Advance Auto Parts 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-36

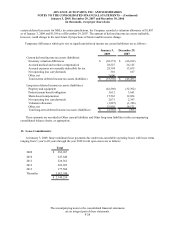

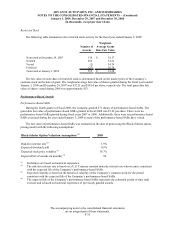

Performance-Based Restricted Stock

During the fourth quarter of fiscal 2008, the Company granted 49 shares of performance-based restricted stock.

The fair value of each share was based on the market price of the Company’s common stock on the date of grant.

The fair value of performance-based restricted stock granted in fiscal 2008 was $25.81 per share. There were no

shares of performance-based restricted stock granted during fiscal 2007 or 2006. Additionally, no shares of

performance-based restricted stock vested during the year ended January 3, 2009.

There has been no expense recognized for performance-based awards since vesting was not considered probable

as of January 3, 2009.

Deferred Stock Units

The LTIP permits the granting of Deferred Stock Units, or DSUs, to members of the Company’s Board of

Directors. The Company granted 12 and eight DSUs in fiscal years 2008 and 2007, respectively, at a weighted

average fair value of $38.94 and $41.64, respectively. The DSUs are awarded at a price equal to the market price of

the Company’s underlying stock on the date of the grant. For fiscal years 2008 and 2007, respectively, the Company

recognized a total of $480 and $344, on a pre-tax basis, in compensation expense for these DSU grants.

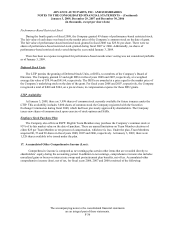

LTIP Availability

At January 3, 2009, there are 3,998 shares of common stock currently available for future issuance under the

LTIP. This availability includes 3,000 shares of common stock the Company registered with the Securities

Exchange Commission during fiscal 2008, which had been previously approved by shareholders. The Company

issues new shares of common stock upon exercise of stock options and SARs.

Employee Stock Purchase Plan

The Company also offers an ESPP. Eligible Team Members may purchase the Company’s common stock at

95% of its fair market value on the date of purchase. There are annual limitations on Team Member elections of

either $25 per Team Member or ten percent of compensation, whichever is less. Under the plan, Team Members

acquired 80, 53 and 90 shares in fiscal years 2008, 2007 and 2006, respectively. At January 3, 2009, there were

1,328 shares available to be issued under the plan.

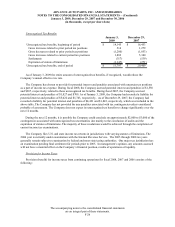

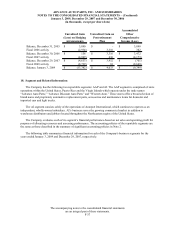

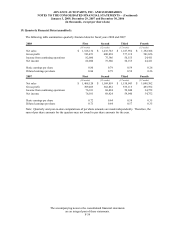

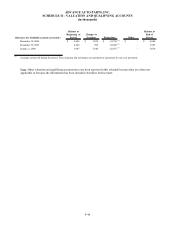

17. Accumulated Other Comprehensive Income (Loss):

Comprehensive income is computed as net earnings plus certain other items that are recorded directly to

shareholders’ equity during the accounting period. In addition to net earnings, comprehensive income also includes

unrealized gains or losses on interest rate swaps and postretirement plan benefits, net of tax. Accumulated other

comprehensive income (loss), net of tax, for fiscal years 2006, 2007 and 2008 consisted of the following: