Advance Auto Parts 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

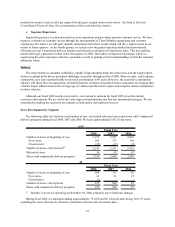

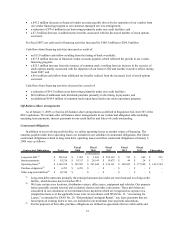

Consolidated Results of Operations

The following table sets forth certain of our operating data expressed as a percentage of net sales for the periods

indicated.

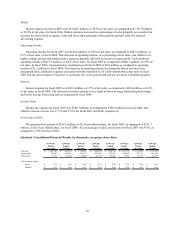

January 3, December 29, December 30,

2009 2007 2006

Net sales 100.0% 100.0% 100.0%

Cost of sales 52.1 52.1 52.3

Gross profit 47.9 47.9 47.7

Selling, general and administrative expenses 39.8 39.3 39.0

Operating income 8.1 8.6 8.7

Interest expense (0.7) (0.7) (0.8)

Loss on extinguishment of debt - - 0.0

Other income, net (0.0) 0.0 0.1

Income tax expense 2.8 3.0 3.0

Net income 4.6 4.9 5.0

Fiscal Year Ended

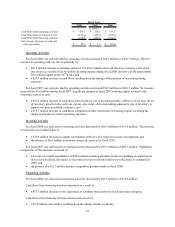

Fiscal 2008 Compared to Fiscal 2007

Net Sales

Net sales for fiscal 2008 were $5,142.3 million, an increase of $297.9 million, or 6.1%, over net sales for fiscal

2007. The net sales increase was due to contributions from the 107 net new AAP and AI stores opened within the

last year, $88.8 million in sales from the 53rd week and an increase in comparable store sales of 1.5%.

AAP produced sales of $4,976.6 million, an increase of $267.2 million, or 5.7%. AAP’s sales increase was

primarily driven by a 1.3% comparable store sales increase, $86.5 million in sales from the 53rd week and sales from

the 90 net new stores opened within the last year. The AAP comparable store sales increase was driven by (i) an

increase in average ticket sales and customer traffic in our Commercial business and (ii) an increase in average

ticket sales by our DIY customers offset by a decrease in DIY customer count. AI produced sales of $165.7 million,

an increase of $30.6 million, or 22.7%. AI’s sales increase was primarily driven by a 9.2% comparable store sales

increase, $2.3 million in sales from the 53rd week and sales from 17 net new stores opened within the last year.

We expect to experience similar trends during fiscal 2009 as we continue to realize benefits from our

turnaround strategies partially offset by the continuation of a challenging macroeconomic environment.

Gross Profit

Gross profit for fiscal 2008 was $2,463.1 million, or 47.9% of net sales, as compared to $2,321.0 million, or

47.9% of net sales, in fiscal 2007, remaining flat. Gross profit reflects a reduction of $37.5 million, or 73 basis

points, or bps, resulting from a non-cash obsolete inventory write-down due to a change in our inventory

management approach for slow moving inventory. Offsetting this reduction in gross profit as a percentage of net

sales were improvements in gross profit from more effective pricing, decreased inventory shrink, and higher sales

from AI, which generated a higher gross profit rate. The impact on gross profit from the 53rd week was

approximately $44 million and did not materially affect our gross profit rate.

SG&A

SG&A expenses for fiscal 2008 were $2,048.1 million, or 39.8% of net sales, as compared to $1,904.5 million,

or 39.3% of net sales, for fiscal 2007, or an increase of 52 basis points. The increase in SG&A expenses as a

percentage of sales was driven primarily by investments in strategic initiatives, increased incentive compensation

and legal settlement costs partially offset by favorable medical costs. Our SG&A rate for fiscal 2008 was favorably