Advance Auto Parts 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

January 3, 2009, December 29, 2007 and December 30, 2006

(in thousands, except per share data)

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

F-23

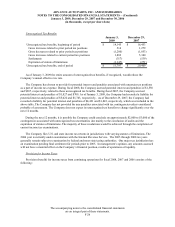

Under the terms of the revolving credit facility, the interest rate (and commitment fee) is based on the Company’s

credit rating.

Other

As of January 3, 2009, the Company had $4,664 outstanding under an economic development note and other

financing arrangements.

Guarantees and Covenants

The term loan and revolving credit facility are fully and unconditionally guaranteed by Advance Auto Parts,

Inc. The Company’s debt agreements collectively contain covenants restricting its ability to, among other things:

(1) create, incur or assume additional debt (including hedging arrangements), (2) incur liens or engage in sale-

leaseback transactions, (3) make loans and investments, (4) guarantee obligations, (5) engage in certain mergers,

acquisitions and asset sales, (6) change the nature of the Company’s business and the business conducted by its

subsidiaries and (7) change the Company’s status as a holding company. The Company is also required to comply

with financial covenants with respect to a maximum leverage ratio and a minimum consolidated coverage ratio.

The Company was in compliance with these covenants at January 3, 2009. The Company’s term loan and revolving

credit facility also provide for customary events of default, covenant defaults and cross-defaults to its other material

indebtedness.

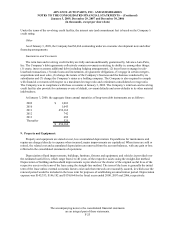

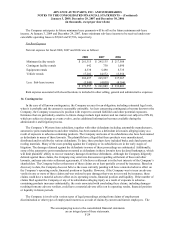

At January 3, 2009, the aggregate future annual maturities of long-term debt instruments are as follows:

2009 1,003$

2010 1,043

2011 452,162

2012 742

2013 689

Thereafter 525

456,164$

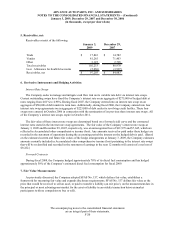

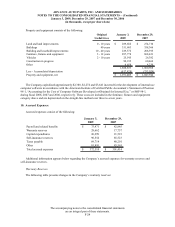

9. Property and Equipment:

Property and equipment are stated at cost, less accumulated depreciation. Expenditures for maintenance and

repairs are charged directly to expense when incurred; major improvements are capitalized. When items are sold or

retired, the related cost and accumulated depreciation are removed from the account balances, with any gain or loss

reflected in the consolidated statements of operations.

Depreciation of land improvements, buildings, furniture, fixtures and equipment, and vehicles is provided over

the estimated useful lives, which range from 2 to 40 years, of the respective assets using the straight-line method.

Depreciation of building and leasehold improvements is provided over the shorter of the original useful lives of the

respective assets or the term of the lease using the straight-line method. The term of the lease is generally the initial

term of the lease unless external economic factors exist such that renewals are reasonably assured, in which case the

renewal period would be included in the lease term for purposes of establishing an amortization period. Depreciation

expense was $145,353, $146,182 and $138,064 for the fiscal years ended 2008, 2007 and 2006, respectively.