the adoption of FSP EITF 03-6-1 will have an impact

on its earnings per share.

In June 2008, the FASB Issued EITF No. 08-3, “Accounting by Lessees for Nonrefundable Maintenance

Deposits.” EITF 08-3 requires that nonrefundable maintenance deposits paid by a lessee under an arrangement

accounted for as a lease be accounted for as a deposit asset until the underlying maintenance is performed. When the

underlying maintenance is performed, the deposit may be expensed or capitalized in accordance with the lessee’s

maintenance accounting policy. Upon adoption entities must recognize the effect of the change as a change in

accounting principle. EITF 08-3 is effective for financial statements issued for fiscal years beginning after

December 15, 2008. The Company does not expect the adoption of EITF 08-3 will have a material impact on its

financial condition, results of operations or cash flows.

In April 2008, the FASB issued FASB Staff Position No. FAS 142-3, “Determination of the Useful Life

of Intangible Assets”, which amends the factors that must be considered in developing renewal or extension

assumptions used to determine the useful life over which to amortize the cost of a recognized intangible asset under

SFAS 142, “Goodwill and Other Intangible Assets.” The FSP requires an entity to consider its own assumptions

about renewal or extension of the term of the arrangement, consistent with its expected use of the asset, and is an